Hugh Hendry Acid Capitalist

@hendry_hughFormer global macro,hedge fund manager distilling market insights via his alter-ego, the acid capitalist. ✉️ Media & Sponsors [email protected]

Similar User

@TruthGundlach

@LynAldenContact

@JeffSnider_EDU

@EconguyRosie

@profplum99

@TaviCosta

@LukeGromen

@crossbordercap

@DiMartinoBooth

@Jkylebass

@DariusDale42

@SantiagoAuFund

@RealVision

@HoweGeneration

@fleckcap

Let's try again, shall we...Bonfire of Vanities and all that. Bored at the weekend? Can't sleep? Here's the raw cut from the interview I recorded Tuesday for the nutty world where fiat despair meets the hope and incredulity of the mining universe. This session with @JayMartinBC…

Some Tokyo vibing for you straight from Bulgari...

Breakfasting, I'm in Tokyo amusing myself. I'd say that after some reflection, the BUN is the actual passing of said apocalypse. Coppola might have called his Vietnam classic "Bond Under Note". Frustrating that its had a series of silly cross overs this year which are anomalous…

Not to interrupt dinner, but can you explain why a 10s/30s inversion is the sign of the apocalypse? Your theory makes sense and doesn’t all at once. I pay attention when that happens. Thanks. 🍻

Damn, that's good AI shit you got at your disposal🏴☠️

The Capitalist Acide World Tour kicks off in Godzilla-like fashion, in Tokyo, with the triumphant arrival of Chief Acid Capitalist Jean-Hugues Hendrix @hendry_hugh. 🇯🇵

Ah the irony, I come to Japan but I'm eating at a Bill Grainger. You can't beat the full Aussie b'fast...Acid Capitalist on Tour.

Smooth trip to Tokyo and publishing every day, just not necessarily on the X

The goggles question Yeah, a hedge might be over doing it - too much feasible tracking error to stocks - but if you forced a gun to my head, demanded that i be long just ONE short-volatility asset, that i couldn’t sell, $BTC would be the one… Now I’ve got to catch a 14h…

I listened to your pod with Alex J. Stay off the moors and beware a 10s/30s sub-inversion. Have a question and putting on my goggles and listening to In-A-Gadda-Da-Vida to divine the answer didn’t work. Am I understanding you correctly that btc is your hedge if you’re wrong?

A Gonzo Rebuttal Q: Not just anyone mind, but @dampedspring , throws down the gauntlet: 'Who is short Treasuries?' And then, some other wise guy jumps in, 'Yeah, I thought that too.' Seriously? Listen up, Andy, I know what you're really after, and we'll get there eventually.…

Q: Someone asks whether the notion of fractional banking - a descriptor for the introduction of an options market - means that $BTC could go $10trn market cap while at the same time a unit being only 200k ? In other works market cap 10x, but unit price only 3x, does fractional…

Q: Someone asks, "when will $BTC decouple from trading like the NDX?" Nasdaq is capitalized at $41trn vs $BTC 's $1trn The fascination with correlation masks 2 human foibles - the simplification of complexity - confirmation bias of existing prejudice The short answer is why…

Living life as though every day were a Super-Moon...

Q: Someone asks, "what is it about $BTC that you find so compelling v's $GLD? Why is $BTC compelling v's $GLD : - powerful stepped function price uptrend - mining supply diminishes with higher prices - an automatic scarcity mechanism - no one under 40 gonna buy $GLD over $BTC -…

Q: Someone noted that $GLD is up 33% Ytd, and erroneously claimed that I hate it. He goes on to say that I buy assets going up and sell assets going down. So what's going on?? -------------------------------- As you say $GLD is up 30% ytd Imagine you're at the blackjack…

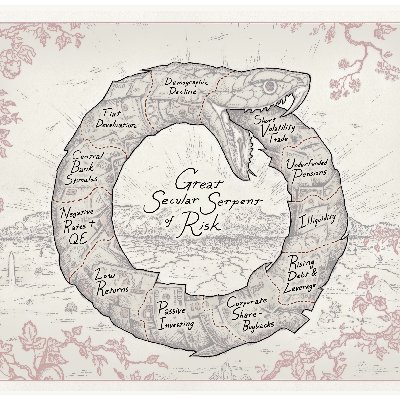

Q: If this plays out, going big on duration before the big implosion and then rotating hard to GLD and BTC seems to be the play. Is that how you see this going? It's also becoming increasingly contrarian BY THE DAY. First, my narrative feels increasingly bonkers at the start of…

Nope, that's their hopium; but I've never accepted this YCC narrative from the past. The Feds are incredibly pro cyclical. Remember the Fed minutes when Richard Fisher, the former president of the Federal Reserve Bank of Dallas asked why are we buying treasuries when everyone…

Hey @hendry_hugh With the staggering global sovereign debt, you have to be assuming Central Banks go full Yield Curve Control?

United States Trends

- 1. $MAYO 10,7 B posts

- 2. Tyson 395 B posts

- 3. Pence 44,9 B posts

- 4. Dora 22,6 B posts

- 5. Laken Riley 40,8 B posts

- 6. Ticketmaster 16,9 B posts

- 7. Kash 73,7 B posts

- 8. Mike Rogers 9.041 posts

- 9. #LetsBONK 6.408 posts

- 10. Debbie 17,2 B posts

- 11. Cenk 11,2 B posts

- 12. Pirates 19,1 B posts

- 13. #FursuitFriday 15,7 B posts

- 14. Iron Mike 16,4 B posts

- 15. Gabrielle Union N/A

- 16. The UK 441 B posts

- 17. Mr. Mayonnaise 1.430 posts

- 18. Fauci 176 B posts

- 19. Whoopi 55,7 B posts

- 20. Scholars 10,9 B posts

Who to follow

-

Jeffrey Gundlach

Jeffrey Gundlach

@TruthGundlach -

Lyn Alden

Lyn Alden

@LynAldenContact -

Jeffrey P. Snider

Jeffrey P. Snider

@JeffSnider_EDU -

David Rosenberg

David Rosenberg

@EconguyRosie -

Michael Green

Michael Green

@profplum99 -

Otavio (Tavi) Costa

Otavio (Tavi) Costa

@TaviCosta -

Luke Gromen

Luke Gromen

@LukeGromen -

CrossBorder Capital

CrossBorder Capital

@crossbordercap -

Danielle DiMartino Booth

Danielle DiMartino Booth

@DiMartinoBooth -

🇺🇸 Kyle Bass 🇹🇼

🇺🇸 Kyle Bass 🇹🇼

@Jkylebass -

Darius Dale

Darius Dale

@DariusDale42 -

Santiago Capital

Santiago Capital

@SantiagoAuFund -

Real Vision

Real Vision

@RealVision -

Neil Howe

Neil Howe

@HoweGeneration -

bill fleckenstein

bill fleckenstein

@fleckcap

Something went wrong.

Something went wrong.