Similar User

@MksShawn

@MarzzR

@RobinFour

@rladudrl78

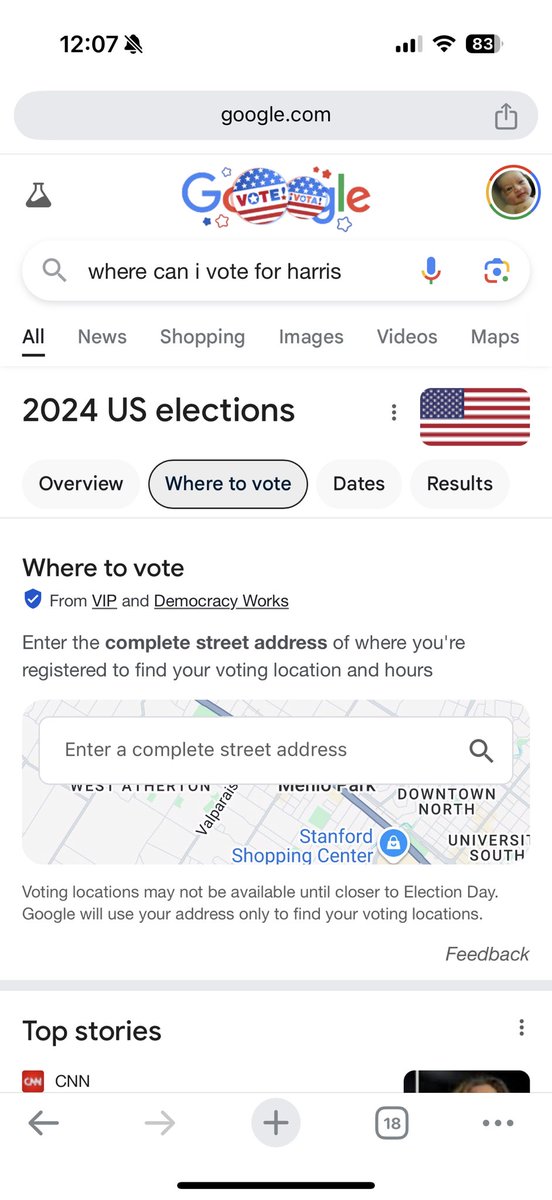

These should return the exact same form of result, but they don’t.

2006.. Fed raises to 4.5% and pauses rate hikes after subprime lenders start to go bust.. Oil sells off in the turbulence but then rallies from 50-150 on the pause, sounds familiar...

Indexation causes past inflation to become durably entrenched. The annual social security COLA is a mechanical way this happens. Notable that this year it was as big as earned income growth in Jan. Given high propensity to spend, likely a support to demand for a few months.

Hate to say it, but we need to increase oil & gas output immediately. Extraordinary times demand extraordinary measures.

Bernie’s misguided attacks have helped develop our current supply shortage. This kind of lunacy boils down to being a national security threat to our country. A complete misunderstanding of basic supply and inelastic demand…and the net result..is frightening.@SenSanders

We can no longer allow big oil companies, huge corporations and the billionaire class to use the murderous Russian invasion of Ukraine and the ongoing pandemic as an excuse to price gouge consumers. It is time to enact a windfall profits tax and reasonable price controls.

#spx #SP500 #stocks #Equities S&P500 model confidence dropping sharply again This has implications for the balance of risks See our prev comments on stocks over recent months as a reference #markets

To date, inflation scares have not prevented strong equity mkt returns. That could be changing. Look under the surface to quantify shifting relationships - in this case $SPY $STOXX $NIKKEI $EEM flirting with negative sensitivity to inflation expectations.

We have the capacity to build a future we can be excited about, for ourselves and our families. United, we can move America #Forward and align the incentives of our people and our representatives.

Welcome to the Forward Party. Learn more at ForwardParty.com. @Fwd_Party #forward #forwardist

Three Qi measures point to a vol event / risk off in the weeks ahead. * $SPY has fallen out of macro regime * Cross Asset Absorption is spiking off low levels. Mkts are increasingly concentrated. * The Qi Vol Indicator is rising Open access 👉 quant-insight.com/insight/storm-… #fintwit

THE most important chart to watch this week. Mixed currently but should RETINA™ flag a new downtrend for Crude #Oil that would be big news. A new downtrend would imply a significant re-pricing lower for US bond ylds. That, in turn, impacts the equity rotation trade & the #Dollar

There are a few warning signs for global risk appetite coming from Qi. 1.) macro explanatory power is falling across several key benchmarks. 2.) momentum is falling across a number of equity indices $DMA $GXA, cyclical sectors $XLE $XHB European Autos, & EM fx $MXN $BRL $ZAR.

Chart of the decade?

One way to think about #NASDAQ hitting 1σ cheap vs macro on Monday is it was political risk premium - a blue wave meant antitrust or rotation to value. Now, if it's gridlock, US Tech can catch back up to fundamentals. And macro model value looks to be making new highs. #catchup

United States Trends

- 1. Tyson 471 B posts

- 2. $MAYO 12,8 B posts

- 3. #wompwomp 4.841 posts

- 4. Pence 56,7 B posts

- 5. Kash 97,1 B posts

- 6. Debbie 31,9 B posts

- 7. Whoopi 102 B posts

- 8. Iron Mike 20 B posts

- 9. The FBI 263 B posts

- 10. Dora 23,8 B posts

- 11. Ronaldo 174 B posts

- 12. Connor Williams 1.308 posts

- 13. #LetsBONK 13,7 B posts

- 14. Mike Rogers 18,8 B posts

- 15. Gabrielle Union 2.080 posts

- 16. #FursuitFriday 16,6 B posts

- 17. Per CNN 3.680 posts

- 18. National Energy Council 5.426 posts

- 19. Staten Island 24,6 B posts

- 20. East vs West N/A

Something went wrong.

Something went wrong.