Warren Pies

@WarrenPiesFounder @3F_Research | PM $FCTE - https://t.co/rVBB7kn402 | Formerly with Ned Davis Research | Recovering Attorney (step 4)

Similar User

@3F_Research

@crossbordercap

@Geo_papic

@EPBResearch

@MichaelKantro

@MacroCharts

@Go_Rozen

@profplum99

@donnelly_brent

@EconguyRosie

@AndreasSteno

@PauloMacro

@dampedspring

@patrick_saner

@UrbanKaoboy

Historically, during soft landings, the S&P 500 rips in 6 months leading into a first Fed cut. Would put the market at 5,200 by May... First time speaking w/ the great @ScottWapnerCNBC was a blast!

New report out to 3FR clients yesterday. Examining the broadening trade and explaining why we are skeptical. Dialing up some duration and further downgrading commodities...

Counterpoint: The FFR-2YR spread was the most inverted it had ever been prior to an initial Fed cut. Translation: The market was priced for a recession and the Fed reassured it...Not that surprising of a result. @3F_Research

Since Sept 18th -The Fed has cut rates 75bps -2-year yield has risen 75bps The market is in the driving seat.

The “Chinese finger trap” market OPEC is in a bind

A USER'S GUIDE TO RESTRUCTURING THE GLOBAL TRADING SYSTEM As markets look forward to a second Trump Admin, there are lots of bad predictions that tariffs will cause horrible inflation, or the President can't affect the dollar. Both are false. /1 hudsonbaycapital.com/documents/FG/h…

Spaces tomorrow with the WisdomTree boys

We have a macro session tomorrow with @WarrenPies here on X. It will be me and @JeremyDSchwartz hosting him. Make sure to tune in. twitter.com/i/spaces/1DXxy…

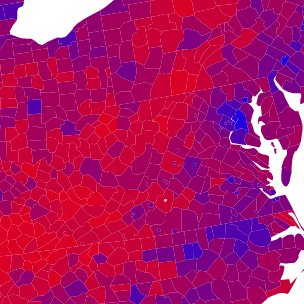

Quick thoughts on the election and November model positioning below…

How were our models positioned ahead of the election? In the excerpt below (from last week's client retrospective), @WarrenPies discusses our Real Asset Allocation Model, the "Trump trade" and why the "guts of the market" turned out to be the best pollster this cycle.

If you weren't convinced, today's post-Fed action should be further evidence that the first Fed cut was not a "policy mistake." Neither is the Fed losing the bond market.

POST-ELECTION (MARKET) THOUGHTS Yields up is a continuation of the growth scare unwind...not a Fed "losing control", a "policy mistake", or concerns over a new wave of tariff inflation. The question going forward: "Can the U.S. economy operate w/ a +7% mortgage rate?"

Many hedge fund managers are still underweight equity risk. x.com/WarrenPies/sta…

For those who have been underinvested in equities, the pressure to chase the market from now to year end will be immense.

For those who have been underinvested in equities, the pressure to chase the market from now to year end will be immense.

Great thoughts here from Warren. 👇

POST-ELECTION (MARKET) THOUGHTS Yields up is a continuation of the growth scare unwind...not a Fed "losing control", a "policy mistake", or concerns over a new wave of tariff inflation. The question going forward: "Can the U.S. economy operate w/ a +7% mortgage rate?"

POST-ELECTION (MARKET) THOUGHTS Yields up is a continuation of the growth scare unwind...not a Fed "losing control", a "policy mistake", or concerns over a new wave of tariff inflation. The question going forward: "Can the U.S. economy operate w/ a +7% mortgage rate?"

United States Trends

- 1. Tyson 472 B posts

- 2. $MAYO 12,9 B posts

- 3. #wompwomp 4.648 posts

- 4. Pence 56,6 B posts

- 5. Kash 94,4 B posts

- 6. Debbie 31,3 B posts

- 7. Whoopi 99,9 B posts

- 8. The FBI 260 B posts

- 9. Dora 24,2 B posts

- 10. Ronaldo 169 B posts

- 11. Iron Mike 20,1 B posts

- 12. Mike Rogers 18,4 B posts

- 13. #LetsBONK 13,4 B posts

- 14. Connor Williams 1.263 posts

- 15. Gabrielle Union 2.039 posts

- 16. #FursuitFriday 17 B posts

- 17. Pepsi 21,3 B posts

- 18. Rising Stars 1.277 posts

- 19. Staten Island 23,9 B posts

- 20. National Energy Council 5.293 posts

Who to follow

-

3Fourteen Research

3Fourteen Research

@3F_Research -

CrossBorder Capital

CrossBorder Capital

@crossbordercap -

Marko Papic

Marko Papic

@Geo_papic -

Eric Basmajian

Eric Basmajian

@EPBResearch -

Kantro

Kantro

@MichaelKantro -

Macro Charts

Macro Charts

@MacroCharts -

Goehring & Rozencwajg

Goehring & Rozencwajg

@Go_Rozen -

Michael Green

Michael Green

@profplum99 -

ʎllǝuuop ʇuǝɹq

ʎllǝuuop ʇuǝɹq

@donnelly_brent -

David Rosenberg

David Rosenberg

@EconguyRosie -

Andreas Steno Larsen

Andreas Steno Larsen

@AndreasSteno -

Paulo Macro

Paulo Macro

@PauloMacro -

Andy Constan

Andy Constan

@dampedspring -

Patrick Saner

Patrick Saner

@patrick_saner -

Michael Kao

Michael Kao

@UrbanKaoboy

Something went wrong.

Something went wrong.

![CFA Charterholder, retired NFL Cheerleader, and Canes Alum []_[]](https://pbs.twimg.com/profile_images/378800000562692082/dbb4b3ae56a3028b68a0ba5804ff4f10.jpeg)