EveryData Jamaica

@EveryDataJMEveryData is the Caribbean's leading credit bureau network specializing in data analytics and credit risk management.

Similar User

@CareerJamaica

@EXIMBankJa

@HiLo_Ja

@ATLunbeatable

@elearningja

@Bookophilia

@suzukijamaica

@ThinkChrysalis

@ExpoJamaica

@GHCaterers

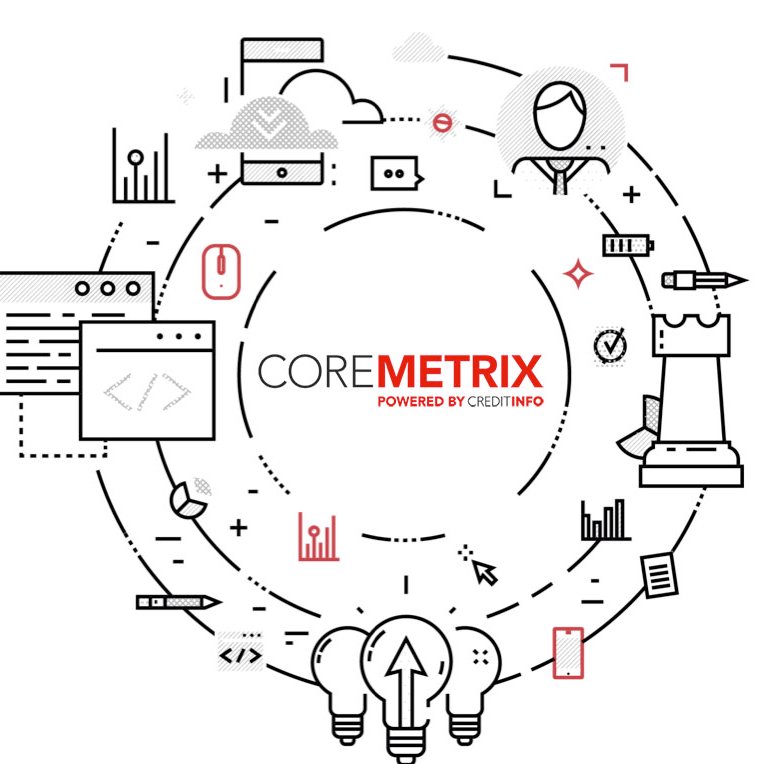

IDM brings decision-making to a whole new level of intelligence with automation and extremely quick turnaround time for implementation of changes in the rapidly evolving lending world.

Instant Decision Module permits accurate lending decisions in an instant. It is a Software as a Service solution dedicated to lenders, including digital and mobile lenders from the financial and non-financial sectors, to enable automated accurate credit decisions. #EveryData

Instant Decision Module (IDM) is a platform for automated evaluation of Credit Data in combination with your organization's customised Input Data.

🔒 Enhance Risk Management: Our service strengthens your risk management processes, helping you mitigate potential losses and protect your business.

Join the ranks of proactive businesses maximizing their potential with EveryData's Monitoring Service! 💪✨ #EveryDataMonitoring #RiskManagement #BusinessGrowth #ProactiveDecisions

🚀 Proactive Decision-Making: Instant notifications keep you in the loop when changes occur, empowering you to make timely and optimal business decisions.

Did you know that your customers' credit status is constantly evolving? 🔄 With our Monitoring Service, you can stay on top of these changes and make smarter business decisions while seizing new opportunities.

Financial stress can be overwhelming, but by implementing the following tips and seeking appropriate support, you can regain control and work towards a more stable financial future.

Consider consulting a financial advisor or counselor who can provide expert guidance tailored to your specific situation.

Research financial literacy resources to enhance your knowledge and skills. Taking proactive measures can empower you and alleviate some of the stress associated with financial challenges. #EveryData #FinancialStress #FinancialFreedom

2. Seek Support: Reach out to trusted friends, family members, or financial professionals for support and guidance. Discussing your financial concerns with someone you trust can offer a fresh perspective, practical advice, and emotional support.

1. Develop a comprehensive budget that outlines your income, expenses, and savings goals. This will provide you with a clear overview of your financial situation and help you prioritize your spending.

3. Take Action and Seek Solutions: Instead of dwelling on financial stress, focus on taking positive steps to improve your situation. Explore strategies such as debt consolidation, negotiating with creditors, or creating a repayment plan.

Lenders consider credit scores when assessing loan applications, and a higher credit score can work in your favour in the following ways:

Having a higher credit score generally increases your chances of loan approval. A good credit score is seen as an indicator of responsible financial behavior and a lower risk of defaulting on loan payments.

4. Expands loan options: Some lenders have specific credit score requirements for certain loan products. By having a higher credit score, you increase your chances of meeting those requirements and gaining access to a wider range of loan options.

1.Demonstrates creditworthiness: A higher credit score reflects a positive credit history, indicating that you have managed credit responsibly. This gives lenders confidence in your ability to repay borrowed money, making you a more favorable candidate for loan approval.

3. Enables access to better loan terms: With a higher credit score, you may qualify for loans with more favorable terms, such as lower interest rates, higher loan amounts, and longer repayment periods. This can make the loan more affordable and save you money in the long run.

2. Improves lender confidence: Lenders use credit scores as a tool to assess the risk associated with lending to an individual. A higher credit score suggests a lower risk of defaulting on loan payments, which makes lenders more likely to approve your loan application.

Building and maintaining good credit takes time and consistent effort. By practising responsible credit habits, you can establish a solid credit history and enjoy the benefits of a good credit score. #EveryData #CreditScore #CreditHygiene

United States Trends

- 1. #OnlyKash 29,9 B posts

- 2. Jaguar 45,3 B posts

- 3. Joe Douglas 10 B posts

- 4. $MOOCAT 1.401 posts

- 5. Maxey 13,6 B posts

- 6. Embiid 21,6 B posts

- 7. Rodgers 12,5 B posts

- 8. Jets 41,4 B posts

- 9. Nancy Mace 59,1 B posts

- 10. Woody 14,8 B posts

- 11. #HMGxCODsweeps N/A

- 12. #HowToTrainYourDragon 15,7 B posts

- 13. Cenk 10,6 B posts

- 14. Howard Lutnick 14,9 B posts

- 15. Toothless 14,9 B posts

- 16. #ysltrial 5.859 posts

- 17. Zach Wilson 1.568 posts

- 18. Sarah McBride 53,8 B posts

- 19. Saleh 18,9 B posts

- 20. Rove 5.543 posts

Who to follow

-

Career Jamaica

Career Jamaica

@CareerJamaica -

EXIM Bank Jamaica

EXIM Bank Jamaica

@EXIMBankJa -

Hi-Lo Food Stores JA

Hi-Lo Food Stores JA

@HiLo_Ja -

ATL Unbeatable

ATL Unbeatable

@ATLunbeatable -

e-learning Jamaica

e-learning Jamaica

@elearningja -

Bookophilia

Bookophilia

@Bookophilia -

Suzuki Jamaica

Suzuki Jamaica

@suzukijamaica -

Chrysalis Communications

Chrysalis Communications

@ThinkChrysalis -

@expojamaica

@expojamaica

@ExpoJamaica -

Great House Caterers

Great House Caterers

@GHCaterers

Something went wrong.

Something went wrong.