Similar User

@RanRegev4

@BlazeES_F

@leasanz3

@rankash93

@mikedavidroby

@Gotnotime20

@BukhariSamsudin

Impressive cooking of Aus CPI. QoQ rents up 1.6%, QoQ new housing up 1% yet housing group in CPI QoQ down 0.1%. How!? Whole new level of gaslighting. @DaveTaylorNews @matt_barrie

Interesting the mobile game Township makes you build more houses before you can continue to develop your town. Perhaps the Australian and many western governments could learn to build before you bring in 100,000s of people.

Anyone else’s iphone battery performance deteriorated drastically lately? My wife and I’s has. Apple up to old tricks? Maybe Apple Intelligence for old models is their old trick in a way that won’t get them in trouble. It would not surprise. #iphone

ABC almost said the word that shall not be spoken ‘immigration’, but pulled up just short with ‘migration’. Migration makes me think of politicians leaving their Canberra investment props whilst collecting LAFH allowance back to PPOR. abc.net.au/news/2024-09-0…

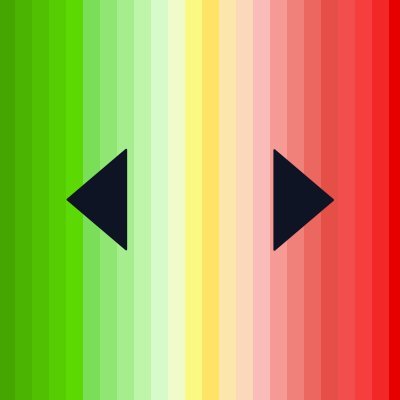

Will Global Liquidity Index and S&P every get to kiss again. 2019/2020 was about 14 months from break up to kiss again. The current divergence started around March 2023.

Another decent rise in the Bank Term Funding Program and a slower couple of weeks in QT. Is this why Powell changed direction? Something breaking?

With US short term yields (1m, 3m & 6m) now in the lower end of the Fed Funds rate, will money markets choose to leave funds in Reverse Repo rather than buying up short term treasuries resulting in reduced liquidity in the near term? @dampedspring @crossbordercap

Looks like about $280b came out of the Reverse Repo and didn’t land in the Treasury General Account. Maybe TGA outgoings are as fast as incoming, but big RRP drawdowns normally show something in TGA. If not TGA, where did it go. #Reverserepo #rrp #liquidity

I know…... You probably assumed this was another chart of Nasdaq melting up….... but it is actually from the year 2000. What if I tell you that for the next 2 years, the white line collapsed by 80%? By no means I'm suggesting that history will repeat itself exactly, but the…

🎉 GIVEAWAY ALERT 🎉 To celebrate the upcoming launch of "The Mad King", we're giving away a one-year free subscription worth $900 to 3 lucky followers! 💥 To enter: 1️⃣ Follow us 2️⃣ Like this tweet ❤️ 3️⃣ Retweet 🔁 4️⃣ Reply with #TheMadKing Winners will be selected…

Wondering if the US Fed will eventually do the same for pension funds as they have done for the banking system. I.e loans with par value for bonds, MBS for collateral. Thoughts?

If I buy $TLT or other treasuries fund and lose money, will the Fed give me par value?

What is more important? The CPI we are told that informs central bank decisions or the CPI people feel on the ground that informs actual consumption.

United States Trends

- 1. Tyson 474 B posts

- 2. $MAYO 13 B posts

- 3. #wompwomp 5.384 posts

- 4. Pence 58,4 B posts

- 5. Syracuse 12,1 B posts

- 6. Kiyan 14,6 B posts

- 7. Debbie 32,8 B posts

- 8. Kash 98,4 B posts

- 9. Whoopi 106 B posts

- 10. Iron Mike 20,7 B posts

- 11. The FBI 251 B posts

- 12. Dora 24,2 B posts

- 13. Shu Shu 27 B posts

- 14. Ronaldo 186 B posts

- 15. Connor Williams 1.416 posts

- 16. Mike Rogers 19,7 B posts

- 17. #LetsBONK 14,4 B posts

- 18. Gabrielle Union 2.164 posts

- 19. #Boxing 18,7 B posts

- 20. Per CNN 3.950 posts

Something went wrong.

Something went wrong.