George Goncalves

@bondstrategistBond market veteran: +25yr on sellside & buyside focused on rates, credit, USD funding, Fed & global macro. My tweets are opinions, not advice! RT≠endorsements!

Similar User

@EconguyRosie

@biancoresearch

@MacroCharts

@JeffSnider_EDU

@DiMartinoBooth

@jessefelder

@BittelJulien

@JulianMI2

@hendry_hugh

@MacroVoices

@EPBResearch

@profplum99

@FedGuy12

@fleckcap

@crossbordercap

🇺🇸Election Impact with Fed Policy Path: Mapping out potential rate scenarios Given the uncertainty and concerns around the US election (and the implications for fiscal policy) we map out the potential impact of the 2024 election on our rates and Fed Funds rate forecasts. For…

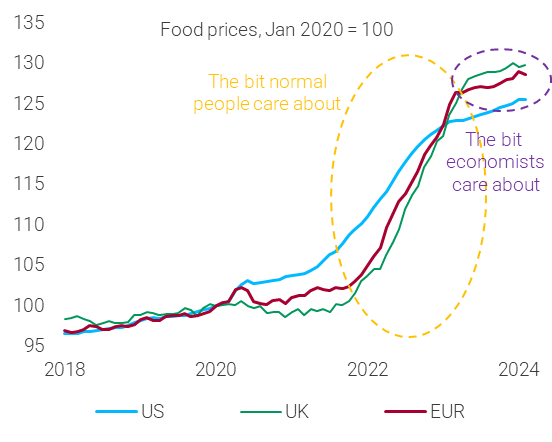

💯 It still amazes me that economists still don't get cumulative change matters more than rate of change.

1/ Quick update on market conditions. Valuations have pushed to the most speculative extreme in U.S. history. While valuations are informative about long-term and full-cycle outcomes, they are emphatically not useful indications of market outcomes over shorter horizons.

lol what do people think is driving growth!

$ quote for those who liken a soft landing to the GFC. “This is one of the more prolonged downturns in hiring activity. Seasonally adjusted hires have declined YoY every month since Aug of 2022, which is approaching the same duration in hiring declines as the recession of 2008.”

From ZipRecruiter on the labor market from last night's call: "ZipRecruiter continues to navigate a protracted labor market downturn." Their Q3 revenues fell 25% y/o/y "primarily due to reduced demand from SMBs (small and medium sized businesses) with continued uncertainty and…

The indices soared while the average stock did not. It was one of the worst-ever days for participation on a day the S&P 500 jumped more than 2.5%. On the NYSE, fewer than 70% of issues rose, and less than 70% of volume flowed into those issues. This has only happened 3 unique…

Irrespective of whether one believes in the recession or soft/no- landing scenario, S&P eps upward revisions has been pedestrian and now eps momentum is beginning to turn downwards. That is not a great backdrop for a market on nose-bleed valuations. Keep an eye on this.

Definition of irrational despondency: The Treasury market responding the very same way to the meek +12k payroll headline today as to the +254k surge we saw exactly a month ago. I am not sure at all what the bondies are seeing but something tells me they are sniffing out a GoP…

“Inflation is always and everywhere a monetary phenomenon.” — Milton Friedman

Great to be on @BloombergTV on the surveillance show with @FerroTV and @annmarie discussing US rate dynamics and the Fed vs fiscal policy implications as we head into one of the most macro intense weeks of the year, with the NFP jobs report, the FOMC meeting and the US election…

You won't find this on the 6 o'clock news... *Continuing jobless claims, highest since November 2021.

Agree with @EPBResearch 👇

Many have argued the post-COVID economy is different and the neutral rate is higher because the economy is more resilient to higher rates, but @EPBResearch believes that resilience is largely related to backlogs. As backlogs in interest-rate-sensitive sectors like motor vehicles…

Outstanding thread. Must read ICYMI.

