Lippy730

@Lippy730Senior Investment Analyst. An older millennial, fundamental oriented, value first, truth fan, striving for success. Patience...

Similar User

@juniormrivera

@ManWithAnswers

@hhaaa786

@Jhm871

@jbofinance1

@Tapies14

@spacegold_

@gsmrabbi

@Alfredo_Car_Ruv

@Sharethelogic

@KietTsan

@spitalfields1

@Jjohnrr

@Aysha35436789

@RealPeteSahut

Year end assessment. Fed sacrificing the perception of a good economy at the cost of ever increasing inflation off of ridiculous high inflation. Another year with higher than 2% inflation with no end in sight.

Year-end assessment. The economy surprised just about every one in 2023 on the upside. I give a lot of credit my colleagues who argued that a soft landing was possible and even probable, although the Fed is still not quite done. That said, I don’t know anyone who expected quite…

BOTH!!

Over the last 10 years, US Federal Government Tax Revenue has increased 60% while Government Spending has increased 93%. To close this gap (aka the deficit), do we need higher taxes, less spending, or both? bilello.blog/newsletter

Sure, the Fed is data driven. It’s driven to find data that supports its policy bias at any point in time.

The US government continues to spend money like a drunken sailor with a budget deficit of -$2 trillion over the last year. We're borrowing from our children's future to spend more money today. Will DOGE be able to reverse this downward trend? bilello.blog/newsletter

This should be the focus from the media and everyone. Not that they have brought down inflation from 9% and hopefully return to 2%. This is a failed fed regime. Powell sucks

US Core CPI has been above 3% for 42 straight month, the longest period of elevated inflation in the US since the early 1990s. youtube.com/channel/UCRoWR…

🚨US National Debt is absolutely exploding higher, increasing by $850 billion in just the last 3 months. In the past 5 years we've seen a 56% increase. The Federal Government is borrowing from our future to spend money like drunken sailors today. youtube.com/watch?v=G9vcz1…

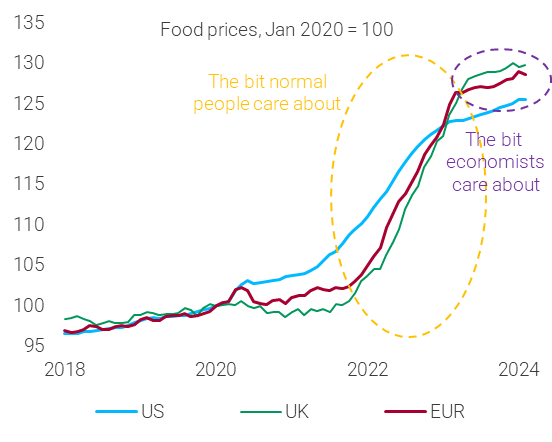

"Voters experience inflation on a cumulative basis, rather than a 12-month basis as economists analyze" - Jim Reid This is the #1 lesson from this election

💯 It still amazes me that economists still don't get cumulative change matters more than rate of change.

🥐Cem Karsan with Rick Santelli in a real cross-examination style interview Trump 🇺🇸 presidency means populism, inflation, Fed stimulus ... and QE is coming ... he who controls the conch 😆

1. Stocks: all-time highs 2. Home Prices: all-time highs 3. Bitcoin: all-time highs 4. National Debt: all-time highs 5. Core CPI Inflation: >3% for 41 straight months, longest run of high inflation since early 1990s 6. Fed: cutting rates again tomorrow youtube.com/channel/UCRoWR…

"I think we nominate the next Federal Reserve chair very early," says Scott Bessent. "President Trump has already said he's not going to renominate Jay Powell, so in a way that increases his independence."

