Pragati Aggarwal

@PragatiAggarwa8MSc Econ | Product Manager @dspmf | Embracing Macro Insights | Occasionally lost, but always curious. All views are personal, not endorsements.

Similar User

@BrianLadner9

@KyleKenson75067

@powelljones_s

@ManishRathiDSP

@rajan_zakhmi

@WitheringLows

@Sk588617Sumit

@Himanshuhans3

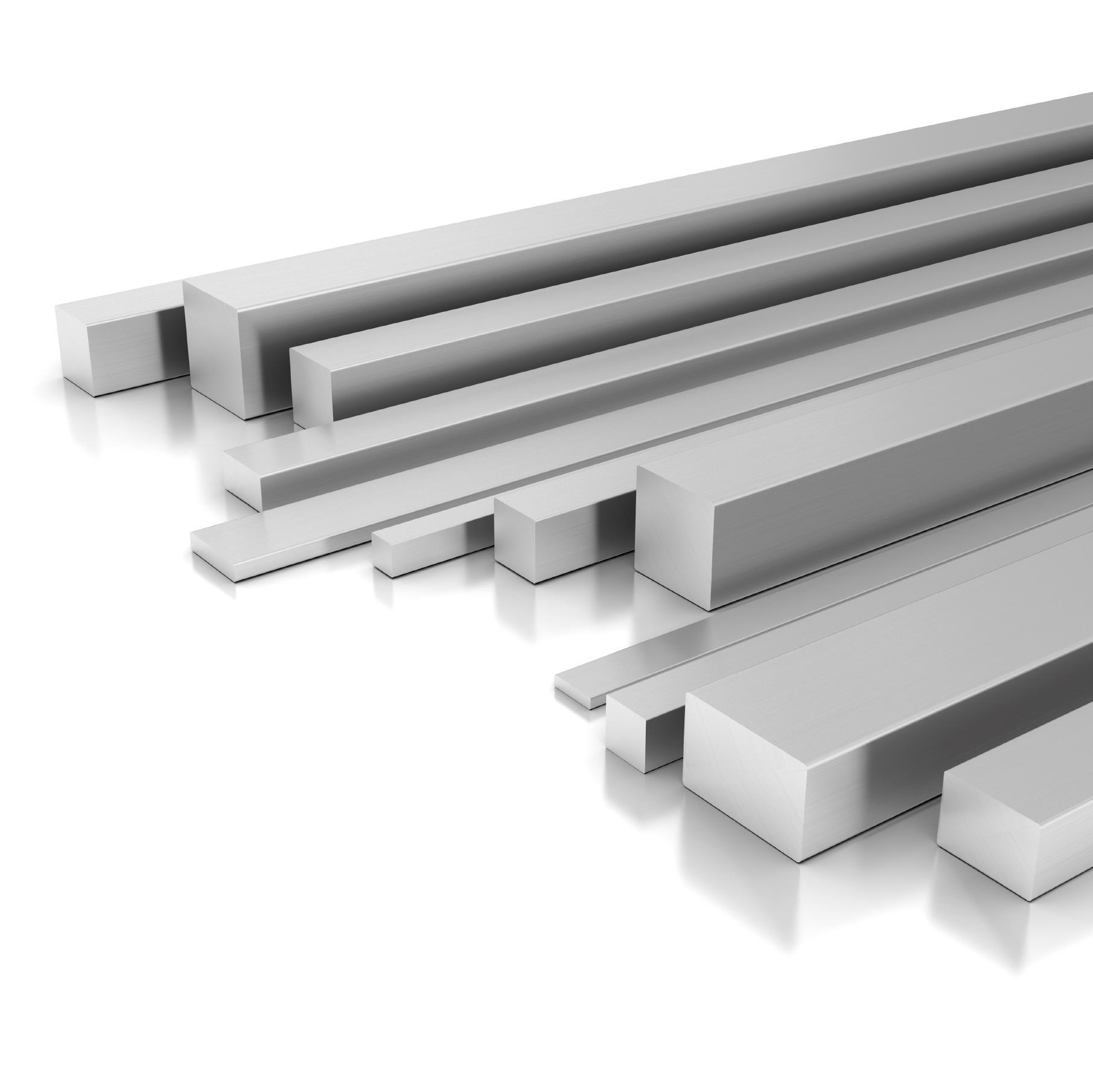

Last 5 yr Nominal GDP CAGR is at 9.6% vs long period (30yr avg) of 12.5%. The peak of this cycle so far is nearly 3% below the AVERAGE of full cycle

SLOWING India GDP: A generalized slowdown. Reflective of lower Govt spend. Manufacturing & Mining take a major hit. Almost everything else has slowed. No surprises. FY25 numbers revision time for Forecasters.

