Lu Wang

@luwangnyccross-asset reporter at Bloomberg. https://t.co/2vshPVdQqy

Similar User

@VildanaHajric

@emily_graffeo

@readep

@LananhTNguyen

@justinaknope

@A_Riley17

@RetoGregori

@BTLipschultz

@cfb_18

@xieyebloomberg

@caroewilson

@MichelleF_Davis

@MollySmithNews

@annecronin

@rhjameson

Here's nice piece on the "perfect record" from Hotchkis via @luwangnyc Think about laying down these returns, and yet crickets from investors? bloomberg.com/news/articles/…

📥 Sign up for the Markets Daily newsletter, exclusively for Bloomberg subscribers. Get expert insight on the forces moving markets right now — and what will move them next — every week day morning: trib.al/VV4zqhr

You know who's not chasing stocks here? Insiders. Corporate executives among S&P 500 firms have some of the least open market purchases in 13 years.

Chinese stocks rebounded from their worst week since late July and Bitcoin hit a two-week high. Get expert insights on what’s moving @markets in the new Markets Daily newsletter bloomberg.com/news/newslette… via @markets @luwangnyc

spx above 5,800 back in jan., highest wall street strategists' forecast: 5,200 a rally few saw coming

The ever-resilient US economy is once again causing havoc for Wall Street worrywarts, who have sounded the recession alarm all year. Via @isabelletanlee, @luwangnyc bloomberg.com/news/articles/…

Speculation is rampant the Fed is about to take decisive monetary action. Spirits flared anew in tech stocks, crypto and junk bonds. NDX saw its biggest weekly rally this year after a massive plunge last week @luwangnyc bloomberg.com/news/articles/…

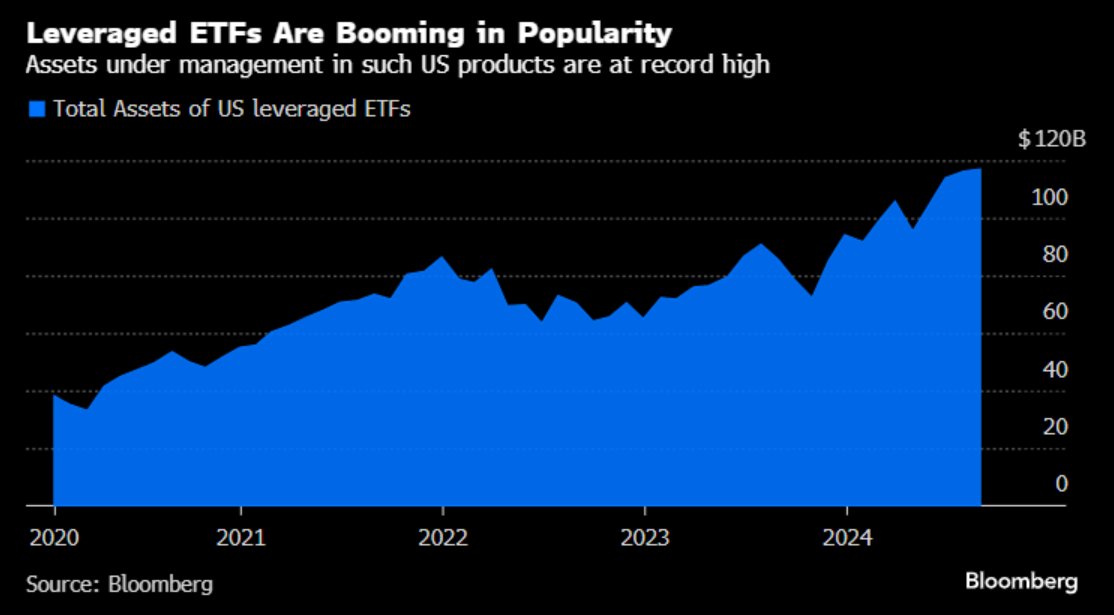

Leveraged ETFs have hit a record $117 billion of AUM and they may be exerting their biggest ever influence on the broader marketplace right before the market close. w/ @luwangnyc bloomberg.com/news/articles/…

Highly interesting chart... Odds of recession by asset class. Look at that divergence. via @luwangnyc @denitsa_tsekova