My hope is that inflation gets under control but I have major major doubts... Powell has some maneuvering to do and I'm not sure he will be successful

In the end, it came down to 2 big factors: 1) Inflation. People are angry about high prices. The situation has improved a lot since 2022, but this chart (below) was top of mind for many. 2) Change. Americans want change, especially from neoliberalism. That's the one thread that…

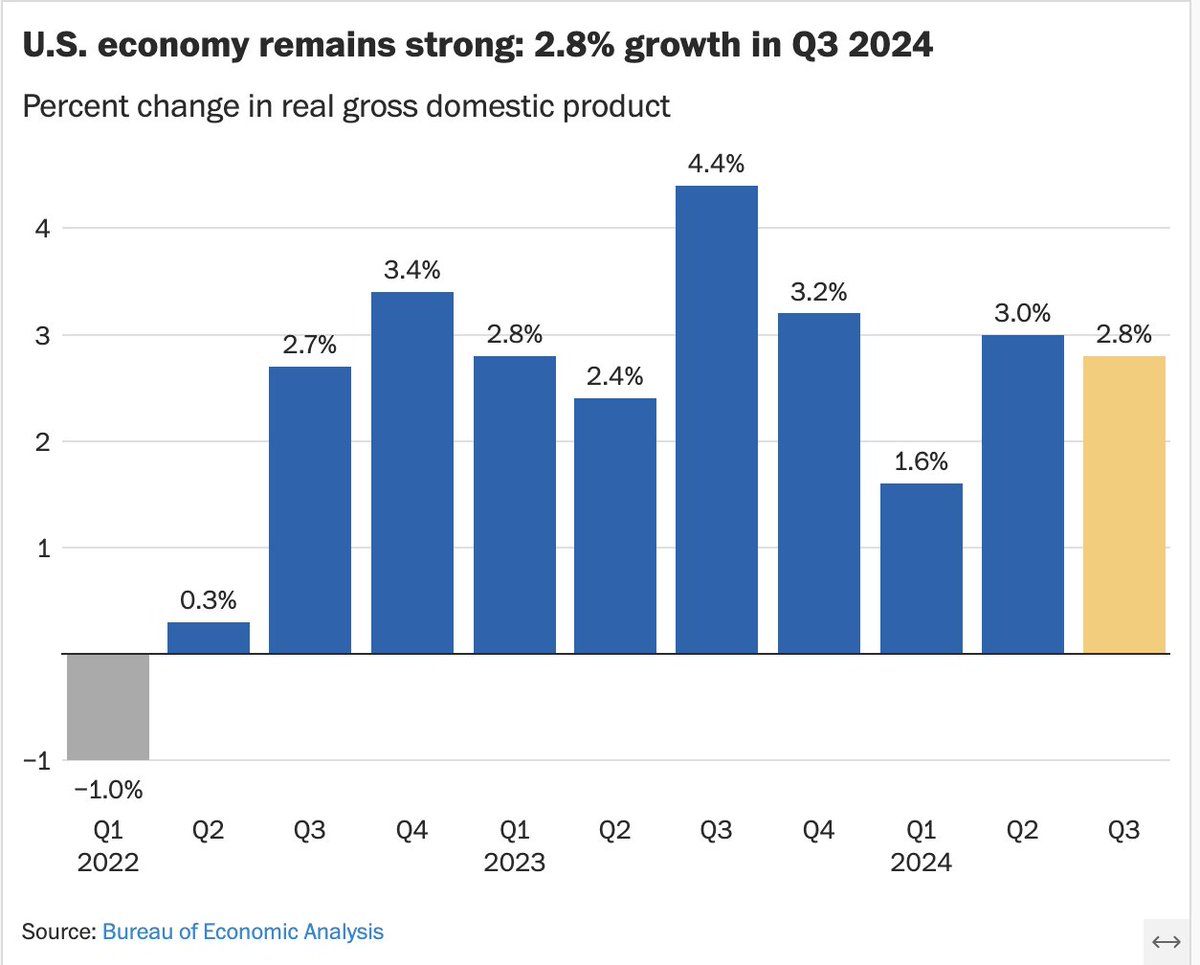

On November 5, the #GDPNow model nowcast of real GDP growth in Q4 2024 is 2.4%: bit.ly/32EYojR #ATLFedResearch Download our EconomyNow app or go to our website for the latest GDPNow nowcast: bit.ly/2TPeYLT

Breaking: The winner of the US election: The US deficit

The biggest quagmire of this market. You have two choices: 1) Sit in cash and watch your wealth get destroyed by currency debasement. 2). Take on tremendous risk and buy overpriced equities and attempt to keep up with inflation. What’s an investor supposed to do?

