MoNaMi

@ValoremEmptorAsymmetric opportunities, style agnostic

Similar User

@yuanshikai2010

@Kevinwagner1965

@avery_richman

@777Condors

@Muhammadindra_1

@fgentileteam

@Emancipation_J

@gold_jeremy

@Chubi999

@Mikeyisback

@AamarYadav

@oimjames

@Empirica3

@ariedejonge1

@gagandeep122

Saucy "You would only think this was about freedom if your whole adult life was spent playing politics on the taxpayer dime."

What is on the march in this country is the opposite of freedom. Occupation locking down the capital & terrorizing people. Blockades shutting down our economy. You would only think this was about freedom if your whole adult life was spent playing politics on the taxpayer dime.

Searching for truth? look for those who are not allowed to speak

r/dataisbeautiful posted by u/jcceagle

Rickrolling shorts since 1987

A thread on attempted election fraud in Canada: First, most breaches of election law here are related to financing, not illegal voting or ballot-box stuffing. And most are minor. That’s because our elxn finance laws are extremely tight and contribution/spending limits low. 1/

1/ My 2021 Top Pick: Teladoc The US healthcare system is broken. We spend more on healthcare than any other country but aren’t seeing comparable outcomes. 25% of healthcare spending is considered waste. Fixing it is one of the greatest opportunities that exist. Enter $TDOC.