.@luwangnyc and I cover the latest passive investing paper to fight about by @mcsammon19 + John Shim 💥: Ok, it's actually pretty nuanced. TL;DR: Who's been selling shares to indexers? It's the listed firms themselves bloomberg.com/news/articles/…

Read more here bloomberg.com/news/articles/…

Your stat of the day... S&P 500 is up 25% in past 12 months, the biggest rise *ever* leading into first rate cut of an easing cycle. Make of this what you will. via @luwangnyc @emily_graffeo

How passive is passive? We @luwangnyc dive into it here. FTSE Russell and S&P DJI are presenting plans to undercut the weighting of the largest megacaps in key indexes. The intervention comes as the likes of Nvidia and Apple grow in dominance bloomberg.com/news/articles/…

A month for the daring trader: August has hosted three of 2024’s four best days for the S&P 500 and two of the worst three

@luwangnyc has a recent article featuring my research on the negative effects of online sports betting. Check out her article below. You can find the full paper at ssrn.com/abstract=48810….

As sports gambling takes off in the US, a worrisome trend is starting to emerge: Americans appear to be yanking money out of their stock-brokerage accounts to fund their online betting trib.al/9xfwklN

How are hedge funds using gen AI? bloomberg.com/news/articles/… A few observations from reporting my story today:

$APPL Buffett’s Apple stake sale has come with a surprise silver lining for investors: its influence in major stock gauges is set to be fully unleashed. That could spur $40bn buy among index funds on next rebalance. w/@luwangnyc @SamJPotter bloomberg.com/news/articles/… via @markets

What if Monday’s extreme volatility in the US stock market wasn’t quite what it seemed? bloomberg.com/news/articles/… via @markets @luwangnyc @denitsa_tsekova

Equity dispersion has lived to fight another day, which means we can all keep arguing about whether it's crowded bloomberg.com/news/articles/… by me and @luwangnyc

Tobin's q is the ratio between a physical asset's market value and its replacement value. Our latest estimate shows this at a new 120 year high. There is debate about its theoretical basis and its empirical calculation...but 1.7x in Q2 2021 was enough to see a pause in the rally.

I was editor for today's @business Big Take by @luwangnyc and @KatLeighDoherty Their story digs into overnight trading, and the quiet little boom unfolding. 24-hour stocks may happen sooner than you think - but there are concerns alongside the optimism. bloomberg.com/news/articles/…

United States Trends

- 1. $CUTO 10,2 B posts

- 2. Russia 867 B posts

- 3. WWIII 160 B posts

- 4. #tuesdayvibe 5.087 posts

- 5. Sony 59,4 B posts

- 6. SPLC 4.098 posts

- 7. #MSIgnite 2.123 posts

- 8. Good Tuesday 36,1 B posts

- 9. Billy Boondocks N/A

- 10. DeFi 152 B posts

- 11. $SHRUB 7.761 posts

- 12. #InternationalMensDay 61,1 B posts

- 13. karl rove 1.231 posts

- 14. Taco Tuesday 7.121 posts

- 15. Beans 23,6 B posts

- 16. Jaguar 11,2 B posts

- 17. #19Nov 3.946 posts

- 18. KADOKAWA 49,4 B posts

- 19. US-made 16,6 B posts

- 20. Accused 108 B posts

Who to follow

-

Vildana Hajric

Vildana Hajric

@VildanaHajric -

Emily Graffeo

Emily Graffeo

@emily_graffeo -

Reade Pickert

Reade Pickert

@readep -

Lananh Nguyen

Lananh Nguyen

@LananhTNguyen -

Justina Lee

Justina Lee

@justinaknope -

Anne Riley Moffat

Anne Riley Moffat

@A_Riley17 -

Reto Gregori

Reto Gregori

@RetoGregori -

Bailey Lipschultz

Bailey Lipschultz

@BTLipschultz -

Claire Ballentine

Claire Ballentine

@cfb_18 -

Ye Xie

Ye Xie

@xieyebloomberg -

Carolina Wilson

Carolina Wilson

@caroewilson -

Michelle F. Davis

Michelle F. Davis

@MichelleF_Davis -

Molly Smith

Molly Smith

@MollySmithNews -

Anne Cronin

Anne Cronin

@annecronin -

Robert Jameson

Robert Jameson

@rhjameson

Something went wrong.

Something went wrong.