Rates Sell-offs during Easing Cycles: They are common, usually large, but typically short-lived… As with all markets, nothing ever goes in a straight line. Furthermore, at times the opposite of what is expected can take place. So, it’s not unusual to see large moves higher in…

Household all over the US are feeling the hurt from high borrowing costs, but swing-state voters are mong the hardest hit. Some great analysis here from @annerquaye: bloomberg.com/news/articles/… via @economics

For the first time in 22 years, bonds are yielding more than stocks. bloomberg.com/opinion/articl…

👇Nice work @bravosresearch - yes, on the macro front, it’s all about the unemployment rate now…

Unemployment rising + economic indicators sending WARNING signs This also happened before the 2008 Financial Crisis collapse A thread 🧵

BREAKING: According to GasBuddy data, weekly (Sun-Sat) US gasoline demand fell 7.8% from the previous week and was 8.8% below the four week moving average. We model US gasoline demand at 7.91mbpd, the lowest weekly level since January.

I agree totally and this fit with my idea of trading. Have a mid term bias (am positive on bonds given the Cb easing cycle and softening of inflation, especially in EZ) and use contra trend movements to Better entry points.

Rates Sell-offs during Easing Cycles: They are common, usually large, but typically short-lived… As with all markets, nothing ever goes in a straight line. Furthermore, at times the opposite of what is expected can take place. So, it’s not unusual to see large moves higher in…

US Treasury #Bonds 👇 x.com/bondstrategist…

Overall, this latest rise in rates has been consistent with the drawdown/quick sell-off period analysis experienced by 2s during easing cycles - they are quick and large in magnitude but ultimately do not last.

👇Really good post on apartment supply by @jayparsons ...only adds downside risks to CPI rent prices @DiMartinoBooth

We've added more new apartment supply in the first nine months of 2024 than we did in any FULL CALENDAR YEAR going back 30+ years. And more coming. We're at peak supply. Enjoy the view (and its impact on falling rents) b/c it won't last past next year, given plunge in starts.…

United States Trends

- 1. Cowboys 33,5 B posts

- 2. #WWERaw 28,2 B posts

- 3. Pulisic 3.272 posts

- 4. #AskShadow 4.567 posts

- 5. Mixon 6.353 posts

- 6. Tunsil N/A

- 7. #USMNT 1.109 posts

- 8. #HOUvsDAL 3.451 posts

- 9. Skenes 12,2 B posts

- 10. Merrill 6.055 posts

- 11. Sean Duffy 20 B posts

- 12. Luis Gil 6.394 posts

- 13. Rhea 13,8 B posts

- 14. #MNFxESPN N/A

- 15. Nico Collins 3.109 posts

- 16. Cowser 1.737 posts

- 17. Mazi Smith N/A

- 18. GOTY 52,4 B posts

- 19. Road Rules 1.371 posts

- 20. Katie Hobbs 18 B posts

Who to follow

-

David Rosenberg

David Rosenberg

@EconguyRosie -

Jim Bianco

Jim Bianco

@biancoresearch -

Macro Charts

Macro Charts

@MacroCharts -

Jeffrey P. Snider

Jeffrey P. Snider

@JeffSnider_EDU -

Danielle DiMartino Booth

Danielle DiMartino Booth

@DiMartinoBooth -

Jesse Felder

Jesse Felder

@jessefelder -

Julien Bittel, CFA

Julien Bittel, CFA

@BittelJulien -

Julian Brigden

Julian Brigden

@JulianMI2 -

Hugh Hendry Acid Capitalist

Hugh Hendry Acid Capitalist

@hendry_hugh -

MacroVoices Podcast

MacroVoices Podcast

@MacroVoices -

Eric Basmajian

Eric Basmajian

@EPBResearch -

Michael Green

Michael Green

@profplum99 -

Joseph Wang

Joseph Wang

@FedGuy12 -

bill fleckenstein

bill fleckenstein

@fleckcap -

CrossBorder Capital

CrossBorder Capital

@crossbordercap

Something went wrong.

Something went wrong.