Dr. Deepak Singhal

@ent_walaENT ||Head & Neck Surgeon|| Voice, Vertigo and Thyroid specialist||Sinus and allergy Specialist || Investor||Trader||Stock Market||

Similar User

@Trading4Bucks

@wealthexpress21

@mystocks_in

@RupakRoyC

@StocksTreasures

@myfirststock99

@niveyshak

@rajuidesai

@_ChartWizard_

@STOCKBAGGER1

@investor_sr33

@krunalparab_

@tradewithakshat

@AdeptMarket

@Breakoutsignal1

Which stock can give 5X returns in next 2 years from CMP according to you and why ?

AmiOrganics Long base breakout ➡️ retest ➡️ bounce back with breakout With Blockbuster results 🔥🔥

Good results from Genus Power Still faster execution is what i expect from this company. Order book is around 31k cr which can increase to 65-70k cr in next one years ✍️✍️🥰

#GenusPower 232 to 460 😎 Almost 2x in 8 months till now Now orderbook has reached to 32500 cr. 🔥🔥 Mcap : 13479 Cr A very very strong orderbook. #Smartmeter

Today Capacite 10% + : expecting very good results with good orderbook Deepak fertilizers 13%+ Made new ATH today : Good result J kumar is gaining momentum. posted good results yesterday Natco will post good result Axis is trading in the same range : good result 😎🙏 #Study

So updating my list again 1. Natco pharma 2. Capacite infra 3. J kumar infra 4. Deepak fertilizers 5. Axis Bank Mukul Agarwal's presence in 4th one in recent quarter holdings. Akash Bhansali in Natco and Mukul agrawal in next 3 Great fundamental and reasonable valuation ✍️

Adding Capacite Infraprojects in this list now Sharing since last one year CMP : 336 PE : 18 P/B : 1.9 Mcap : 2839 Cr TTM sales : 2071 cr Revenue growth guidance : 25% With Improving OPM Order book : 8800 Cr Technical support at 330/310 Wait for reversal #MukulA #VikasK #DYOR

Two stocks which i am accumulating in correction are 1. Natco Pharma 2. J Kumar Infraprojects Let's see 🤞🤞 #PFstocks #LongtermInvestment

मन कह रहा है कि j kumar 450 पर मिल जाए एक बार तो मज़ा आ जाए बस ऐसे ही 🙈🙈😜

So updating my list again 1. Natco pharma 2. Capacite infra 3. J kumar infra 4. Deepak fertilizers 5. Axis Bank Mukul Agarwal's presence in 4th one in recent quarter holdings. Akash Bhansali in Natco and Mukul agrawal in next 3 Great fundamental and reasonable valuation ✍️

South Indian Bank कोई Fundamentals चैक करके बतायेगा की क्या समस्या है इन्हें? मुझे तो समझ में नहीं आ रहा 🙊🙈

लालच बुरी बला है!

IRCTC Technical S support near 770 but I think this can go down to 570 No major growth in revenue and profit and still overvalued I'll avoid 🙂

Jio Financial Services Technically bearish Weekly closing below 310 will make it more weak Fundamental: overvalued

#NiftyPharmaIndex At crucial support My target of 27-28k is still intact ✍️✍️ I am still bullish on this sector 😇😇

#NiftyPharmaIndex I am upgrading my target to 27000. Yes you read it right. Upgrading target by 35% from previous target 🎯🎯😎 Disc : not a buy/sell recommendation 🙏

सस्ता, सुंदर और टिकाऊ एक जगह मिल जाए, ये आजकल बहुत ही मुश्किल है चाहे वो कोई भी सर्विस हो 😇✍️✍️

Quality kuch jyda hi ghatiya h dr , main thing is ke haath lgate hi pta lg jata h then le nhi paate.

True.. more consolidation, more valuation adjustment, and cheaper valuation will be available for investment, and high return possibilities will be increased.

