Similar User

@JohnRKamprath

@Roland03776540

@Edwardike368

@patri37356

@MachinistImprov

@MacDad33

@terealbert32

@johnpistilli1

@njresende

@spdsk8trgrl

@am49pm

@Mining_Atoms

@trendwhizo

@TheDarkLordChap

@MuniBondz

Whenever I see Jimmy Kimmel complaining about President Trump I can't help but recall this video:

Best outdoor furniture selection and awesome deals!

Win $$$ @BedBathBeyond .. I’ll award winners all day long. Must Rt and tell me what you love about it. #BedBathBeyondWinner

Gareth what’s your thoughts on FNV?

Ackman Covers His Short, BTC Double Top, Stocks Swing, Trade Setups & Levels twitter.com/i/broadcasts/1…

wow what bullshit this is, a younger me would think this was a joke, but sadly I have become numb to this craziness

Smells like systemic risk to me! Question though, how do short term and long term yields move as this event gets priced in?

It’s funny (also sad) that I said to Michael Blum weeks ago at hedgeye live that I felt like I was at galts gulch (a place where normal productive members of society can congregate and share ideas)

I remember reading Atlas Shrugged years ago. The productive class eventually stopped being productive and checked out. I’d like to check out. Show me the way to Galt’s Gulch. #DefundDC

LISTEN TO GREEN, PEOPLE. This trend, along with the incentives described by mega-managers of pensions at the Milken confab to sell equities and go all in UST/Distressed debt--is the most important MACRO point, maybe EVER.

Druckenmiller: "When you have free money, people do stupid things. When you have free money for 11 years, people do really stupid things. So there's stuff under the hood, it's starting to emerge. ... I would assume there's a lot more bodies coming." zerohedge.com/markets/lot-mo…

A very large private equity investment has gone Blotto. Paging @Mike_Taylor1972 @OtherSide_AM @HedgeyeRJM

KKR-Backed Envision Healthcare Plans Chapter 11 Bankruptcy Filing | If only someone had warned the buyers/lenders…Oh, wait… wsj.com/articles/kkr-b…

Whatever you do, do not look at what American business (that isn't trying to sell you stock) thinks... = New Cycle Lows

Interesting we’re seeing CRE problems everywhere. CapRate / Hurdle Rate mismatch.

What a novel idea. Now do student loans…

KJP: "If you buy a car, you are expected to pay the monthly payment...It's that simple."

Imagine you get to your bank's drive through and there are 400,000 cars in front of you. That's #bitcoin right now.

I’ve truly been “running with the @Hedgeye stars” #HedgeyeLive2023

JP Morgan currently has $2.4 trillion in deposits in the US. For the entire year of 2022, JP Morgan paid ~$10 billion in interest on these deposits, or 0.4%. Meanwhile, Apple's new savings account will pay 4.2% in interest to depositors. If JP Morgan were to raise their…

This is perhaps the most pronounced alligator mouth that I've seen. Some of the largest beneficiaries of what has arguably been the most speculative macro environment in history are now beginning to demonstrate clear signs of chronic underperformance. Despite the recent rally…

Current rumor is market maker getting taken out. Causing inflated USD market prices on Binance US. My hunch is Binance getting forced out of US market in CFTC settlement and continuing the rotation from BUSD->BTC->USDT that I said was driving up the market to reallocate funds…

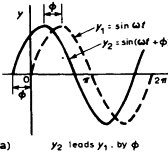

This remains one of the craziest chart pictures in my career... at every maturity the market is saying "no way" to the Fed... closest analog is an "inverse" 1995-6 when Greenspan Fed kept rates lower while market thought inflation a risk and politicians pushed for lower rates…

Was just walking home from dinner in London, listening to @hendry_hugh on @Hedgeye and ran into the man himself! Hugh, nice quick chat on red cabbage exchange rates and commodities! podcasts.apple.com/ca/podcast/rea…

United States Trends

- 1. #AskShadow 3.384 posts

- 2. GOTY 46,4 B posts

- 3. Sean Duffy 6.254 posts

- 4. Jackson Merrill N/A

- 5. Paul Skenes 4.071 posts

- 6. #AskSonic N/A

- 7. Mika 116 B posts

- 8. Balatro 25,2 B posts

- 9. Katie Hobbs 12,2 B posts

- 10. Secretary of Transportation 6.778 posts

- 11. San Marino 46 B posts

- 12. Elden Ring 33,7 B posts

- 13. Road Rules N/A

- 14. NL Rookie of the Year 1.131 posts

- 15. #TheGameAwards 57,3 B posts

- 16. Mixon 2.931 posts

- 17. Real World 73 B posts

- 18. Bakkt 15,4 B posts

- 19. Morning Joe 95,8 B posts

- 20. Ichiro 5.264 posts

Who to follow

-

John Kamprath

John Kamprath

@JohnRKamprath -

Roland in NYC

Roland in NYC

@Roland03776540 -

EdwardEisenhauer

EdwardEisenhauer

@Edwardike368 -

Jocie Patrick

Jocie Patrick

@patri37356 -

Joseph Pijanowski

Joseph Pijanowski

@MachinistImprov -

Mac

Mac

@MacDad33 -

Albert Fernandez

Albert Fernandez

@terealbert32 -

jp

jp

@johnpistilli1 -

Nelson Resende

Nelson Resende

@njresende -

Leslie

Leslie

@spdsk8trgrl -

adrian magrath

adrian magrath

@am49pm -

B.F. Randall ⚛ ⛏ ⚡

B.F. Randall ⚛ ⛏ ⚡

@Mining_Atoms -

trendwhizo

trendwhizo

@trendwhizo -

wizer

wizer

@TheDarkLordChap -

The Muni Guy

The Muni Guy

@MuniBondz

Something went wrong.

Something went wrong.