sahil bhadviya

@sahilbhadviyaYouTube Educator | SEBI Registered Research Analyst: INH000018391 | Ex-Data Analytics Consultant, London

Similar User

@sabarisec

@manojgupta1979

@LearningEleven

@LaurusLabs

@tushar9590

@_KiranRajput

@Aditya_joshi12

@Abhishekkar_

@Stock_Precision

@analystmohalla

@nid_rockz

@godisinside

@LuckyInvest_ARK

@StocksCall_

@Nigel__DSouza

Real luxuries in life that I enjoy every single day 1. A good night sleep 2. Slow mornings 3. Afternoon nap 4. Hot home cooked meal - All the time 5. Fun with my kid 6. Follow my passion (learn and share knowledge on investment and personal finance) 7. Flexibility to work (I…

2 most common mistakes of retail investors in stock market. Thanks @WealthEnrich ji for highlighting this :)

Was recently assisting a friend assess & realign his #portfolio. I realised 2 vital points : 1. Stock selection done primarily on past performances. 2. Profit booking in winner stocks done too early & losers are held for much longer. Hope you are not doing the same mistakes?

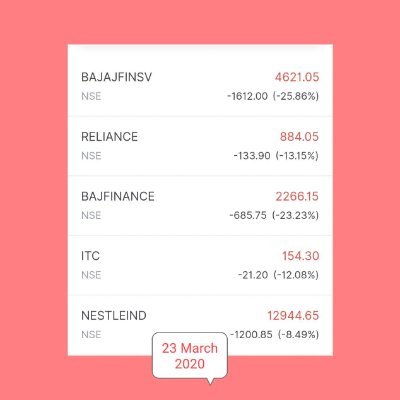

Patience and conviction is the holy grail of long term investing. But the catch is that - Its much much easier said than done. That is the reason very few % of people emerge as winners in stock market.

If you keep buying and selling stocks based on quarterly results, you would end up with a new portfolio every quarter :) Don't sell based on 1-2 bad quarters. Likewise, don't buy simply based on 1-2 good quarters. Situations can change really fast. Think long term while…

Microfinance sector - Getting worse! Equitas - Another massive provisioning in Q2 for microfinance sector.

💯 Enjoy till the party last. But it will eventually end very badly.

Sometime in the next 3 years, markets will realise that most of the solar stocks are pure commodities like sugar and other companies. They are competing on a global scale. Today, times are good- never extrapolate peak margins and best regulations to continue forever. It’s ok to…

Golden words. Wish we have more entrepreneurs like Mr Sridhar Vembu.

A company that has $1 billion cash, which is about 1.5 times its annual revenue, and is actually still growing at a decent 20% rate and making a cash profit, laying off 12-13% of its workforce should not expect any loyalty from its employees ever. And to add insult to injury,…

This is one of the biggest challenge we face as investor. A lot of stocks give cyclical upswing and we consider it as structural change in industry. Its very very difficult!

Many but most often, it is mistaking cyclical upswing to be structural change in industry. So we buy on low PE after stock has run up and then watch the stock go down a long way as the cyclical downturn takes hold

Among all the finance creators on Youtube, I'd rate @ishmohit1 @soicfinance - #1. He is the undoubtably the best finance teacher.

May the festival of lights illuminate your life with happiness and prosperity. Wish you all a very happy Diwali 😇

Today's stock price movement of IDFC First and Nuvama were completely opposite of their results! Even I didn't expect it. There is only one explanation - Market always factor in both good and bad news in advance. IDFC First already down 35% from the peak whereas Nuvama is up…

It was a conscious decision to prioritise my health and avoid metro cities. Clean water and air are the most importance yet most neglected part of our life. Kitna bhi paisa bana lo - you can’t earn good health.

Every 2nd child has cough and respiratory ailments , mountains of garbage, toxic foam over Yamuna … I went for a run in morning and couldn’t breathe properly after 10 min What have we done to our city..

On twitter I only find people with 100% success rate. If a stock goes up ->They say - I told you. It will go up. If a stock goes down -> They say - I told you. It will go down. And I wonder - How can I get wrong with some of my investment thesis!

Excellent comparison. Interesting, metal has outperformed Nifty 13 times out of 25. This is crazy! However, when Nifty has outperformed, its with big margins. Any day - Nifty is a clear winner with big margin. But lesson is - Metal can also be a part of asset allocation.

Here is my opinion: For me, its the froth getting settled. Looking at the valuations, baring banking and finance, I don't see any discount. As the price has been marked up big time in last 3-4 yrs. Need more correction to really call it a discount. Not yet :) And that can happen…

United States Trends

- 1. $CATEX N/A

- 2. $CUTO 7.467 posts

- 3. #collegegameday 1.766 posts

- 4. $XDC 1.283 posts

- 5. DeFi 104 B posts

- 6. #Caturday N/A

- 7. Henry Silver N/A

- 8. Good Saturday 35,8 B posts

- 9. #saturdaymorning 3.053 posts

- 10. Jayce 78,7 B posts

- 11. #MSIxSTALKER2 5.738 posts

- 12. #Arcane 294 B posts

- 13. Senior Day 2.859 posts

- 14. Pence 84,5 B posts

- 15. Renji 3.412 posts

- 16. Fritz 8.001 posts

- 17. McCormick-Casey 27,7 B posts

- 18. Zverev 6.568 posts

- 19. Fishers N/A

- 20. Tyquan Thornton N/A

Who to follow

-

SABARI SECURITIES

SABARI SECURITIES

@sabarisec -

Manoj Gupta

Manoj Gupta

@manojgupta1979 -

Sekhar

Sekhar

@LearningEleven -

Laurus Labs

Laurus Labs

@LaurusLabs -

tushar

tushar

@tushar9590 -

Kiran Rajput

Kiran Rajput

@_KiranRajput -

Aditya Joshi

Aditya Joshi

@Aditya_joshi12 -

Abhishek Kar

Abhishek Kar

@Abhishekkar_ -

Stock Precision

Stock Precision

@Stock_Precision -

Analyst Mohalla

Analyst Mohalla

@analystmohalla -

Shreenidhi P

Shreenidhi P

@nid_rockz -

Peaceful Investor™🇮🇳

Peaceful Investor™🇮🇳

@godisinside -

Ashish Kacholia

Ashish Kacholia

@LuckyInvest_ARK -

Raghunath Capital ⚡

Raghunath Capital ⚡

@StocksCall_ -

Nigel D'Souza

Nigel D'Souza

@Nigel__DSouza

Something went wrong.

Something went wrong.