Similar User

@TChoramle

@SatyamG4BJP

@StocksLife1

@pateldeep9699

@Marwaha_Manuj

@vijay15984

@pallavi_nagpal

@PalaniappanP11

@djsundriyal91

@ChallaVasureddy

@GrantFerguson_

@JoeDavi52353628

@Harshitjain_08

@FnOlearner

@abrahamakhil_93

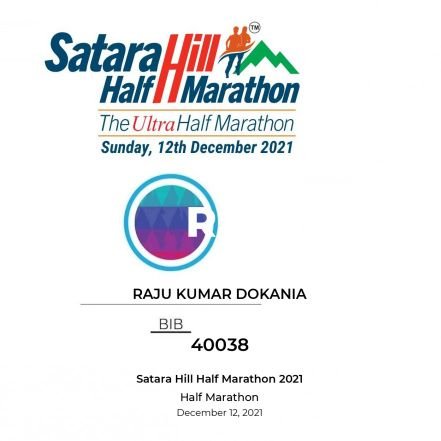

I am learner and still learning to be a winner. Daily my self motivation I am a winner.

My SIP investment and current valve .. don't stop your SIPs. #InvestmentStrategies #SIP

Screeners I use during the Quarterly results: Fundamental Screener : screener.in/screens/214772… Technical Screener: chartink.com/screener/sneha… These screeners helps me to find out the performing stocks specially swing trades. Explained the art of writing the screeners in my…

You don't lose anything in good stocks until you sell in loss. Just hold and relax. Volatility is the part of the stock market.

This indicator made me a full-time trader… It consistently makes me $1500 in 45 minutes, And it’s the best indicator I’ve seen in 7 years of trading. Take 2 mins to see how ANYONE can use this:🧵

Question: How is the stock market going to be ahead? Answer: It was explained 3 months back. Understand everything in detail in 17 minutes.

Question: How to find a multibagger stock? Answer: Spend 11 minutes and watch this video.

After trading for over 6 years, I’ve found the BEST scalping strategy… I’ve tested ICT, support/resistance, and moving averages, But this one beats all of them… Here’s the scalping strategy that’ll make you rich:

Bro's Tip: If the price is almost the same the entire day, but volumes are going up, then it means something good can happen 😉.

Start with 10 Lakh → Double every 3 years → 30 years → End up with 100 Cr! 🚀💰 That's the power of compounding. 🙌

How Warren Buffett picks stocks for long-term.

I've been investing for 8 years and understanding annual reports is a must. But don’t worry, you don't have to go through all 300-500 pages; I'll show you the key sections to focus on and explain everything in this video: youtu.be/SB1LDms_qho

Points to select the good companies for swing trading: 1. Among top 3-4 market leaders of its sector 2. Posting best ever yearly profits 3. Expanding to increase the revenue over next 2-3 years 4. There is a technical chart pattern After fulfilling above conditions, it’s…

Fundamentals analysis - Valuation check Which stock is this ? Review and comment on your business analysis Section 1: 1. market cap = 1,263 cr (above 1000 cr) ✅ 2. PE = 29.04 < 42.14 (Industry PE) ✅ 3. PEG = 3. ROCE = 27.29 ✅ 4. ROE = 22.14 ✅ 5. Debt / Equity = 0.03…

For those who want to create a watchlist on screener with all the key fundamental ratios mentioned on my previous tweets, please look at my watchlist screen shot below 1. Once you create and save a watchlist with the key metrics, you can easily add a stock and within 5 minutes,…

Valuation of Power Transmission and Distribution Sector ✅ From the below screenshot after carefully analyzing and comparing all the key fundamental metrics, write your review on which are the stocks looks still undervalued compared to the peers and has great potential to grow…

Key data points to consider while reading the company’s annual report ✅ #annualreport #sabarisec

Fundamental Analysis - Step by Step Guide✅ #valueinvesting #sabarisec Tons of DMs asking how to conduct a fundamental analysis of a company! Here's a step-by-step guide: Excited to share a comprehensive guide I've personally crafted, detailing a step-by-step approach to…

Select 1 index preferably nifty/bnf. Only 1 lot/set. Only risk defined strategies(select 1) . Keep only long dated options preferably monthly. Set ur target loss&profit. Try to Book small profit/loss. Try to observe and learn. Practice above with discipline for 30-60 sessions

I am following this system Doubling my portfolio each year. Read it to understand

One of My Known person has made 2 cr in 3 years from 10 lakh capital by doing cash trading. His strategy is to buy with high allocation during quarterly results after looking for those stocks which posted strong quarterly results YoY and QoQ with high OPM in both. During…

You can’t lose money even if you wish for, if you follow these five conditions: 1. No F&O 2. No Intraday 3. No Stop Loss 4. No Margin 5. Not more than 5% in one stock

United States Trends

- 1. Fauci 106 B posts

- 2. Spotify 2,83 Mn posts

- 3. Snape 5.130 posts

- 4. Pete 921 B posts

- 5. CEOs 30,6 B posts

- 6. Hawk Tuah 25,4 B posts

- 7. $EMT 4.074 posts

- 8. $HAWK 7.673 posts

- 9. Mbappe 173 B posts

- 10. #EarthMeta 1.670 posts

- 11. Sister Jean 1.129 posts

- 12. United Healthcare 124 B posts

- 13. Arsenal 428 B posts

- 14. Brian Thompson 172 B posts

- 15. Preemptive 40 B posts

- 16. UHC CEO 11,2 B posts

- 17. Citibike 12,8 B posts

- 18. Alan Rickman N/A

- 19. Team USA 6.877 posts

- 20. Chipotle 8.919 posts

Who to follow

-

@HR.Tushar choramle#

@HR.Tushar choramle#

@TChoramle -

SatyaNarayana Goud 🇮🇳🚩

SatyaNarayana Goud 🇮🇳🚩

@SatyamG4BJP -

Venkat

Venkat

@StocksLife1 -

Deep Patel

Deep Patel

@pateldeep9699 -

Manuj Marwaha

Manuj Marwaha

@Marwaha_Manuj -

Vijay parmar

Vijay parmar

@vijay15984 -

Pallavi Nagpal Jairath

Pallavi Nagpal Jairath

@pallavi_nagpal -

Arudhra

Arudhra

@PalaniappanP11 -

dhananjay

dhananjay

@djsundriyal91 -

Dr Vasureddy Challa

Dr Vasureddy Challa

@ChallaVasureddy -

GrantFerguson.

GrantFerguson.

@GrantFerguson_ -

Tharavadikal

Tharavadikal

@JoeDavi52353628 -

Trader Harshit Jain

Trader Harshit Jain

@Harshitjain_08 -

The Options Trader 🇮🇳

The Options Trader 🇮🇳

@FnOlearner -

Akhil Abraham

Akhil Abraham

@abrahamakhil_93

Something went wrong.

Something went wrong.