Similar User

@JASON2017TSLA

@AleBracone

@WuJenneyi

@mamamargincall

@QoonMs

@AsafoShakur

@Javier7784

For only the 14th time since 1966, the stock/bond ratio plunged below -3.5, signaling extreme fear among investors. Comparable panic-driven stock selloffs tended to reverse, especially over the following month. A year later, the S&P 500 was higher 92% of the time.

One of the BEST investing videos ever Jim Simons was an incredible investor:

I've tracked every Economist and Barron's cover for over 20 years. Barron's has an accuracy rate of 56%. Not a great fade. But what about when they're both bullish on stocks and/or the economy at about the same time? Judge for yourself.

The new Barron’s cover is circling FinX once again. This is notoriously known to be a contra indicator. However, let me remind you (because everyone conviently forgot) of the previous time the Barron’s cover was plastered on FinX 👇

Sometimes just 2 much data; sometimes there are 2 data points that are so oppositional, they offer what COMES NEXT, when cross referencing the 2 data points 100% the case for the coming week and what we outline in our Research Report at finomgroup.com

Only 6 weeks away! 👇

Why should you attend the 2023 Master Trader Program this October? One word... RESULTS! Every year our clients dominate the U.S. Investing Championship leaders list WITH REAL MONEY👇and you can too! Learn to trade like a champion. Register at 4stocktraders.com - or start…

M.S. Mike Wilson: "...fading fiscal support, lower liquidity, falling inflation will weigh on $SPX $SPY $QQQ 2nd half of year...stocks are as stretched as they can get in a narrow performance that’s driven by excess liquidity from March’s banking bailouts. Soooo, it's Tuesday?

What not aging well looks like!

Morgan Stanley's Mike Wilson: ⚠️ Bear market rally over ⚠️ 2008-likeness showing in many macro-fundamentals ⚠️ Weaker inflation bullish for bonds, not equities ⚠️Earnings risks are rising ⚠️ $SPX 3000-3300 still most likely outcome early '23 $SPY $NYA $QQQ

China’s slowing foreign direct investment inflows may signal slower global growth, according to @AleGrindal @NDR_Research, as greenfield FDI in the country reached a new low in 2022. bit.ly/3OJ6YcM

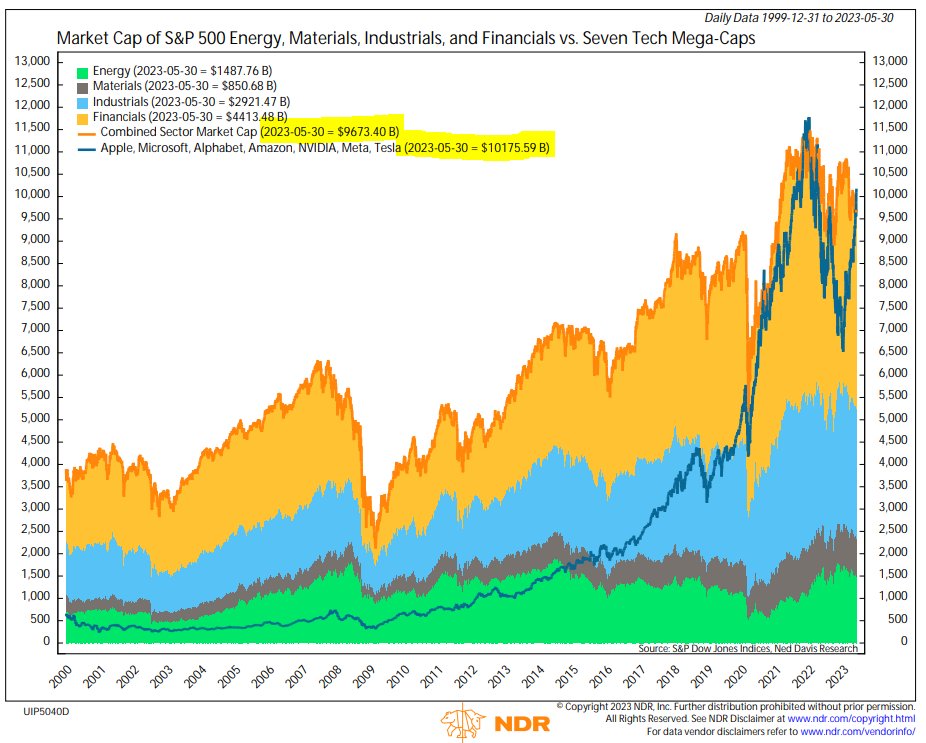

The seven largest companies now have a market cap greater than the Energy, Materials, Industrials, and Financials sectors combined. @NDR_Research

Earnings season is mostly done (84% of $SPX reported). A 🧵: The beat rate is up to 78.5%, reversing a 2yr decline. Investors learned a long time ago that mgmt keeps expectations low, but this implies companies are getting a better handle on macro conditions. @NDR_Research 1/5

“.. YOU KNOW WHAT THEY SAY…..Sell in May, Go Away….or my revised version: Short in May, Only To Panic Cover in July.” - BofA h/t @carlquintanilla $SPX $SPY $QQQ $DIA

Wow, finished in under 2 hours. Faster than any runner will be tomorrow!

Cheering for the Red Sox today and Boston Marathon runners tomorrow!

United States Trends

- 1. Tyson 536 B posts

- 2. Karoline Leavitt 19,1 B posts

- 3. #wompwomp 7.016 posts

- 4. Paige 7.961 posts

- 5. Syracuse 22,6 B posts

- 6. Pence 62,2 B posts

- 7. Kiyan 27,3 B posts

- 8. Kash 108 B posts

- 9. The FBI 271 B posts

- 10. Jarry N/A

- 11. Debbie 36 B posts

- 12. Frankie Collins N/A

- 13. Whoopi 118 B posts

- 14. #TOKKIVSWORLD 1.894 posts

- 15. #LetsBONK 16,7 B posts

- 16. Dora 24,9 B posts

- 17. White House Press Secretary 22,8 B posts

- 18. Villanova 1.866 posts

- 19. Ace Bailey N/A

- 20. End of 1 23,8 B posts

Something went wrong.

Something went wrong.