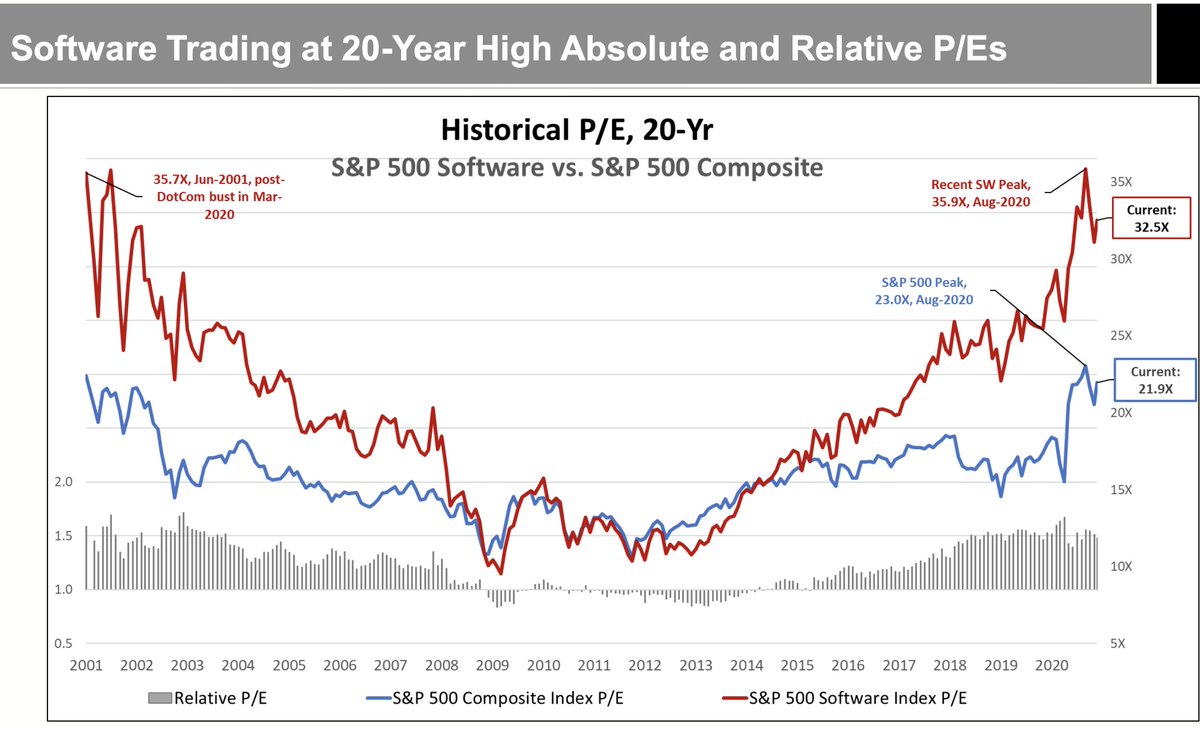

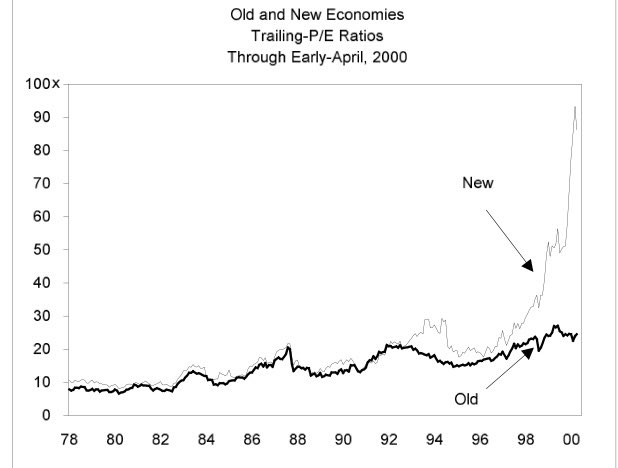

1/ Lessons From The Tech Bubble: Last year, I spent my winter holiday reading hundreds of pages of equity research from the 1999/2000 era, to try to understand what it was like investing during the bubble A few people recently asked me for my takeaways. Here they are -

Luckily #coronavirus knows to not travel to @TorontoPearson - what a move @epdevilla @JohnTory @fordnation @barbarayaffe putting the small stores/restaurants out of businesses and criminalizing family Christmas dinner while the free travel

Conservatives and their lies.

1/ $DASH about to IPO for around $30B. On top of the profitability question, there's another one about the durability of that profitability (moats). Having launched 2 and 3 sided mktplces for Eats, I can tell you the latter was exponentially harder to build *and* manage.

For the ages to come

The stupidity of housing bears 101: Quoting The Onion to back up their arguments (FYI: the onion is a satirical news source) To be fair though, MacBeth's book would also fall in the same category.

Win

Yep

Jesus effing christ

Snowflake opens at $245 per share in market debut, after pricing IPO at $120: @CNBC $SNOW

United States Trends

- 1. Thanksgiving 644 B posts

- 2. Custom 85 B posts

- 3. #ConorMcGregor 6.839 posts

- 4. #BillboardIsOverParty 83,6 B posts

- 5. Mbappe 423 B posts

- 6. #CONVICT 6.675 posts

- 7. Zuck 4.429 posts

- 8. Madrid 524 B posts

- 9. Vindman 29,3 B posts

- 10. Liverpool 337 B posts

- 11. #YIAYlist N/A

- 12. #drwfirstgoal N/A

- 13. Verify 30,4 B posts

- 14. Brandon Crawford 2.800 posts

- 15. HAZBINTOOZ 8.440 posts

- 16. Gonzaga 6.812 posts

- 17. Kissing 48,8 B posts

- 18. Ferrari 34,6 B posts

- 19. Juan Williams 1.651 posts

- 20. Standard Time 13,5 B posts

Who to follow

-

和自己和解,重新定义成功

和自己和解,重新定义成功

@yuanshikai2010 -

Kdog65

Kdog65

@Kevinwagner1965 -

Lord Rizz Twit

Lord Rizz Twit

@avery_richman -

value_badger

value_badger

@777Condors -

Muhammad Indra🇮🇩🇲🇾

Muhammad Indra🇮🇩🇲🇾

@Muhammadindra_1 -

GENTILE REALTY GROUP

GENTILE REALTY GROUP

@fgentileteam -

Jordan Magtoto

Jordan Magtoto

@Emancipation_J -

Jeremy

Jeremy

@gold_jeremy -

Henrik Sjöblom

Henrik Sjöblom

@Chubi999 -

Zion

Zion

@Mikeyisback -

Amar Yadav (Modi Ka Parivar)

Amar Yadav (Modi Ka Parivar)

@AamarYadav -

James

James

@oimjames -

Empirica

Empirica

@Empirica3 -

arie de jonge

arie de jonge

@ariedejonge1 -

gagan deep

gagan deep

@gagandeep122

Something went wrong.

Something went wrong.