Jason C Hsu

@hsu_jasonCEO/CIO @ Rayliant Global Advisors; Founding Partner and Vice Chairman @ Research Affiliates; Adjunct Professor in Finance @ UCLA Anderson

Similar User

@RA_Insights

@tseides

@larryswedroe

@SamanthaTwenty

@practicalquant

@behaviorgap

@JeremyDSchwartz

@NDR_Research

@Finominally

@jvogs02

@NorbertKeimling

@M_C_Klein

@cullenroche

@mrzepczynski

@PeterLazaroff

Rayliant has launched our latest #ETF, Rayliant SMDAM Japan Equity ETF (RAYJ), w/ Sumitomo Mitsui DS Asset Management. @hsu_jason highlights our latest ETF offering designed to capture growth in Japan's dynamic equity market. Visit funds.rayliant.com/rayj to learn more.

Happy 50M RAYE! Thank you to all of the investors who have made an allocation! To learn how Rayliant's active Emerging Markets ex-China ETF could fit into your portfolio, please visit our Funds website funds.rayliant.com/raye

The Rayliant SMDAM Japan Equity ETF (RAYJ) is the newest addition to our #ETF lineup. CIO @hsu_jason went deep with @BRoth_Thor on RAYJ and the investment thesis for #Japan during a recent episode of @etf_central's Behind the Ticker podcast. Watch: bit.ly/3QKUK3u

.@hsu_jason's appearance on @Huhn_Bryan’s "Affordable Freedom" podcast emphasized the importance of recognizing survivorship bias in investment returns, highlighting the need for honest conversations about risk. Full episode: spoti.fi/4dLRleN

Wild how much manufacturing we buy from them

That’s the fade. Isn’t it? We don’t want China’s Big Brother potentially influencing our children through subliminal TikTok messages. But it’s OK for US video game producers to encourage children to bloody slaughter everything! 🤷♂️

Ah! Got it. Chinese weapons manufacturers are liable if their guns are used in crimes, but not US weapons manufacturers. Makes perfect sense. 🙄

.@hsu_jason will speak at 3 of NC's CFA societies on "EM Ex-China Opportunities: Friendshoring, Demographics, and More!" To register: 1. CFA Raleigh bit.ly/43Thun9 (4/17) 2. CFA Winston-Salem bit.ly/4cQreTu (4/18) 3. CFA Charlotte bit.ly/4aq1jQF (4/18)

Catch @hsu_jason's recent guest slot on @ForwardGuidance with @JackFarley96 Will China's recent bear market be nearing an end? Does this present a bullish case for investing in onshore Chinese stocks? Tune in to find out! Listen to the full episode: bit.ly/4cLy2ln

The choice by @Fidelity to start charging retail clients $100 commissions may be one of the slimiest things I've seen in a long time. Makes @RobinhoodApp look good in comparison. 🤮🤮🤮

Index funds make up 46% of Fidelity's assets, but only 6% of its revenue (which was $28b last year, about double entire ETF industry). That gap may be one of the reasons they looking to add ETF surcharge on platform, the optics of which may not be worth the money.

🆕🎙️@Downtown and @michaelbatnick are joined by @hsu_jason, Chairman & CIO at @rayliant to discuss international markets and how to invest in friendshoring live at @FutureProofAC Retreat!!🔥 Out now on all podcast platforms⏯️podcasts.thecompoundnews.com/show/TCAF/inve…

Banks aren’t the only ones, even non-bank brokerage firms whose motto might be “customer first” will now apparently charge fees to *their own customers* to try to force fees from selected issuers. Disappointing and surprising move from one of my fave brokerage houses. Didn’t…

We get the following question almost every day: "I went to buy your strategy/MF/ETF at Big Bank’s broker [UBS, MS, GS, Merrill, Wells Fargo, etc.] and they said your ticker is blocked because of “due diligence.” What’s up?" Answer: We haven’t engaged in their pay-to-play scheme…

The thing is, many investors don't associate tickers with companies. So this is punishing retail and small investors, not the ETF company. Thousands of little investors are going to buy a few shares, pay $100 commissions, and lose their minds. But they're going to be furious…

Big shakeup coming for some ETFs listed on Fidelity’s platform. Story from @emily_graffeo & @kgreifeld “Under the plan, which will come into force on June 3, investors will face a $100 servicing charge when they place buy orders on a cohort of ETFs” bloomberg.com/news/articles/…

For those of us who like to believe in clear black and white in conflicts, who like to believe that we are always on the side of the just and who romanticize that the righteous shall prevail. I think this interview should disable u of all three assumptions.

In a recent interview with @MorningstarInc Hong Kong & Singapore’s Kate Lin, @hsu_jason makes the case for #EmergingMarkets ex #China – one of the world's fastest growing investment categories. Click here to watch the full interview on YouTube: bit.ly/47cTuvL