The current cycle peak clocking 3% lower than the long period average of 12.5% #DSP5things

A warm-up for the next 5th!

A 'Bluebox' insight from the upcoming December version of #DSPNetra. Releasing on 5th December 2024

Growth has moderated from high teens to low teens and single digits. Services sector has started to cede its lead to other sectors. Link to the full report: x.com/dspmf/status/1…

Our November 2024 edition of #DSPNetra is out! Stay ahead of the curve with the latest insights on economic trends with Netra. Follow the thread below or download here: dspim.co/NetNov24

India’s outperformance is not without reason

India outperforms the world because more firms earn a higher return for shareholders than most other markets, consistently. The long-term edifice of this trend is key to India’s performance, but at an appropriate price. Download #DSPNetra: dspim.co/NetNov24

It's a common misconception that the balance of trade is the sole determinant of a country's economic health. In reality, the BOP, which encompasses both trade and capital flows, provides a more comprehensive picture. As the adage goes, "It is not the balance of trade in the…

Foreign Flows: The Silent Drivers of India's Macroeconomic Stability, Not Stock Prices When Foreign Investment Flows are mentioned, most investors think about the daily yo-yo of FII flows into Indian equity markets, that too only secondary. Fact check: Between FY23 and…

The last page of this month @dspmf Netra 👌 At times, simple things need to be told again.

India’s ‘easy-money’ environment x.com/dspmf/status/1…

In H1 2024, India's primary market issuances were largest (number of IPOs) and second largest (by value raised) Scan back history. Periods with such 'easy-money' environment are ripe with examples of investor follies. Time to be vigilant and conservative while analyzing…

Your November Read.

#DSPNetra November edition covers: 1. A 300 year view of monetary and fiscal policy. And likely impact of a U-turn. 2. FII Flows Are A Bigger Driver of Macro Stability Than Equity Markets. Why? 3. De-leveraging by Public & Private Corp. 4. Slowing growth momentum & complexion.…

The fifth perspective, on the 5th

Writing #DSPNetra every month is an education in itself. Repetition compounds. Version 41 coming on 5th Nov 2024. Contributors: @ParthShah__16 @PragatiAggarwa8

Sharing the Infographics again why you should shift away from Small / Midcaps & shift to Defensive cateogry/ Largecaps in overheated markets

The hustle for deposits is showing up in numbers. Source: #DSPTathya

India's Foreign Flows: A Mirage or Reality? Flows, liquidity, and performance chasing can only alter short term market moves. It doesn't dictate long term returns. The narrative that India would benefit from a Chinese slowdown by attracting foreign investments has been widely…

International Policy Coordination is just one form of International Economic Cooperation

United States Trends

- 1. DeSantis 35,7 B posts

- 2. Pete 309 B posts

- 3. Jokic 12,7 B posts

- 4. Kerr 7.376 posts

- 5. Mavs 12,6 B posts

- 6. Podz 3.453 posts

- 7. Clemson 25,3 B posts

- 8. Wiggins 2.800 posts

- 9. Nuggets 17,2 B posts

- 10. Brea 2.700 posts

- 11. Jamal Murray 1.541 posts

- 12. azealia 4.394 posts

- 13. Kentucky 19,3 B posts

- 14. Kuminga 2.374 posts

- 15. Marcus Smart 2.706 posts

- 16. XDefiant 18,7 B posts

- 17. NBA Cup 15,6 B posts

- 18. #MFFL 4.188 posts

- 19. #HonkaiStarRail 104 B posts

- 20. Gundam 193 B posts

Something went wrong.

Something went wrong.