Similar User

@StevenR50661969

@AlonSolomon5

@ChamliesCharles

@Diiewam

@ThelastSilverR

@goldwatcher5000

@CHIZZA45

@Shares_Doctor

@neofoo23

@JpmScrew

@Davidjlee881

@T_Klimchuck

@jackgermon

@Lisa00007369

@guy0682

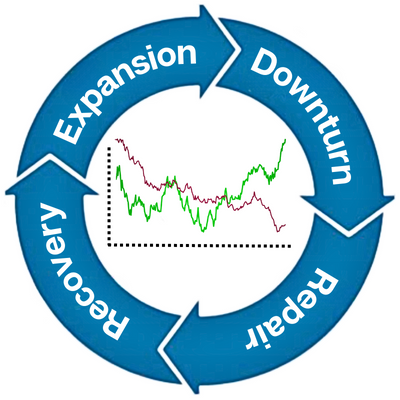

Being in Congress means you can enrich yourself in so many "legal" ways. For instance, the stock market!

Some banger comments in the recent Grantham note: gmo.com/americas/resea… Quality: "U.S. quality stocks have a long history of slightly underperforming in bull markets and substantially outperforming in bear markets (although they did unusually well in the recent run-up). In…

Great news! Literally nobody cares about gold anymore, so now it can moon 🥳

tweet of the day

I ask this with all sincerity: What is the game plan here?

Demand is a function of price. Consumption is just the amount consumed/purchased. They are related but not the same. To say that "demand is high" based on rising consumption may not be accurate. It may simply be that price is down.

@LukeGromen Here is how the analog overlay of the current advancing phase for the gold price is looking versus its advancing phase in the 1970s. The timing of this ultimate cycle-high is expected between 2027-2028 which is supported by other analysis. (1/2)

Interestingly, gold was $170 on this day in May 1975. A little over four years later it was $800.

As we’ve repeatedly told you all, fewer than twenty people control the entire crypto market.

Aside from Radix, Jane Street and Tower Research were revealed as Binance’s biggest “VIP” traders. The CFTC complaint detailed that Radix was the largest flows contributor (12%). However, in conversations I’ve had, I’ve learned that Tower is actually the largest at 20%.

For months I've been wondering about the disconnect between the red-hot labor market & icy-cold consumer sentiment. Why are Americans, particularly lower-income ones w/ the fastest wage growth, so pessimistic about their finances? What are we missing? 🧵 washingtonpost.com/opinions/inter…

