James Moy

@Jamesmoy_Private Portfolio Manager. Multi strategy, Long/Short Equities, Global-Macro and special situations.

Similar User

@DrLiet

@RealPeterLinder

@sohko2019

@30mega3

@EdoardoPescoso1

@Arthurdev02

@BrBrBrBrent

@tpanic3g

@TeacherSantiag1

@ednaldoxara

@Rikjou_

@sarora04

@rockbhavan

@RafaelSMasca5

@FornasAmparo

The biggest bear on Wall Street is now bullish, setting a 2025 S&P 500 target of 6,500. You've been warned. 🫠 $SPY

Yield curve inversion has already set the stage for a recession This had also happened in 1928, 1972, and 2000 All of them ended in a recession Buckle up 🧵

🚨BREAKING NEWS🚨 INSTITUTIONAL TRADERS JUST SOLD THE MOST AMOUNT OF STOCKS LAST WEEK IN MORE THAN 9 YEARS IN EVERY BUBBLE LIKE 1929, 1987, 2001, & 2008 THE LAST STAGES WERE WHEN INSTITUTIONS STARTED DUMPING ON THE BAG HOLDING RETAIL WHICH BUY IT UP THIS BUBBLE WILL POP… $SPY

U.S banks are currently sitting on $750 billion in losses on real estate debt, per PiQ. That is 7 times larger than it was in 2008 when the housing bubble, per PiQ.

This photo, taken at last year's Berkshire meeting, explains why Buffett is dumping his entire Bank of America stake, once one of his top 3 biggest all-time investments. If you don't know what this photo means, you could be on the verge of losing everything. A thread:

ECB'S KAZAKS: RATE CUTS ARE NECESSARY AS THE ECONOMY IS WEAK.

Global net liquidity is exploding. This means unprecedented monetary destruction, economic secular stagnation, and risky assets' expansion. via Bloomberg

All correct👇👏 “It really is different this time. It’s worse, much much worse” And I add…. We will have a severe Recession! @NorthmanTrader thanks! 🙏

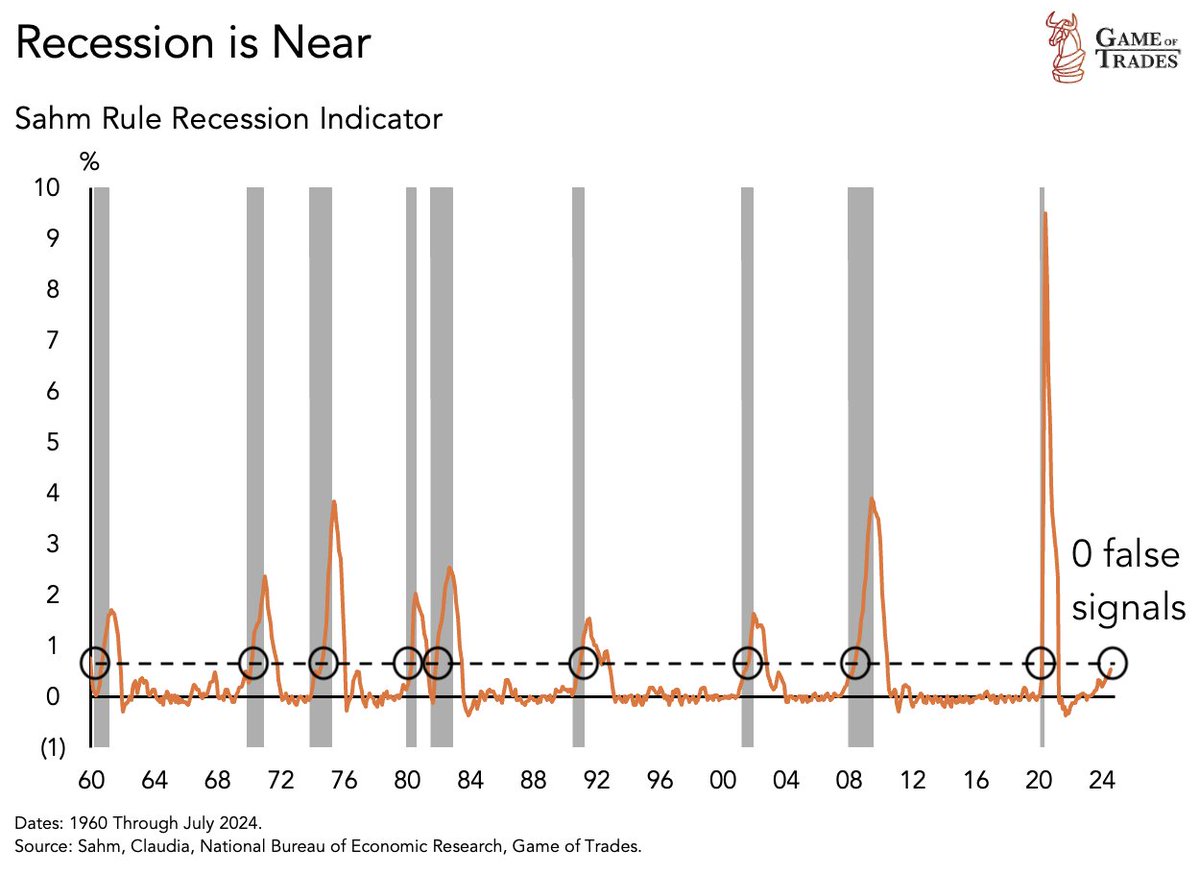

The Sahm Rule has been triggered It has predicted the last 9 recessions With 0 false signals yet This won’t end well A thread 🧵

