Similar User

@HalevyMike

@TFugit2222

@huutri1986

@NoahsArk1112019

@Big_DawgFX

@STzu20

@skboucoyannis

@__Daviiddd

@hosnyhamdy15

@AcThorne22

@OswaldFaust2

@JoshFielden_

@shaf_eth

@Enab001

@taysmom1

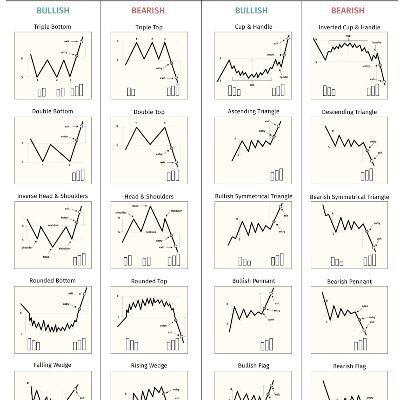

After Trump’s election, for 4 years, market will have the biggest fastest baddest bull market ever recorded in history After 4 years of macho ultra super Maga bullish move, there will be a steep correction which most people gonna think it’s a crash but it’s not

$SPY $DIA $QQQ markets finished az $NFLX finally stopped trackin it, also $NVDA imploding all day long, this shud b thu top 🔪🐷🩸

$QQQ is down 5 days in a row now, with an oversold RSI. $SPX $SPY @Optuma

$SPX - Did the market make a 73 day cycle low today? We'll find out next week. It hit the 20 day MA which is an important support level so from a price perspective it makes sense. Obviously, in order to confirm the low, SPX needs NVDA to convincigly beat expectations next week.

$SPY $DIA $QQQ beyond this, take into account $TSLA iz up 3%, therez no way CALLZ dont work here, u gotta b stupid if ur still short 🚀

$SPY MFI just hit ZERO lol, almost impossibull, just got filled 585 CALLZ for money $2🚀

$SPX - I still expect a bounce to the 20 DMA this week, but there's a 73 day cycle low on November 15. It's up to you to decide what it means with regards to the election winner. The last time a correction ended 10 days after election day was 2012, when Obama won his 2nd term.

If #liquidity curve is correct --> not good for #stockmarkets #FED #stockmarketcrash #StockMarket

That said, the Iran Israel war is likely to prevent it from dropping to 0.83 in October, and if we fast forward to November 6, and there's uncertainty regarding the US election winner, we may see $VIX: $VXV reaching levels not seen since March 2020. x.com/CyclesFan/stat…

$SPX is at an all time high and the relative level of fear in the market is bigger than it was during the entire 3 month correction last summer. Imagine what would happen if $VIX: $VXV dropped to 0.83 like it did in August or September. We're talking about 6000+ in October.

$SPX is close to breaking out of the recent consolidation. In the April-July uptrend it rallied 14.45% so the 1st potential target to end the uptrend out of the August low, is the level at which that uptrend will equal the previous uptrend in percentages, around 5860.

#SPX: McClellan Summation Index (a swing trade indicator) is rolling over. $SPX #SPY $SPY #ES $ES #StockMarket

$SPX monthly - The 14 month RSI closed at 72.47 in September. When RSI was above 70 SPX hasn't made any cyclical top since 1994 without a divergence, that lasted anywhere between 4 months in 2021 and 24 months in 1998. The bottom line is that we're nowhere near a major top yet.

$SPX - The calendar week of September 19 to September 26 is statistically the most bearish week of the year. So far in 2024 SPX is up 1.8% during this week which indicates that something different is going on this year. The next potential resistance is the 1.618 extension at 5806

$SPY $DIA $QQQ there'z 2 much fukin nonsense goin on rite now, sumthin dont smell rite. $NVDA iz just 1 of many warning signalz rite now. oil iz another. thu cowardz cuttin rates hard with market at ATHs. i do believe $VIX will XPLODE again next week. wee shall c ☠

$SPX - Made a new ATH for real by closing above The July high(5667). The next potential resistance is ~5805. An indicator which I occasionally use and has predicted the March high is pointing to another multi week top on 9/24-9/25. We'll find out next week if that's the case.

$SPX - Made a new intraday ATH at 5690. The reaction to the FOMC favors a decline into 9/25 but it has to close below the 20 DMA to confirm that. There's also an alternate scenario in which it keeps making marginal new highs until 9/25. Tomorrow's action should make it clearer.

$SPY started thu Sept 30 556 PUTS 7.28

Here is an update to $SPX 2024 Forecast.

Here is what I'm keeping an eye on in regard to the $SPX, seeing if the momentum can continue to mid-September '24. Also, here is a comparison of how Bonds have correlated with respect to the $SPX going back to 2018. At times Bonds have been in sync with the $SPX and at other…

$NDX - The touch of the lower Bollinger band on Friday has led to a bounce today. This bounce is likely to top on Friday or next Monday when there's a 15-16 trading day high to high cycle that goes back to late May. The target could be around 19100.

That last dip down was brutal and an harbinger for more selling...

9/5/24, also possible is 9/16/24 according to the forecast. For 9/5/24 keeping an eye on $SPX ~5671, and $SPX ~ 5833 for the 16th.

United States Trends

- 1. Dayton 5.085 posts

- 2. Chargers 56,7 B posts

- 3. Seth Trimble N/A

- 4. Quentin Johnston 5.993 posts

- 5. Ravens 68,3 B posts

- 6. Drake 356 B posts

- 7. Kerr 7.764 posts

- 8. #WWERaw 68,5 B posts

- 9. Canada 417 B posts

- 10. Lamar 182 B posts

- 11. Herbert 19,9 B posts

- 12. Maui 15,7 B posts

- 13. Jalen Washington N/A

- 14. Cadeau 9.503 posts

- 15. Kofi 16,5 B posts

- 16. #BALvsLAC 9.385 posts

- 17. Derrick Henry 9.357 posts

- 18. Heels 22,3 B posts

- 19. Nets 14,5 B posts

- 20. RJ Davis N/A

Who to follow

-

Mike.Halevy

Mike.Halevy

@HalevyMike -

Philipthegreat.eth

Philipthegreat.eth

@TFugit2222 -

Tri Trương

Tri Trương

@huutri1986 -

NoahsArk

NoahsArk

@NoahsArk1112019 -

Big_Draco🐐

Big_Draco🐐

@Big_DawgFX -

S_Tzu

S_Tzu

@STzu20 -

Katerina-Shelagh Boucoyannis

Katerina-Shelagh Boucoyannis

@skboucoyannis -

David

David

@__Daviiddd -

Hosnyhamdy15

Hosnyhamdy15

@hosnyhamdy15 -

Thorne / Astarion

Thorne / Astarion

@AcThorne22 -

Faust Oswald 🇧🇯

Faust Oswald 🇧🇯

@OswaldFaust2 -

Josh

Josh

@JoshFielden_ -

shaf

shaf

@shaf_eth -

Enab

Enab

@Enab001 -

taysmom1

taysmom1

@taysmom1

Something went wrong.

Something went wrong.