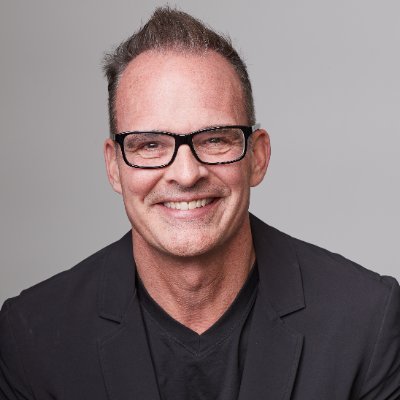

Xander Snyder

@XanderSnyderXSr Commercial Real Estate Economist at First American Financial. Opinions, views, and perspectives contained in tweets are my own.

Similar User

@JacobShap

@EricFinnigan

@GPFutures

@JohnWake

@George_Friedman

@AltosResearch

@nt4ox

@IUpolice

@DanteDelgado

@RDC_Economics

@_MichaelHart

@UntrendedYOC

@OMG_itsizzyb

@housing_alex

@TrailerParkGuy

News today is focused on Target missing expectations on earnings and revenue last quarter. It was Target's biggest earnings miss in two years, and its first revenue miss since summer 2023 — despite slashing prices on thousands of items this year. @XanderSnyderX's blog today is a…

Black Friday is right around the corner. How will the holiday shopping season impact the performance of retail CRE? I dive into that issue in greater detail in this latest X-Factor. Read it here! blog.firstam.com/cre-insights/x…

Today's Producer's Price Index release shows that construction material prices are continuing to stabilize. Throughout 2024, inputs to construction (ITC) costs, which surged during the pandemic’s supply chain disruptions, didn't move by much. While delays still exist for certain…

What should we expect from the CRE market in 2025? Join me today at 11am PT // 2pm ET to learn more! Sign up here: ncsmarketing.firstam.com/cre-econ-webin…

Well I'd call that good news. Today's PCE release shows that inflation, according to the headline PCE index, has essentially reached the Fed's 2% target. Annual growth in headline PCE was 2.1%, though core PCE growth, the Fed's preferred measure of inflation, was still slightly…

In the near-frozen CRE market we've lived through over the last two years, assumable debt has come to be used more often to creatively get deals across the finish line. As the new year approaches, and the gradual thawing of the frozen CRE sales market begins in earnest, assumable…

Housing starts come in a touch above consensus estimates (1350k) to a seasonally adjusted annual rate of 1354k. Housing starts were down-0.5% from last month, weighed down by groundbreaking on MF projects. For single-family: 🟢SF Permits were up modestly (+0.3%) compared to…

Builder sentiment increased in October to 43, a bit higher than the expected 42. This is the second consecutive month of increase, though sentiment still remains in negative territory (below the break-even point of 50). Of the index’s three components, current sales conditions…

What's holding up the existing home sales (EHS) market? The rate lock-in effect is keeping more people in their homes, which limits the number of homes being listed for sales. As a result, EHS are at a record low, just 2.9% of total households compared to the pre-pandemic average…

I had the opportunity to join @BullRealty on America's Commercial Real Estate show to talk about the latest trends in retail real estate. How strong is the consumer, and how does that impact the retail property market given the limited amount of space currently available to…

REconomy has made it to its 100th episode! Listen in at the link below. In addition to meeting the newest economist on our team, we'll also cover some of the most regularly asked questions and review forecasts we've made. blog.firstam.com/reconomy-podca…

As I've been increasingly mentioning lately, there appear to be glimmers of light in the CRE market. That doesn't mean all pain is over. The analogy I like to use is that the CRE economy is more like a cargo ship than a speed boat - it turns slowly. But it does seem like the turn…

Construction employment continued to trend up in September (+25,000), similar to the average monthly gain over the prior 12 months (+19,000). Nonresidential building construction was down on a MoM but residential building continued to trend higher. The residential construction…

This marks 45 consecutive months of 100,000 or more jobs added. That's a record. Not to mention with revisions, employment in July and August combined is 72,000 higher than previously reported. A soft landing scenario is still possible.

While we're still certainly in a challenging moment for CRE, there are glimmers of light beginning to emerge. Yesterday I shared a blog post on the refinancing market stabilizing. In the latest episode of the REconomy podcast, Mark Fleming and I discuss other bright spots that…

United States Trends

- 1. $CUTO 3.015 posts

- 2. ICBM 155 B posts

- 3. #KashOnly 25,8 B posts

- 4. The ICC 134 B posts

- 5. Katie Couric N/A

- 6. Good Thursday 30 B posts

- 7. Gm Elon 1.225 posts

- 8. Bezos 32,7 B posts

- 9. International Criminal Court 68,2 B posts

- 10. #thursdayvibes 4.263 posts

- 11. #ThursdayMotivation 5.918 posts

- 12. Dnipro 64 B posts

- 13. Gallant 172 B posts

- 14. Vegito 3.108 posts

- 15. #ThursdayThoughts 3.766 posts

- 16. Happy Friday Eve N/A

- 17. #21Nov 3.646 posts

- 18. Adani 882 B posts

- 19. $BTC 849 B posts

- 20. Unvaccinated 10,9 B posts

Who to follow

-

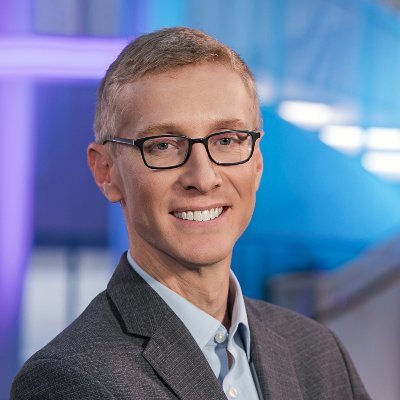

Jacob L. Shapiro

Jacob L. Shapiro

@JacobShap -

Eric Finnigan

Eric Finnigan

@EricFinnigan -

Geopolitical Futures

Geopolitical Futures

@GPFutures -

John Wake

John Wake

@JohnWake -

George Friedman

George Friedman

@George_Friedman -

Altos Research

Altos Research

@AltosResearch -

NT at Oxford

NT at Oxford

@nt4ox -

IU Police and Public Safety

IU Police and Public Safety

@IUpolice -

Dante Delgado

Dante Delgado

@DanteDelgado -

Realtor.com Economics

Realtor.com Economics

@RDC_Economics -

Michael Hart

Michael Hart

@_MichaelHart -

Covered Land Play

Covered Land Play

@UntrendedYOC -

Isabelle Harrison

Isabelle Harrison

@OMG_itsizzyb -

Alex Thomas

Alex Thomas

@housing_alex -

Trailer Park Guy

Trailer Park Guy

@TrailerParkGuy

Something went wrong.

Something went wrong.