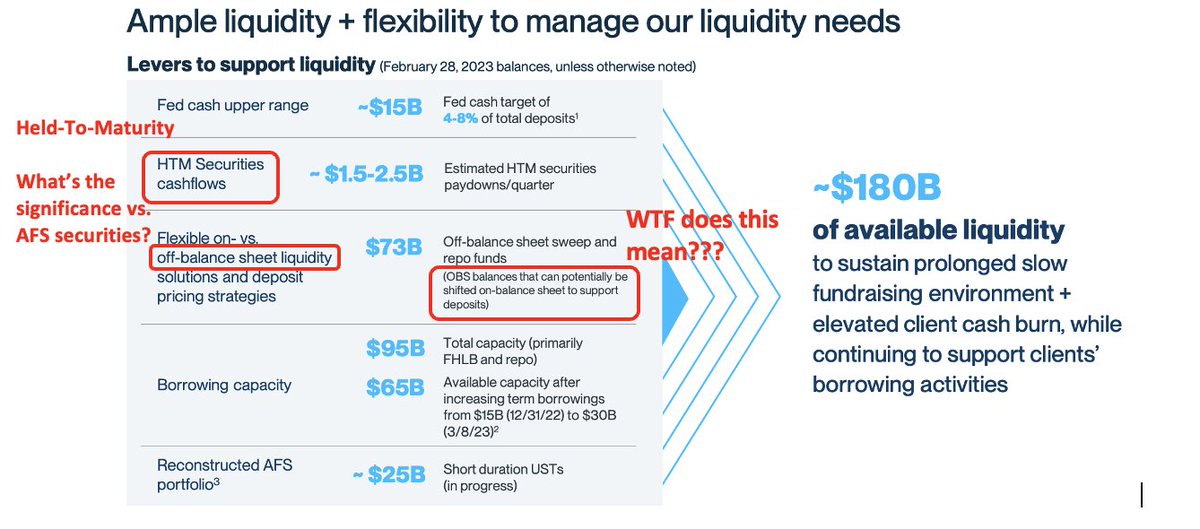

🏦📉 SVB Crash Explained📉🏦 Silicon Valley Bank—#16 largest US bank with $212B — just crashed 60% in 1 day & fell 22% post-close. Stock halted now. @BillAckman is calling a US gov bailout. @peterthiel is calling a bank run. JPM, BAC, WFC all dropped 6%. What's next? Is this…

"This is an ecosystem that is totally corrupt... I can't believe @cz_binance has a license to operate in the UAE," @Nouriel tells CNBC's @dan_murphy on stage at Abu Dhabi Finance Week.

SHE IS THE CEO OF FTX / ALAMEDA WHERE WHERE THE SIGNS LMAO

The figure above is showing (Fed debt) x 6%. Divide that by tax receipts and you get >50% as shown. Of the marketable Fed Gov debt ▪️ 58% is in Notes (2yr, 3yr, 5yr, 10yr) ▪️ 16% is in Bills (1y or less) ▪️ 16% is in Bonds (20yr, 30yr) ▪️ 8% is in TIPs

For context, in fiscal 2021: ▪️ $4.47 trillion in new Notes were issued (of those, $2.04t were to cover redemptions) ▪️ $0.72 trillion in new Bonds were issued (of those, $0.69t coved redemptions) So ~30% of the debt outstanding needs to be rolled over each year.

A 6% rate will ultimately put the Federal Gov debt interest expense to greater than 50% of tax receipts. Add in a recession, expect tax receipts to fall by 20-30% so interest on debt becomes more like 65%+ of tax receipts. So how likely is 6% in terms of a sustainable rate?

Wow, Raskin just slamming Republicans

United States Trends

- 1. Jake Paul 1,02 Mn posts

- 2. #Arcane 192 B posts

- 3. Jayce 36,8 B posts

- 4. Serrano 244 B posts

- 5. Vander 11,3 B posts

- 6. maddie 16,1 B posts

- 7. #SaturdayVibes 2.132 posts

- 8. #HappySpecialStage 53,7 B posts

- 9. Canelo 17,3 B posts

- 10. Jinx 93 B posts

- 11. #NetflixFight 75,7 B posts

- 12. The Astronaut 23,8 B posts

- 13. Isha 27 B posts

- 14. Father Time 10,5 B posts

- 15. Logan Paul 24,8 B posts

- 16. Super Tuna 16 B posts

- 17. Boxing 312 B posts

- 18. Good Saturday 19,9 B posts

- 19. He's 58 29,1 B posts

- 20. #netflixcrash 16,9 B posts

Who to follow

-

Steve

Steve

@StevenR50661969 -

Alon Solomon אלון סולומון

Alon Solomon אלון סולומון

@AlonSolomon5 -

Chamlies

Chamlies

@ChamliesCharles -

Dieter !™️

Dieter !™️

@Diiewam -

SilverR

SilverR

@ThelastSilverR -

golddowratio1 #silversqueeze

golddowratio1 #silversqueeze

@goldwatcher5000 -

FREEDOM 🇨🇦 ♤SILVER 🇨🇦 THETA

FREEDOM 🇨🇦 ♤SILVER 🇨🇦 THETA

@CHIZZA45 -

Shares Doctor

Shares Doctor

@Shares_Doctor -

ValueFounder

ValueFounder

@neofoo23 -

ScrewJPM

ScrewJPM

@JpmScrew -

David Joshua Lee

David Joshua Lee

@Davidjlee881 -

Thomas Klimchuck

Thomas Klimchuck

@T_Klimchuck -

Greg Germon

Greg Germon

@jackgermon -

Lisa

Lisa

@Lisa00007369 -

אדרל

אדרל

@guy0682

Something went wrong.

Something went wrong.