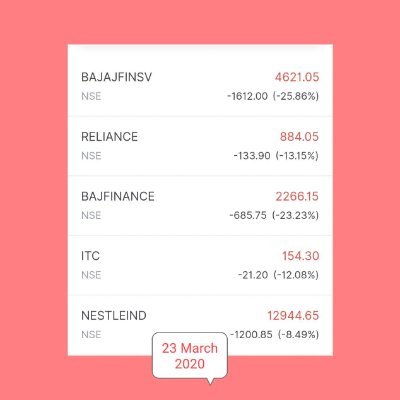

Why we want immediate recovery ? If you are investing your money , even if recovery happens after 6 months , what’s the problem. You are getting lower valuations , save and invest more at lower valuations ( simple ) . If you invest at lower valuations, your risk is lower .

I am also thinking on the same page. Nifty 50 : 23950 to 25000 in this year This is my view for nifty 50 only. I might be wrong 😇🙏

Again 25400 may come in this year , that’s the view . Read 5 times .

I recently visited Zudio twice, and yes, there was a good rush. But, If they want to sustain for a longer period, they need to update their collection in every segment and also extend their present business segments. Zudio is mainly for casuals only.

Is there any specific reason ?

Thanks for your kind suggestions Overall, HDFC ergo, Niva Bupa, and Icici lombard are good when taken from trustworthy agents only. Reading policy details is a must before opting also.

Which is the best health insurance company as per your experience. I had care health insurance, and twice they rejected my cliams without any proper reason. I want to change it. Any suggestions from your personal experience?

Morepen is at breakout retest level. This can correct to 70 Rs level. If results mismatch, then can correct more looking at the market scenario 🥲 Tata motors, i have already updated x.com/ent_wala/statu…

@ent_wala Doctor sahab what's your view on Tata Motor and Morepenlab in this corrected market.

HFCL is currently taking support at 112 Weekly closing below this will cause more pain. Results were not good 🙏

Ji HFCL your View shall we consider this price for Buying

Why FIIs are selling so much this time? In Oct, they have net sold more than 97k crore value equities. Today also they have sold more than 5k cr Rs worth equity. Reason : Overvaluation of indian indexes More pain ahead for midcap and smallcap for next few months 🥲🥲

United States Trends

- 1. Jake Paul 995 B posts

- 2. #Arcane 230 B posts

- 3. Jayce 6.524 posts

- 4. Good Saturday 26,4 B posts

- 5. #SaturdayVibes 3.140 posts

- 6. Serrano 248 B posts

- 7. #saturdaymorning 2.114 posts

- 8. #PlutoSeriesEP5 133 B posts

- 9. Vander 16,9 B posts

- 10. AioonMay Limerence 108 B posts

- 11. Pence 82,1 B posts

- 12. #SaturdayMotivation 2.074 posts

- 13. maddie 21,3 B posts

- 14. WOOP WOOP 1.409 posts

- 15. John Oliver 14,5 B posts

- 16. Caturday 7.500 posts

- 17. Jinx 111 B posts

- 18. Fetterman 37 B posts

- 19. Father Time 10,8 B posts

- 20. He's 58 31,1 B posts

Who to follow

-

Stock Market Intelligence 📈

Stock Market Intelligence 📈

@Trading4Bucks -

WEALTH EXPRESS

WEALTH EXPRESS

@wealthexpress21 -

Mystocks

Mystocks

@mystocks_in -

VALUEPICKER

VALUEPICKER

@RupakRoyC -

Tosif Ahkter

Tosif Ahkter

@StocksTreasures -

My First Stock

My First Stock

@myfirststock99 -

Arka Bhattacharjee

Arka Bhattacharjee

@niveyshak -

Rajeev Desai

Rajeev Desai

@rajuidesai -

𝗧𝗵𝗲 𝗖𝗵𝗮𝗿𝘁 𝗪𝗶𝘇𝗮𝗿𝗱

𝗧𝗵𝗲 𝗖𝗵𝗮𝗿𝘁 𝗪𝗶𝘇𝗮𝗿𝗱

@_ChartWizard_ -

Himani

Himani

@STOCKBAGGER1 -

Sandeep R

Sandeep R

@investor_sr33 -

Stock Market का जीतू भैया | Krunal 🇮🇳

Stock Market का जीतू भैया | Krunal 🇮🇳

@krunalparab_ -

Trade With Akshat

Trade With Akshat

@tradewithakshat -

Grandmaster of Stocks💎

Grandmaster of Stocks💎

@AdeptMarket -

Breakout signals🚀

Breakout signals🚀

@Breakoutsignal1

Something went wrong.

Something went wrong.