B Padmanaban ([email protected])

@padhucfpCFP, Mid & Small cap Specialist, Data & Number Crunching, Crorepathi Creator, Financial Coach. On a mission in making Millennials to Millionaire Indians...

Similar User

@pattufreefincal

@StableInvestor

@LearningEleven

@arvind_kothari

@ActusDei

@_KiranRajput

@iRadhikaGupta

@connectgurmeet

@ValueEducator

@ipo_agarwal

@DhanValue

@mohan_koushik1

@stockifi_Invest

@soicfinance

@AdityaD_Shah

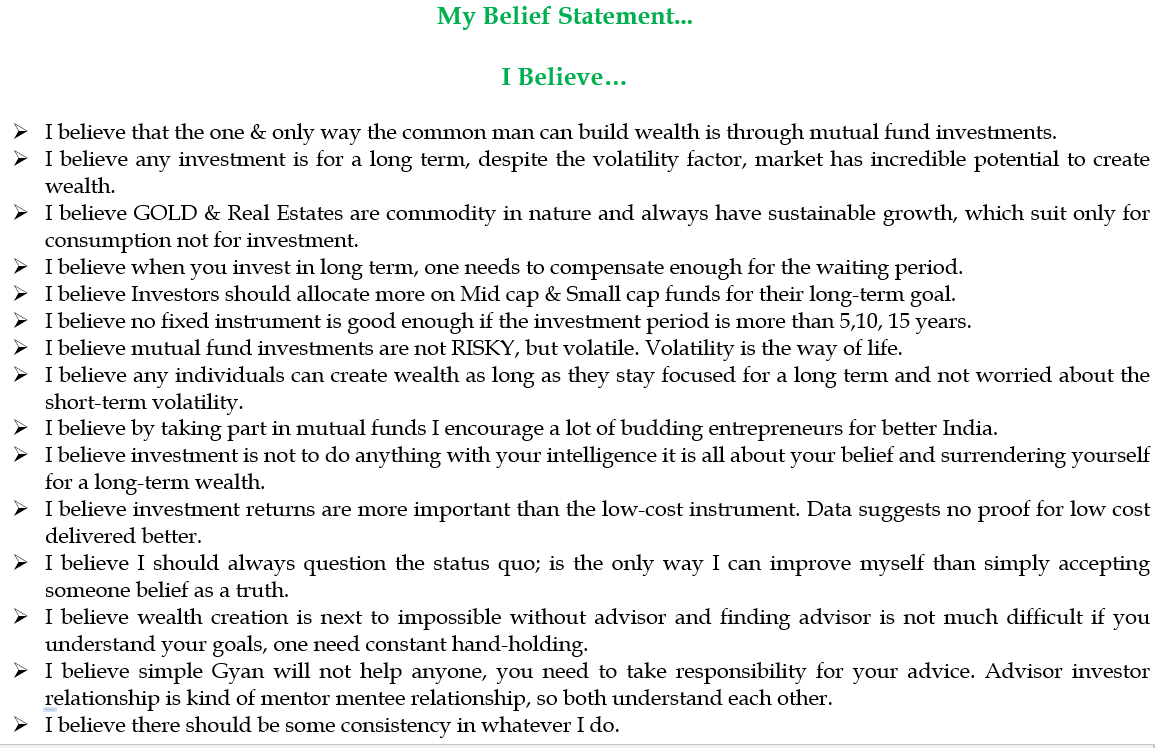

These are my belief statements, few may agree & if u don't, see it as different perspective. Without implementation, learning anything is of no use. Investing is not easy, controlling emotion is tougher. Advise without understanding of the receiver is dangerous. #fortuneplanners

Good habit is one that is very difficult to start and very easy to give up. Bad habit is one that is very easy start and very difficult to give up... Mahatria

Despite an approximately 10% fall, the small cap generated nearly 15% this calendar year. Few clients expressed gratitude for the returns. Most clients are concerned about the drop from the September high. Wealth creation is a complex process, which is why professional…

Some of the active funds in the same period it is mentioned. Just for your observation. No recommendation...

Imagine 3 years ago, you invested ₹1 crore in Nifty Midcap 150. Kept withdrawing ₹1 lakh every month via SWP. In 3 years, you redeemed ~36% of your initial corpus. Yet, your current investment value is ₹1.27 cr. SWP looks amazing on paper. But it can be problematic.🧵

Thanks a lot sharing my interview. 🙏

"பணத்தை விட நேரம் தான் ரொம்ப முக்கியமானது".!😍👌 அனைவரும் கண்டிப்பாக பாருங்கள் நட்புக்களே.!⏰⏰⏰ #timemanagement #money #howtoearnmoneyonline #investment

My reason for sharing the short period is to understand, during the fall or up movement how much each fund participated. To take a call on any fund at least you should look at 1 year return. When the market falls continuously actively managed fund will do well compared to passive…

Multi Asset Allocation One Year Return. Do your due diligence before investing...

You Check yourself, is there any difference! Can we choose anyone fund and keep investing.

Sir small question... To me, Sip ( be it any fund) is all about dollar cost avg & how long one can continue. Does fund like this ( good or bad days) make a difference?

