Similar User

@EponymouslyAnon

@NIKOSKINOS

@CalvaneseSam

@MotzNZ

@GTsonef

@X_Blue77

@JeffTomasich

@chardseycakes

@Aparigratosha

@LouisPhdSB

@marketsgonewild

@v_ffs

@garynh123

@TanamiRoad

@ric_mus

My man @mrouben with the 🇨🇦 round-up

Canadian Kitties: Monthly Thread - Feb 2023 @joekittyano @gozmike @chadhammerman @convexreflexive @DerParadiso @NIKOSKINOS @Chacal2900 @ASharpclaw @CablesCap @GTsonef @Deliorm92393096 @PoundingDaRock @mik_sinclaire @TheOldFirm1 @Mattybomb1 @KiwiPMI @marketsgonewild @DanRach7

Sam’s breakdown of what is happening with inflation is on point. If you’re not following this man, you need to.

Inflation is becoming more entrenched with every passing day. With wage gains now firmly embedded in the economy, the Federal Reserve will have to take action to shock the business cycle into layoffs.

The utter stupidity of the government 🤦🏼♀️

Instead of cutting spending and reducing inflation below wages, they’re solution is to simply peg wages to inflation. We’re in this for the long haul folks.

Q4 2022 US Household Debt Overall delinquencies are still fairly low, but this is an interesting change.

Chances are better of winning the Powerball 🎰

These CBO projections also assume that the Fed cuts interest rates in 2024 without a recession having occurred, and that unemployment remains low continuously into 2033 with no recessions ever.

Many people have heard "crash landing"/"soft landing" thrown about in the media but don't actually understand what they mean. Dario does a great job of actually defining them below

🚨The average 30-year fixed mortgage rate jumps back to 6.75%. That’s a new high mark for 2023.

#bigflip in one chart. Safe to say what was visionary is now mainstream

If you understand nothing about the #bigflip are are not into SOFR curve trades, won’t be trading bond futures, yet wanna take away something simple that can have an important and lasting impact on your trading year, let it be this: $ did not peak yet for this cycle.

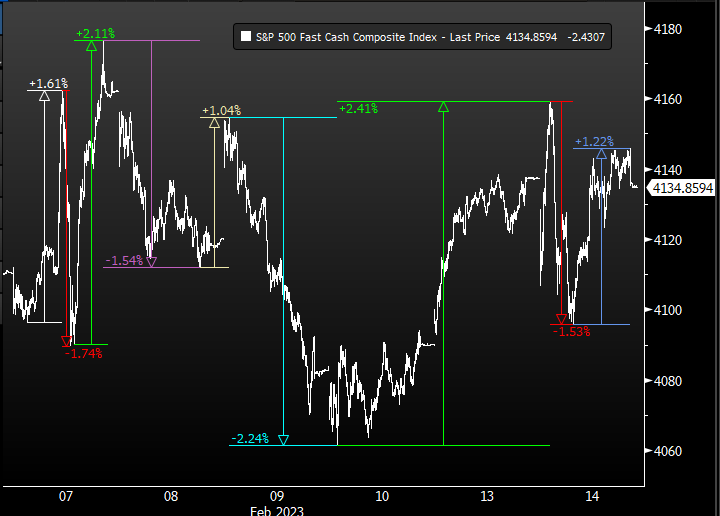

Interesting analysis from @biancoresearch on SPX and VIX action of late

1/4 Tick chart of the NYSE-ONLY session for the SPX (9:30AM-4PM ET). It shows the last week (Feb 7 - 14). Highlighted and admittedly messy are all the 1% reversals in the S&P over this time frame. The S&P 500 has reversed NINE times. FOUR of these reversals are > 2%.

This 👇🏻

I'm so tired of people looking at change in YoY number. The two months relevant to the change in YoY CPI are Jan 2023 (the month added) and Jan 2022 (the month removed). Just look at MoM, or better yet the index itself, kthx.

Wow. NZ housing is broken 😳

House prices continued to decline in January, but house sales bounced. We continue to forecast a 22% fall in house prices from their Nov 2021 peak (currently down 15%). bit.ly/ANZ-REINZ-Jan23

Things are feeling too good for the average American #whatrecession? #bigflip @INArteCarloDoss

Americans' concerns about inflation, recessions, and stagflation may be receding given @Google search trends for all three topics have dropped considerably @DataArbor

CDN Millennials are insolvent. Even after all the free money, of which they did not understand the tax burden @kittysquiddy “(CERB) was a factor in rising tax obligations. 46% of millennials had tax-related debt, rising 9% from the previous year” bnnbloomberg.ca/nearly-half-of…

United States Trends

- 1. Thanksgiving 646 B posts

- 2. Custom 85,2 B posts

- 3. #ConorMcGregor 6.851 posts

- 4. #BillboardIsOverParty 84,2 B posts

- 5. Mbappe 424 B posts

- 6. #CONVICT 6.685 posts

- 7. Zuck 4.508 posts

- 8. Madrid 532 B posts

- 9. Vindman 29,6 B posts

- 10. Liverpool 338 B posts

- 11. #YIAYlist N/A

- 12. #drwfirstgoal N/A

- 13. Verify 30,5 B posts

- 14. Brandon Crawford 2.800 posts

- 15. Gonzaga 6.828 posts

- 16. HAZBINTOOZ 8.480 posts

- 17. Kissing 48,9 B posts

- 18. Ferrari 34,7 B posts

- 19. Juan Williams 1.653 posts

- 20. Standard Time 13,6 B posts

Who to follow

-

EponymouslyAnonymous

EponymouslyAnonymous

@EponymouslyAnon -

Ragnarøkk Capital

Ragnarøkk Capital

@NIKOSKINOS -

Sacal

Sacal

@CalvaneseSam -

Mots

Mots

@MotzNZ -

Thrifty

Thrifty

@GTsonef -

Blue77

Blue77

@X_Blue77 -

Jeff Tomasich

Jeff Tomasich

@JeffTomasich -

Richard Leahy

Richard Leahy

@chardseycakes -

Narile

Narile

@Aparigratosha -

Louis Philippe

Louis Philippe

@LouisPhdSB -

matt

matt

@marketsgonewild -

FFS

FFS

@v_ffs -

Carlos Danger

Carlos Danger

@garynh123 -

TheTanamiTrack

TheTanamiTrack

@TanamiRoad -

Rick

Rick

@ric_mus

Something went wrong.

Something went wrong.