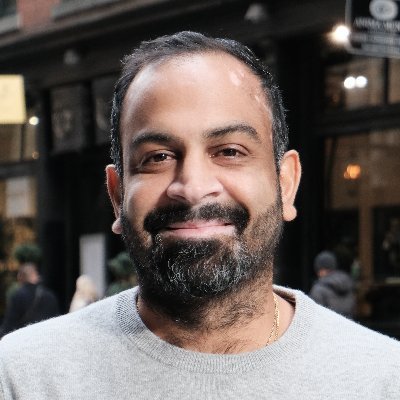

Micah Rosenbloom

@micahjay1Seed stage investor at @fcollective. Over 50 founding teams served & counting! Founder of 3 tech companies - Handshake, Brontes (acq by 3M) and Sample6/Corvium.

Similar User

@fcollective

@lpolovets

@epaley

@chadbyers

@semil

@dafrankel

@chudson

@aileenlee

@kirstenagreen

@Samirkaji

@rebeccakaden

@SusaVentures

@schlaf

@upfrontvc

@fdestin

In order to respond to the question "what do you invest in?" from founders, angels, scouts, VCs, LPs, and my mother... we've created this easy to use cheat-sheet. Only 26 categories - guess we don't follow that many themes ;)

We’re often asked by entrepreneurs, VCs, and others in the entrepreneurial community, “What kinds of companies do you invest in?” The short answer is – almost anything. We’ve backed startups developing solutions in industries ranging from AdTech to Zoological DNA tests. /🧵

Ep. 24 of the @rhobusiness pod is live! I asked @fcollective @micahjay1 about the hidden VC motives founders should be vigilant about and... 1. How different investor types present unique challenges for founders accepting money from them 2. The delicate (but important) process…

👏 The response to our AI SEO Strategy Generator launch yesterday has been awesome, check out a preview below. We've built this to give ambitious marketing teams some fresh plays to drive organic growth to their domain, leveraging their unique internal data and content. Get…

🔥

I joined the dads basketball league at my kids school. Thankfully I realize there's a new set of rules when you get to this age. If you have the lane, you get it. No aggressive defensive, no fighting over rebounds. I would have played more as a kid with these rules!

when investors see a wave of very similar companies- it makes it harder to stand out - suggestions for how to overcome this? (besides the usual good #s, good team etc)

a tension I see in founders presenting is that some investors want to see a big vision / picture and others want more a tactical plan - so founders tend to oversteer the presentation in one direction or the other

Any good arguments for a 2 computer set up - home + office vs. just moving laptop back and forth? If so, what equipment do you use at each and any synch issues?

Sometimes "play the game on the field" is interpreted as to recognize the changing dynamics of an industry and adjust. Other times, its interpreted as do what everyone else is doing. The first is the better answer.

Good news United is increasing the rate you acquire PQP points by 20%*. *They are also increasing the status requirement by 20%. The rock fetch for ridiculously low value continues and yet I'm a sucker for it - sigh ;)

One of the biggest fundraising mistakes I've made is over-weighting a VC's willingness to write a check as validation on the business.

From a start-up perspective, Product-Market fit isn't just a binary condition around whether customers want the product. IMHO it includes a) whether enough $ can be extracted from the product to warrant engineering and GTM costs, b) whether there's a plausible GTM motion and c)…

I'm not much of a fashionista but I think the rope hats are going to be short lived.

Nothing quite brings out Type A parenting in NYC quite like beginning the college search.

So love the voice, transparency and authenticity of this brand and these videos. Will be interesting to see where this new product heads ...

In this seed market, it seems the curve of hope is significantly valued more than the curve of reality -> modest revenue may be less valued than no revenue at all. One rationale is that with AI, "test" revenue isn't necessarily indicative of a big opportunity. Similarly, a…

100%

observation in early stage landscape: tech is developing faster than companies can build and deploy a product, which makes picking a "winner" in any particular space more difficult. in such times, team velocity and flexibility is critical criteria to consider.

Congrats guys! Excited to collaborate :)

Today we’re unveiling @chemistry_fund - a new firm founded by @kshenster, @Mark_Goldberg_ and me. We’re also announcing a debut fund of $350M – dedicated to going all in with a select number of high conviction investments at the Seed and Series A. I couldn’t be more excited to…

So pumped for you!! Back in the saddle :)

Social media is so toxic these days even Zillow is triggering ;)

A challenge of the VC model is that valuations are static for months or years. It can set a floor or ceiling, when in reality company values are changing regularly, based on macro factors and company performance. Not to mention that most VCs will hold the company at different…

United States Trends

- 1. $MAYO 11,6 B posts

- 2. Tyson 420 B posts

- 3. Pence 48,7 B posts

- 4. Kash 82,1 B posts

- 5. Dora 23,5 B posts

- 6. Debbie 23 B posts

- 7. Mike Rogers 13 B posts

- 8. #LetsBONK 9.265 posts

- 9. Gabrielle Union 1.302 posts

- 10. Laken Riley 48,6 B posts

- 11. Iron Mike 17,8 B posts

- 12. Ticketmaster 17,6 B posts

- 13. Whoopi 72 B posts

- 14. #FursuitFriday 16,3 B posts

- 15. Pirates 20,3 B posts

- 16. Cenk 12,5 B posts

- 17. Fauci 184 B posts

- 18. National Energy Council 2.287 posts

- 19. The FBI 235 B posts

- 20. The UK 457 B posts

Who to follow

-

Founder Collective – Seed Stage Venture Capital

Founder Collective – Seed Stage Venture Capital

@fcollective -

Leo Polovets

Leo Polovets

@lpolovets -

Eric Paley

Eric Paley

@epaley -

Chad Byers 🦍

Chad Byers 🦍

@chadbyers -

Semil

Semil

@semil -

David Frankel

David Frankel

@dafrankel -

Charles Hudson

Charles Hudson

@chudson -

aileenlee

aileenlee

@aileenlee -

Kirsten Green

Kirsten Green

@kirstenagreen -

samir kaji

samir kaji

@Samirkaji -

Rebecca Kaden

Rebecca Kaden

@rebeccakaden -

Susa Ventures

Susa Ventures

@SusaVentures -

Steve Schlafman 🐌

Steve Schlafman 🐌

@schlaf -

Upfront Ventures

Upfront Ventures

@upfrontvc -

Fred Destin

Fred Destin

@fdestin

Something went wrong.

Something went wrong.