Everyone knows that a good Career is a result of a Solid Education. The challenge lies in the journey. As everyone knows, equity is a very solid asset clause by stay invested in the long term one can make HUGE Wealth. The challenge lies in the journey. We receive coaching…

It shows how little you understand about the performance of funds. See how often quant beat the market, even in poor markets. Mr. Sandeep Tandon made it clear that they wanted to be safe and were uneasy with the current valuation based on their methodology. The market will…

Quant Mutual Fund: When the bull runs, we're at the top. When the bear knocks, we're hitting the bottom. Investing with #Quant is like riding a rollercoaster with no safety belt. 🎢📉 #MarketMystery x.com/rooshabh11/sta…

It has been repeatedly demonstrated that emotional investment always outperforms practical investment. The way the narrative is constructed, gold fans will be thrilled when the market drops, while all stock investors will cry. There is still a long way to go in financial…

This is media 😀😀😀 It says Gold Lovers are excited with the fall of Gold prices. A slight fall in the market, the same media will come with headlines "Bloodbath in Dalal Street. Thousands of Crores eroded in a single day" 😀😀 Did you ever think why media doesn't post such…

Very informative, and desperately needed. Instead of simply ignoring the market's volatility, someone who takes the time to understand would surely see it as their closest friend.

Sensex Falls & Recovery Faster Fall, Faster Recovery: Sharp declines often rebound quickly Recovery Outlasts Fall:Time to recover is longer than the fall itself. Valuation>Price Correction: Deep valuation corrections lead to stronger rebounds. Every Fall has Recovered so far😀

This post educates on the importance of selecting mutual funds wisely based on risk appetite and fund performance. Multi Asset Fund is the most sought after category. However, amidst the recent market fluctuations with Sensex & Nifty down by over 10%, it is crucial to assess…

Very True. No one asks when the market delivered more than 15%, but can't accept the fall in the overall gain. Behavioral finance only felt during the fall.

Inspite of the latest fall, markets have done well only over the last 1 year. Nifty is still up 22% Midcap is up 34% Smallcap is up 35% Investors who have invested for over a year are still in green, the problem is the ones who have invested in the last 2-3 months. Here’s…

Gold performance this month at a glance. Dedicated to all the GOLD lovers...

Height of Stupidity. 12 funds means 12% exit load. He does not know ABCD of MF, but he is suggesting what to do to others.

How much market Corrected so far. It is about 10%. It is natural for any long-term wealth creation to see a 10% decline. It will undoubtedly make those who have never seen it feel horrible. The recovery is just a matter of time. Continue investing as long as you have a…

The market began to decline on September 26. I've chosen two scenarios of Large cap Funds. 1. From September 26 to November 12, 2. From October 31 to November 12 — that is, the entire month of November so far. Many investors are unable to tolerate this slight decline, and…

Top 47 Sector Leader Stocks Which are Down From ATH Price!🔽📉 Courtesy WhatsApp forward.. As of yesterday, investors' portfolios are down 6–7% from their peak. Despite this decline, investors' compound annual growth rate (CAGR) over a ten-year period remains around 20%.…

United States Trends

- 1. Serrano 165 B posts

- 2. #TysonPaul 78,4 B posts

- 3. #NetflixFight 41,2 B posts

- 4. #netflixcrash 5.262 posts

- 5. #buffering 6.903 posts

- 6. Ramos 64 B posts

- 7. ROBBED 71,4 B posts

- 8. Shaq 8.619 posts

- 9. My Netflix 49,8 B posts

- 10. Rosie Perez 8.376 posts

- 11. Cedric 14,4 B posts

- 12. Jerry Jones 6.961 posts

- 13. #boxing 34,1 B posts

- 14. WTF Netflix 12 B posts

- 15. Christmas Day 13,8 B posts

- 16. Love is Blind 4.365 posts

- 17. The Netflix 228 B posts

- 18. $NFLX 4.485 posts

- 19. Streameast 2.463 posts

- 20. Robbery 18,6 B posts

Who to follow

-

M Pattabiraman

M Pattabiraman

@pattufreefincal -

Stable Investor

Stable Investor

@StableInvestor -

Sekhar

Sekhar

@LearningEleven -

Arvind Kothari

Arvind Kothari

@arvind_kothari -

Neil Borate

Neil Borate

@ActusDei -

Kiran Rajput

Kiran Rajput

@_KiranRajput -

Radhika Gupta

Radhika Gupta

@iRadhikaGupta -

Gurmeet Chadha

Gurmeet Chadha

@connectgurmeet -

Value Educator

Value Educator

@ValueEducator -

G K AGARWAL

G K AGARWAL

@ipo_agarwal -

Pankaj Parekh

Pankaj Parekh

@DhanValue -

Koushik Mohan

Koushik Mohan

@mohan_koushik1 -

Abhijit Chokshi | Investors का दोस्त

Abhijit Chokshi | Investors का दोस्त

@stockifi_Invest -

Intrinsic Compounding

Intrinsic Compounding

@soicfinance -

Aditya Shah

Aditya Shah

@AdityaD_Shah

Something went wrong.

Something went wrong.