Similar User

@dimit

@crescatkevin

@lcdnews

@htsfhickey

@hedgopia

@WhatILearnedTW

@VrntPerception

@MikaelSarwe

@edclissold

@spiralcal

@businesscycle

@Peter_Atwater

@michaellebowitz

@ParrillaDiego

@NDR_Research

According to our models at the end of February: 1. S&P 500 largest deviation above fair value in history. And therefore: 2. S&P 500 lowest forward looking return estimate in history. What a time to be alive... and sell SPX to a bag-holder. #TYGBLAF

Get to work now Elon. Fun is over. Make @realDonaldTrump a "deficit hawk" and interest rates will collapse. Don't even need to talk about the Fed....

From CBO, federal deficit hits a record $1.8 T. This is fiscal malpractice when growth exceeds 3%. What are we going to do when the economy turns? Both parties are to blame. cbo.gov/publication/60…

2024 is now the weakest on record for both Existing Home Sales and Pending Home Sales despite mortgage rates falling more than 1.25% from the high last October. #TYGBLAF

Believe by @Yellowcard One of the best tributes to the first responders on 9/11. It hits hard to this day every time I listen to it. youtube.com/watch?v=6ZREjB…

I wonder why we never talk about this chart anymore... Fed Balance Sheet vs. S&P 500:

I was today years old when I learned that @hussmanjp has never actually spoken with Jeremy Grantham. Mind blown. Gents, I implore you to pick up the phone before it's too late. Reference 11:30 in this video interview with Grantham: youtube.com/watch?v=az5Ujf…

How late is the Fed to cut rates? Judging by the unemployment rate, their last move a year ago should have been a cut, not a hike! At this point in the 2008 cycle, the Fed had already cut rates 13 times (0.25% increments) for a total of 3.25%! @biancoresearch #TYGBLAF

The unemployment rate today has the exact same trajectory as the 2008 GFC. It’s probably nothing. #TYGBLAF

The shows clear as day that the reason the Democrats have an open border policy is to import voters

Great interview gents! I especially liked the part on insider transactions. I don't follow insider buys/sells as a regular part of my research process, so hearing from Jesse about what's happening right now was a real eye opener for me.

Really enjoyed this interview with @jessefelder whose warning of investors "extrapolating the unsustainable" in expectation of a "Platinum-locks economy" is well worth heeding youtu.be/M5UdRAd3KvI

First Nirvana, now this 😔

Uhhhh guys…? Long duration credit spreads are at the tightest level since 2005. I’m not so sure we should be pricing-to-perfection with leading indicators licking the floor. But YOLO amiright @biancoresearch !? #TYGBLAF

Well, well, well, Look who joined the party... Existing home sales now worst on record in addition to pending home sales. #TYGBLAF

Got to hang out with @MebFaber and the Cambria crew to ring the closing bell at the S&P 500 options pit @CBOE So cool.

Hey @GuyDealership, I track my private party car values each quarter on kbb, and they took a significant hit in the last 3 months. Any idea what’s going on? My cars: 2016 Honda Odyssey (-$3,596) -21% 2016 Ram 1500 Crew Cab (-$4,239) -17%

United States Trends

- 1. Mike Rogers 149 B posts

- 2. #FridayVibes 7.658 posts

- 3. Good Friday 67,4 B posts

- 4. Muppets 3.993 posts

- 5. Pam Bondi 330 B posts

- 6. Jason Kelce 2.011 posts

- 7. Happy Friyay 2.831 posts

- 8. CONGRATULATIONS JIMIN 331 B posts

- 9. #BOYCOTT143ENT 11 B posts

- 10. #FursuitFriday 12,8 B posts

- 11. $MAD 5.749 posts

- 12. #FridayMotivation 12,4 B posts

- 13. #WeStandWithMadein 9.675 posts

- 14. Roller Coaster 3.498 posts

- 15. McCabe 27,2 B posts

- 16. Chris Brown 32,5 B posts

- 17. Randle 7.731 posts

- 18. Dan Scavino 2.141 posts

- 19. Kang 36,8 B posts

- 20. Jim Cramer 2.197 posts

Who to follow

-

DC

DC

@dimit -

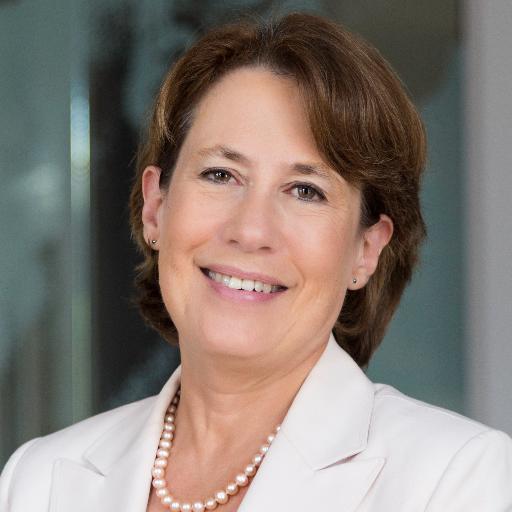

Kevin C. Smith, CFA

Kevin C. Smith, CFA

@crescatkevin -

Leveraged Loans

Leveraged Loans

@lcdnews -

fred hickey

fred hickey

@htsfhickey -

hedgopia

hedgopia

@hedgopia -

13D Research & Strategy

13D Research & Strategy

@WhatILearnedTW -

Variant Perception

Variant Perception

@VrntPerception -

Mikael Sarwe

Mikael Sarwe

@MikaelSarwe -

Ed Clissold

Ed Clissold

@edclissold -

Chris Carolan $=1/∞

Chris Carolan $=1/∞

@spiralcal -

Economic Cycle Research Institute (ECRI)

Economic Cycle Research Institute (ECRI)

@businesscycle -

Peter Atwater

Peter Atwater

@Peter_Atwater -

Michael Lebowitz, CFA

Michael Lebowitz, CFA

@michaellebowitz -

Diego Parrilla

Diego Parrilla

@ParrillaDiego -

Ned Davis Research

Ned Davis Research

@NDR_Research

Something went wrong.

Something went wrong.