1/5 My Favorite Anecdote About The Economy A good way to measure the perceived health of the US economy is to measure the public's ability to spend on things they want but do not need, aka discretionary spending. 🧵

JUST IN: The US economy is having a remarkable year: 2.8% GDP growth in Q3. That’s in line with expectations and well above the usual norm of ~2% growth. Strong consumer spending and government spending continue to boost growth.

1. Stocks: all-time high 2. Home Prices: all-time high 3. Gold: all-time high 4. Bitcoin: all-time high 5. National Debt: all-time high 6. Core CPI Inflation: >3% for 41 straight months, longest period of high inflation since early 1990s 7. Fed: cutting rates again next week

As the 10yr rate moves higher, I would expect growth to moderate. The nominal rate is still north of 5% and with the 10yr currently around 4.30% the environment is still loose. Im watching to see when the 10yr rate gets above the nominal rate to worry.

On October 29, the final #GDPNow model nowcast of real GDP growth in Q3 2024 is 2.8%: bit.ly/32EYojR #ATLFedResearch Download our EconomyNow app or go to our website for the latest GDPNow nowcast: bit.ly/2TPeYLT

It would be great if it actually happened, but I have my doubts

Elon: 'Let's Cut Two TRILLION From The Budget!' -- today on the Liberty Report: rumble.com/v5klomq-elon-l…

Group stink... I mean think

POLL: THE FEDERAL RESERVE ARE TO CUT THE FED FUNDS RATE BY 25 BASIS POINTS IN BOTH NOVEMBER AND DECEMBER TO 4.25%-4.50%, SAY 103 OF 111 ECONOMISTS.

United States Trends

- 1. Mike 1,83 Mn posts

- 2. #Arcane 173 B posts

- 3. Serrano 243 B posts

- 4. Jayce 29,6 B posts

- 5. Vander 8.438 posts

- 6. Canelo 17,2 B posts

- 7. maddie 13,8 B posts

- 8. #NetflixFight 74,9 B posts

- 9. Logan 80,3 B posts

- 10. Father Time 10,8 B posts

- 11. Jinx 84,9 B posts

- 12. He's 58 28,5 B posts

- 13. Boxing 310 B posts

- 14. #netflixcrash 16,7 B posts

- 15. ROBBED 101 B posts

- 16. Rosie Perez 15,2 B posts

- 17. Shaq 16,6 B posts

- 18. #buffering 11,2 B posts

- 19. Tori Kelly 5.419 posts

- 20. Roy Jones 7.324 posts

Who to follow

-

JuniorMafia78

JuniorMafia78

@juniormrivera -

Maybe

Maybe

@ManWithAnswers -

Crypto for Life

Crypto for Life

@hhaaa786 -

The Anti Trump Resistance

The Anti Trump Resistance

@Jhm871 -

Jorge Benitez

Jorge Benitez

@jbofinance1 -

Tapies🛸

Tapies🛸

@Tapies14 -

Adam Zimmerman

Adam Zimmerman

@spacegold_ -

Fojlay Rabbi

Fojlay Rabbi

@gsmrabbi -

Fredy

Fredy

@Alfredo_Car_Ruv -

FlybeforeyouDie

FlybeforeyouDie

@Sharethelogic -

Kiet Tsan

Kiet Tsan

@KietTsan -

spital fields

spital fields

@spitalfields1 -

J

J

@Jjohnrr -

Arman

Arman

@Aysha35436789 -

Pete Sahut🍕

Pete Sahut🍕

@RealPeteSahut

Something went wrong.

Something went wrong.