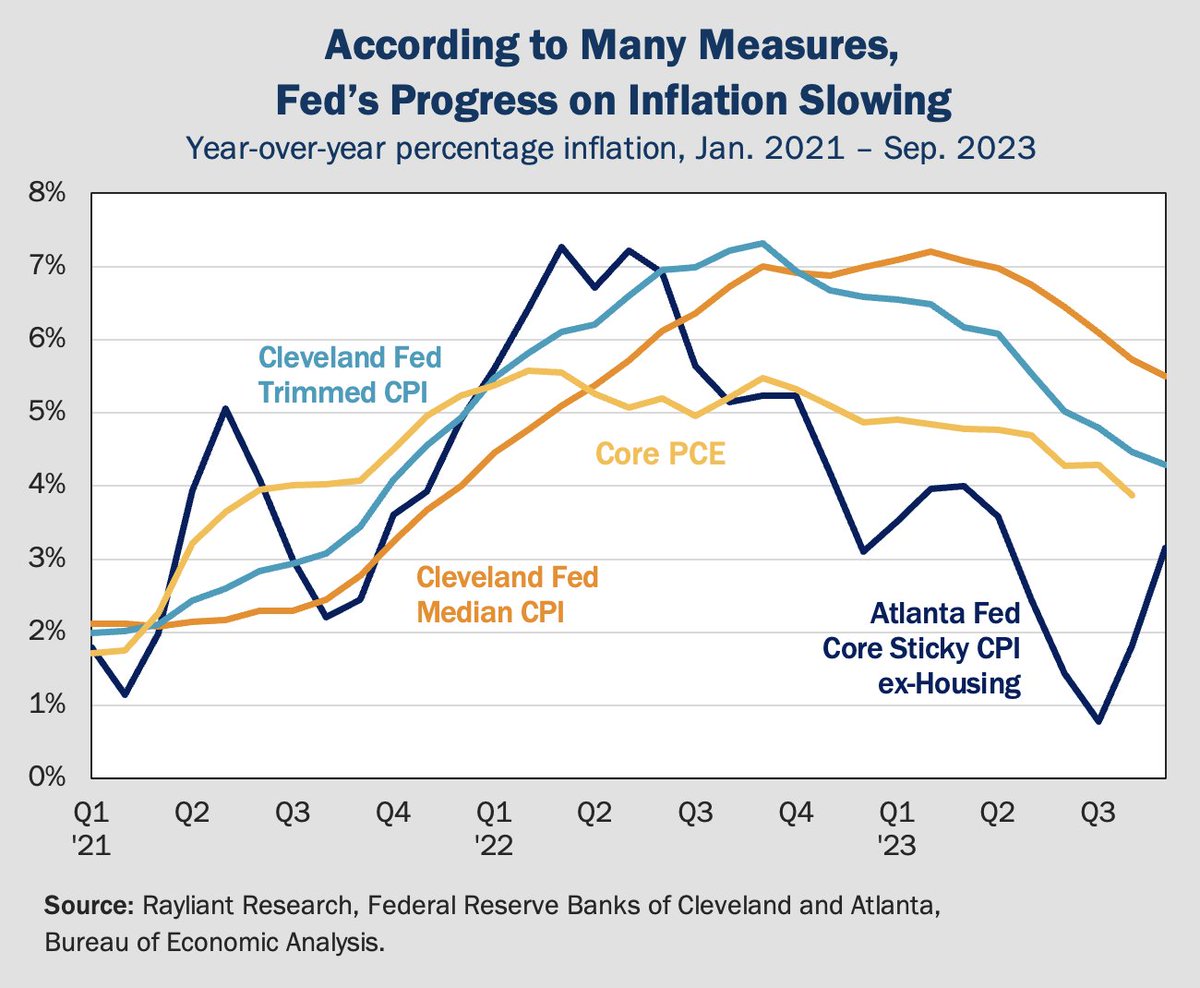

Headline CPI comes in at 3.7%, while core CPI sits at 4.1%, but still higher than the Fed’s 2% target. The #CentralBanks progress in its war on rising prices might be slowing, reinforcing the higher-for-longer sentiment over recent weeks. Read more: bit.ly/46y7ksO

At the FutureProof Festival, @hsu_jason shared why #Japan and #China are two of his top picks for value and #momentum. #finance #investing #stocks @FutureProofAC

In a recent episode of @Bloomberg's "What Goes Up" podcast with @Reganonymous and @VildanaHajric, @hsu_jason talked about some of the reasons that EM ex-China is a growing investment category. #EmergingMarkets

United States Trends

- 1. Kendrick 466 B posts

- 2. #AskShadow 15,6 B posts

- 3. $CUTO 7.104 posts

- 4. Luther 35,7 B posts

- 5. Daniel Jones 43,2 B posts

- 6. Drake 68,8 B posts

- 7. Wayne 47,8 B posts

- 8. Squabble Up 21,6 B posts

- 9. Kdot 5.371 posts

- 10. TV Off 28,8 B posts

- 11. MSNBC 167 B posts

- 12. Giants 74,9 B posts

- 13. Dodger Blue 10 B posts

- 14. Kenny 23 B posts

- 15. #TSTTPDSnowGlobe 4.892 posts

- 16. Reincarnated 27,6 B posts

- 17. Gloria 43,8 B posts

- 18. #AyoNicki 3.542 posts

- 19. NASA 66,9 B posts

- 20. One Mic 4.445 posts

Who to follow

-

Research Affiliates

Research Affiliates

@RA_Insights -

Ted Seides

Ted Seides

@tseides -

Larry Swedroe

Larry Swedroe

@larryswedroe -

Samantha Russell 👩🏼💻

Samantha Russell 👩🏼💻

@SamanthaTwenty -

Jack Forehand

Jack Forehand

@practicalquant -

Carl Richards

Carl Richards

@behaviorgap -

Jeremy Schwartz

Jeremy Schwartz

@JeremyDSchwartz -

Ned Davis Research

Ned Davis Research

@NDR_Research -

Nicolas Rabener

Nicolas Rabener

@Finominally -

Jack Vogel

Jack Vogel

@jvogs02 -

Norbert Keimling

Norbert Keimling

@NorbertKeimling -

Matthew C. Klein

Matthew C. Klein

@M_C_Klein -

Cullen Roche

Cullen Roche

@cullenroche -

Mark Rzepczynski

Mark Rzepczynski

@mrzepczynski -

Peter Lazaroff

Peter Lazaroff

@PeterLazaroff

Something went wrong.

Something went wrong.