ChoongMan

@twit_withman가치투자자/Asset Collector/Resource Allocator/Steward Investor/Bystander/중용/중도/균형

Similar User

@costelo78

@hiool

@hagjukim

@krronem

@acornstock_kr

@cnookie

@jjjoal2

@JJspeech

@neozodia

@gichang7

@chogunwook

@senseejun

@zeez777

@goRaikkonen

@goldmanssass

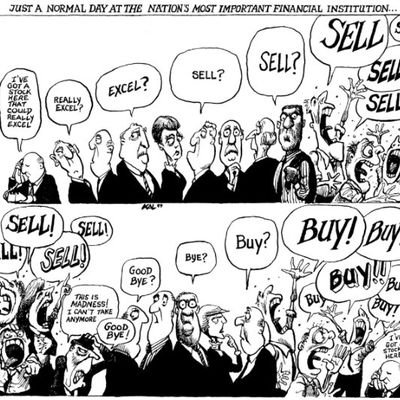

📌 Returns Investors should worry when the Fed stops raising or cuts rates 👉 isabelnet.com/?s=return h/t @GoldmanSachs #markets #investing #commodities #dollar #bonds #sp500 $spx #spx #stocks #stockmarket #equities #returns

"... truly secure and resilient technologies owned by the mass of people, not individuals or institutions." 오늘 @jack의 명언이 쏟아지는 중.

I believe in you and your ability to understand systems. It’s critical we focus our energy on truly secure and resilient technologies owned by the mass of people, not individuals or institutions. Only that foundation will provide for the applications you allude to.

You don’t own “web3.” The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralized entity with a different label. Know what you’re getting into…

Just a friendly reminder that Tencent bought a 5% stake in Tesla for $1.8 billion in 2017 Tencent’s stake is now larger than most companies in the S&P 500 $TSLA $TCEHY

1. 나는 연봉 1억이 진짜 대단한 줄 알았다. 외제차도 한 대 뽑고, 떵떵 거리면서 살 줄 알았다. 근데 솔직히 별거 아니다. 워워, 돌을 던지기 전에, 지금 200 버는 사람들 놀리냐고 하기 전에. 2010년 내 월급이 190이었다. 그런 삶이 어떤지 잘 안다. 우선 끝까지 말을 들어보자.

인플레이션인가? 병목현상인가?

"... Investing requires patience to deal with the inevitable ups and downs that such companies experience as well as the ability to delay significant gratification." Why it is usually a mistake for investors to take profits ft.com/content/f8f8b0… via @financialtimes

United States Trends

- 1. $CUTO 3.015 posts

- 2. ICBM 149 B posts

- 3. #KashOnly 25,4 B posts

- 4. The ICC 131 B posts

- 5. Good Thursday 29,9 B posts

- 6. Katie Couric N/A

- 7. Gm Elon 1.189 posts

- 8. Bezos 32,5 B posts

- 9. International Criminal Court 67,1 B posts

- 10. #thursdayvibes 4.232 posts

- 11. #ThursdayMotivation 5.877 posts

- 12. Gallant 170 B posts

- 13. Dnipro 63,6 B posts

- 14. Vegito 3.071 posts

- 15. #ThursdayThoughts 3.747 posts

- 16. Happy Friday Eve N/A

- 17. #21Nov 3.622 posts

- 18. $BTC 849 B posts

- 19. Adani 879 B posts

- 20. Reece James 11,1 B posts

Who to follow

-

Park Seungyoung

Park Seungyoung

@costelo78 -

Seongjin Kang

Seongjin Kang

@hiool -

Kim, Hag-Ju (김학주)

Kim, Hag-Ju (김학주)

@hagjukim -

B. W.

B. W.

@krronem -

AcornStock

AcornStock

@acornstock_kr -

정신욱

정신욱

@cnookie -

우리형 칼 아이칸

우리형 칼 아이칸

@jjjoal2 -

JJ's view

JJ's view

@JJspeech -

내 이름은 개

내 이름은 개

@neozodia -

BAIK GICHANG

BAIK GICHANG

@gichang7 -

Chogunwook

Chogunwook

@chogunwook -

Henry Kim

Henry Kim

@senseejun -

Grace

@zeez777 -

안알랴줌

안알랴줌

@goRaikkonen -

골드만쌌쓰

골드만쌌쓰

@goldmanssass

Something went wrong.

Something went wrong.

![BOT [전시][학술,세미나][강좌][공모][도서] 등 다양한 정보를 나눕니다.](https://pbs.twimg.com/profile_images/1851787739815178240/aTfJCmQD.jpg)