Similar User

@dpl_fp

@Integrated4FAs

@jimmymoock

@InvMasterminds

@alisusko_alison

@SimetricIoT

@meganbelt

@Lisa_M_Murphy

@aytotallycan

@Hebdenconsult

@FinServOrg

@Stock_Hoe

@WIPhilharmonic

@SabrinaScarpa

Given that risk management for an individual is a moving target—that it is dynamic, multifaceted, and complex—we need a new approach to address it. One approach is agent-based modeling. Learn more on how to plan risk with agent-based models and Fabric: hubs.ly/Q020zN_x0

Our co-founder and CEO, Govinda Quish, details how Fabric addresses portfolio design and risk. Watch this short clip to get a better understanding of Fabric.

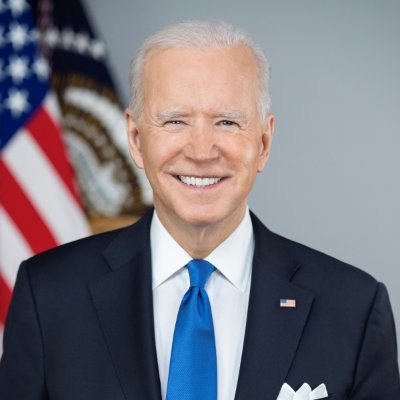

Our co-founder, Rick Bookstaber, will be featured on PBS WealthTrack today at 8 pm ET. Rick sat down and discussed complex financial risks alongside Consuelo Mack. Be sure to tune in tonight. #wealthmanagement #risk

What is Fabric and what makes it unique? We're passionate about bringing the best solutions for managing wealth to clients through their advisors, and that our diverse team of experts is uniquely positioned to deliver on this promise. hubs.ly/Q01RXCqw0

In Opinion “We are entering a new epoch of crisis, a slow-motion tidal wave of risks that will wash over our economy in the next decades — namely climate change, demographics, deglobalization and artificial intelligence,” Richard Bookstaber writes. nyti.ms/3TOVpkY

Are you at #impact2022? Come get a demo our Risk Aware Portfofio Deaign platform. Or just come say hi! lnkd.in/gqux72Ti

Register to listen to co-founders, Rick Bookstaber and Govinda Quish discuss the important of measuring and evaluating risk with @RetireOne's David Stone. It is a conversation you do not want to miss next Tuesday, August 23rd at 2:00 pm ET: hubs.ly/Q01kjNLX0

The past can produce some powerful ideas, so share them when they have merit! I hope you enjoy reading those questions below which I feel are wonderful on more levels than I can express: hubs.ly/Q019qd8P0

Fabric's Co-Founder and Head of Risk, Rick Bookstaber, will be speaking at the ACE Academy Conference in Nashville on May 15th. He will be discussing Best Practices in Portfolio Risk Management for Fiduciaries. Register at hubs.ly/Q017Z09M0

"The Human Genome Is Finally Fully Sequenced" Such an outstanding achievement as we seek to understand all the risk permutations to our human bodies. Kind of looks like using Factor Analysis in risk management, but on a whole different level for sure!

What level spotter are you for your clients? Jeff Roush (pictured below in 1978), COO and Co-Founder, defines the 'gymnastics spotter analogy' with his clients, to describe his role in designing, implementing and monitoring their portfolios. hubs.ly/Q016zRss0

Brooke definitely has this one right. It will be interesting to see if Goldman grasps the patience it takes to earn the right at the advisors firm. Goldman Sachs RIA custodian delayed indefinitel... riabiz.com/a/2022/3/16/go… via @RIABiz

Agent-based models can be used to understand traffic flows, to anticipate potential stampedes from panicking crowds and they can be used with markets as well. Rick Bookstaber on a look at history to model the market and show client #risk: hubs.ly/Q015KDS40

Advisors: What is your story? I guarantee that taking time to carefully consider and craft stories across the horizon of managing a client’s life goals deepen the client's trust relationship and accelerate all towards mutual success. hubs.ly/Q014jRTv0

How do you seek to explain “happenstance” in relation to risk? Perhaps risk and happenstance are closer than you think. Without #risk, there is no growth…no life! hubs.ly/Q014jVH10

What do vineyard vine cordons and portfolio management risk vs yield have in common? I have found many enjoyable ways to communicate and educate clients in risk and return using the world of growing and making wine. hubs.ly/Q013Szgm0

Famous chefs and financial advisors…what’s your secret special sauce? #Clients self-select advisors based upon their own desires and goals as diners select restaurants based upon favored chefs, menu styles and service levels. hubs.ly/Q013SvHy0

What do the best wine vineyards have in common with the best advisors in #risk management during springtime pruning? hubs.ly/Q013G-mK0

Raise your hand if you think asset custody is the ugly part of the advice world? #FinancialAdvisors #WealthManagement #Risk hubs.ly/Q013nLQ80

United States Trends

- 1. Dalton Knecht 31,2 B posts

- 2. #LakeShow 4.513 posts

- 3. Spurs 16,4 B posts

- 4. #DWTS 25,9 B posts

- 5. #Lakers 1.389 posts

- 6. Cavs 49,7 B posts

- 7. Linda McMahon 37,9 B posts

- 8. #RHOBH 9.958 posts

- 9. Celtics 56,9 B posts

- 10. #WWENXT 27,8 B posts

- 11. Keldon Johnson 3.159 posts

- 12. Honduras 46,5 B posts

- 13. Tatum 33,4 B posts

- 14. Kam Jones 1.884 posts

- 15. Chris Paul 2.685 posts

- 16. Garland 67,4 B posts

- 17. Chase U 5.752 posts

- 18. Marquette 5.153 posts

- 19. $QUANT 3.461 posts

- 20. Hampton Inn 1.223 posts

Who to follow

-

DPL Financial Partners

DPL Financial Partners

@dpl_fp -

Integrated Partners

Integrated Partners

@Integrated4FAs -

Jimmy Moock

Jimmy Moock

@jimmymoock -

Jeff Thomas, Host of Investment Masterminds

Jeff Thomas, Host of Investment Masterminds

@InvMasterminds -

Alison

Alison

@alisusko_alison -

@Simetric IoT

@Simetric IoT

@SimetricIoT -

Megan Belt

Megan Belt

@meganbelt -

LisaMM

LisaMM

@Lisa_M_Murphy -

pringles 😡

pringles 😡

@aytotallycan -

Hebden Consulting

Hebden Consulting

@Hebdenconsult -

FinServ Foundation

FinServ Foundation

@FinServOrg -

Ga💤anfar Ibn Hassan

Ga💤anfar Ibn Hassan

@Stock_Hoe -

WI Philharmonic

WI Philharmonic

@WIPhilharmonic -

Sabrina Scarpa

Sabrina Scarpa

@SabrinaScarpa

Something went wrong.

Something went wrong.