light

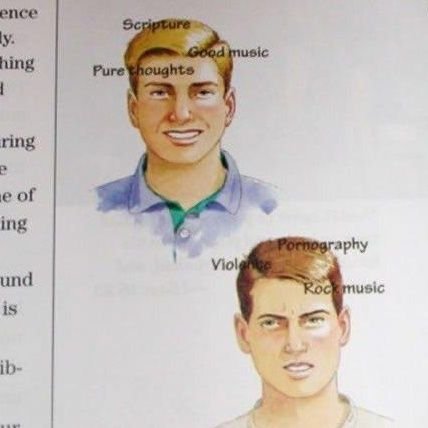

@lightcryptoI heard you say once That a lie is sweet in the beginning And bitter in the end And truth is bitter in the beginning And sweet in the end

Similar User

@CryptoDonAlt

@CryptoHayes

@zhusu

@ThinkingUSD

@Rewkang

@ColdBloodShill

@Arthur_0x

@cmsholdings

@AWice

@zachxbt

@CryptoCred

@blknoiz06

@UpOnlyTV

@jimtalbot

@Cryptopathic

think 2023 will be more about revanche than echoes

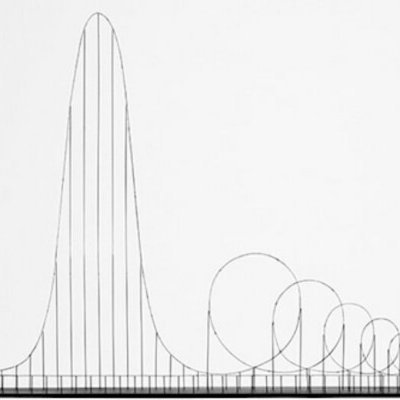

One thing that I've found more and more baffling in the last few weeks is the vertical ascent of SUI, with it quintupling off the lows (Ex 1). The market is starved for winners, and believes it has found one here, yet it all feels awfully chintzy for two reasons that I think feed…

In early August, the remnants of ETH seized from the multibillion dollar PlusToken scheme awoke on-chain for the first time since 2021. Over the last 24h about 7k ETH of the remaining 542k ETH ($1.3b) was sent to exchanges indicating intent to begin selling the remaining tokens.

market saw a glimpse of the future there, it may finally be ETH's turn

imagine that in the long run this will have a salutory effect on the market; a form of catharsis allowing the space to look forward, leaving the sins of the last cycle, as much as we can, in the rear view mirror

[DB] FTX Founder Sam Bankman-Fried Found Guilty of Defrauding FTX Customers by Jury in New York: Reuters

a banking crisis in the developed world has advanced Bitcoin's origin story further in the discursive terrain “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

think 2023 will be more about revanche than echoes

Without harming others with your shitty model, easy way to figure out that USDC at ~0.9 is likely a +EV buy — hard to imagine a market composed of people in (1) this state of panic and (2) risk management hell during (3) weekend liquidity are overpricing USDC.

think market takes a Genesis bankruptcy in sanguine stride — Genesis Global Capital going down without pulling DCG in would quell hysteria surrounding GBTC turning into a spot BTC pinata.

am partial to this thesis, imagine a lot of the drip out that was ahead of us was instead pulled forward by these implosions

FTX, Alameda, and a wide array of insolvent lenders would not have filed for Chapter 11 protection if they hadn’t already sold the entirety of their liquid assets in a last-ditch effort to extend runway.

the mauling this bear market put on nearly everyone has been savage treasure those who have kept it together

United States Trends

- 1. $MAYO 11,6 B posts

- 2. Tyson 417 B posts

- 3. Pence 48,4 B posts

- 4. Kash 81,3 B posts

- 5. Dora 23,3 B posts

- 6. Debbie 22,5 B posts

- 7. Mike Rogers 12,7 B posts

- 8. #LetsBONK 8.937 posts

- 9. Laken Riley 48 B posts

- 10. Gabrielle Union 1.233 posts

- 11. Ticketmaster 17,5 B posts

- 12. Iron Mike 17,6 B posts

- 13. Whoopi 70,4 B posts

- 14. Pirates 20,2 B posts

- 15. #FursuitFriday 16,1 B posts

- 16. Cenk 12,3 B posts

- 17. Fauci 177 B posts

- 18. National Energy Council 1.947 posts

- 19. The UK 442 B posts

- 20. The FBI 239 B posts

Who to follow

-

DonAlt

DonAlt

@CryptoDonAlt -

Arthur Hayes

Arthur Hayes

@CryptoHayes -

朱溯 (3/AC)

朱溯 (3/AC)

@zhusu -

Flood

Flood

@ThinkingUSD -

Andrew Kang

Andrew Kang

@Rewkang -

Cold Blooded Shiller

Cold Blooded Shiller

@ColdBloodShill -

Arthur

Arthur

@Arthur_0x -

THE CMS

THE CMS

@cmsholdings -

Alex Wice

Alex Wice

@AWice -

ZachXBT

ZachXBT

@zachxbt -

Cred

Cred

@CryptoCred -

Ansem 🐂🀄️

Ansem 🐂🀄️

@blknoiz06 -

Up Only

Up Only

@UpOnlyTV -

jim

jim

@jimtalbot -

path.eth 🛡️

path.eth 🛡️

@Cryptopathic

Something went wrong.

Something went wrong.