If your third largest customer is committing fraud, is that bullish??? Nvidia $NVDA Super Micro Computer $SMCI

The US added 818,000 fewer jobs than originally thought, per the recent revision This is the largest revision since 2009

BREAKING: Warren Buffett's Berkshire Hathaway discloses that they have sold nearly 50% of their shares of Apple, $AAPL. Buffett's position in AAPL was reduced by $86 BILLION. Is Buffett calling a top in tech? Warren Buffett's cash pile hits a record $277B in Q2 2024.

The “buy the dip” and “no recession coming” NARRATIVES starting We are facing the last months of calm waters. Things will get ugly before or after 5 Nov 2024 (US elections) Good luck on ur perma Long portf. And don’t be that dumb to start shorting right now and without stopLs

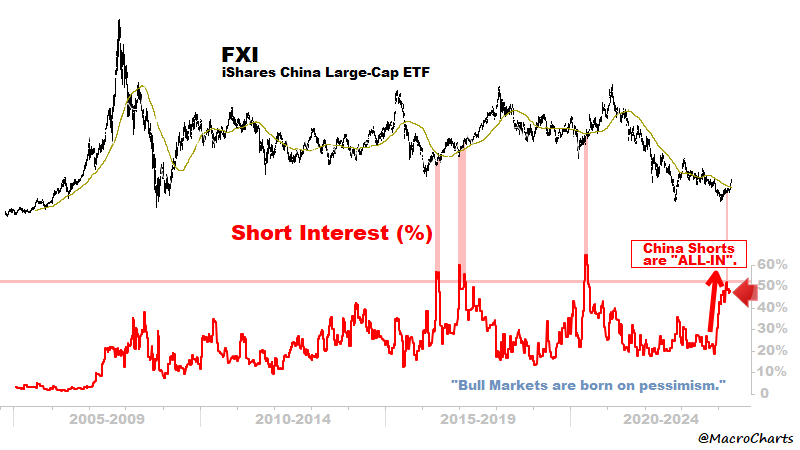

China Shorts are "ALL-IN". Bull Markets are born on pessimism.

❗This Project Veritas secret recording from April 2021 is being censored on virtually every platform. ⚠️ Will X censor it too? Pay close attention to what CNN Technical Director, Charlie Chester, reveals: "Once the public are no longer scared of "Covid", "climate change" will…

European stocks just dropped by the most in more than 9 months

US Equity risk premium is at its lowest level in 22 years The S&P 500’s earnings yield is unattractive compared to bond yield

United States Trends

- 1. #AskFFT 1.205 posts

- 2. Mason Mount 6.748 posts

- 3. $CUTO 12,3 B posts

- 4. Go Birds 4.652 posts

- 5. #RollWithUs 2.199 posts

- 6. Rashford 40,7 B posts

- 7. #TheOfficialTSTheErasTourBook N/A

- 8. #sundayvibes 8.321 posts

- 9. Thielen 3.161 posts

- 10. Ireland 75,7 B posts

- 11. #FFNow N/A

- 12. Go Bills 5.264 posts

- 13. Good Sunday 82,7 B posts

- 14. Waddle 2.825 posts

- 15. Full PPR 1.407 posts

- 16. Pacheco 7.191 posts

- 17. Breece 2.259 posts

- 18. Shakir 2.365 posts

- 19. Mooney 3.328 posts

- 20. Bucky Irving N/A

Who to follow

-

DrLiet

DrLiet

@DrLiet -

Peter Linder

Peter Linder

@RealPeterLinder -

うかつゆだん

うかつゆだん

@sohko2019 -

30メガネ

30メガネ

@30mega3 -

Lillo

Lillo

@EdoardoPescoso1 -

Arthur

Arthur

@Arthurdev02 -

ZERO_chainz_Brent

ZERO_chainz_Brent

@BrBrBrBrent -

Tim Panić

Tim Panić

@tpanic3g -

Santi Salgado Esteves

Santi Salgado Esteves

@TeacherSantiag1 -

Ednaldo Xará

Ednaldo Xará

@ednaldoxara -

Rikjou

Rikjou

@Rikjou_ -

sachin arora

sachin arora

@sarora04 -

Rock

Rock

@rockbhavan -

Rafael de Sousa Mascarenhas

Rafael de Sousa Mascarenhas

@RafaelSMasca5 -

AMPARO FORNAS

AMPARO FORNAS

@FornasAmparo

Something went wrong.

Something went wrong.