Ed L

@trader_investrTweets r fyi & entertainment only, NOT advice!! I may be long/short tweeted assets. DO NOT TRADE/INVEST BASED ON THESE TWEETS!! RTs/Follows r NOT endorsements!

Similar User

@Tiros5gJames

@Matthew71189

@LVIGinPA

@ScottBa53645538

@Stonehearthcap

@MMS_Inc

@thedowlinggroup

@RatherKittrell

@mConcepts_

@TraderAchilles1

#lizjny @LIZJNYshow New to the chat. Sounds like great stuff! Any thoughts on NKE on the follow of last week's 3 std-dev meltdown?

#lizjny New to the chat. Sounds like great stuff! Any thoughts on NKE on the follow of last week's 3 std dev meltdown?

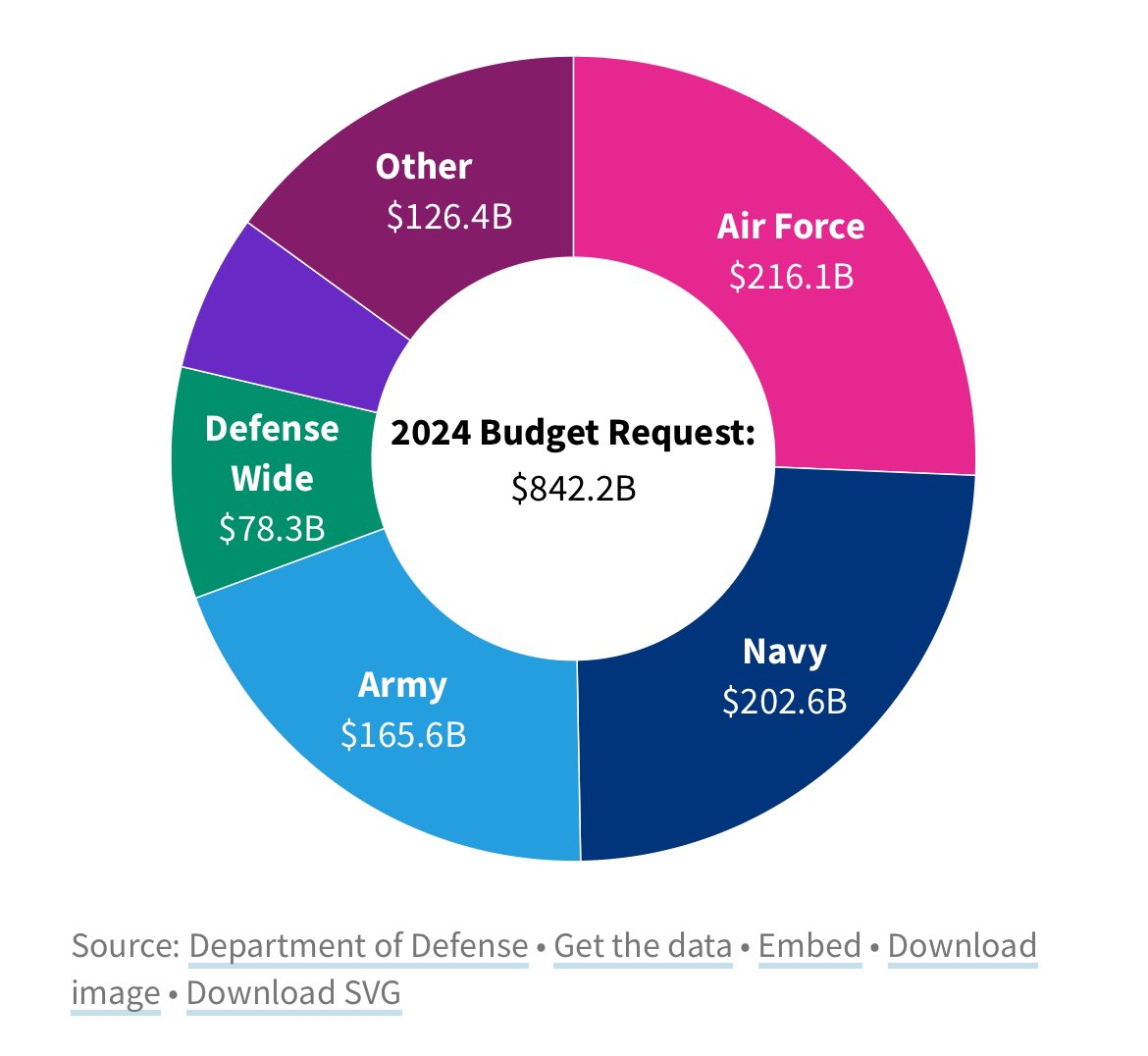

White House announces another $7.7 billion in student debt relief Wednesday morning, bringing the total to $167 billion. That’s about the size of the U.S. Army’s budget:

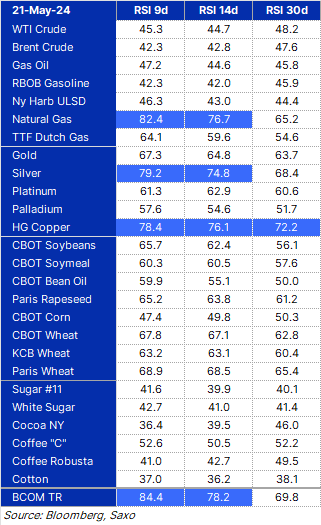

It's not often we find the BCOM TR index in overbought territory, and it highlights the broad nature of the recent rally with MTD gains being led by precious metals (8.7%), industrial metals (7.4%), and grains (7%). #Natgas, #silver and #copper all in need of consolidation.

If you missed our analysis on @MadMoneyOnCNBC w/ @jimcramer on Friday, you can review the written material here - madmimi.com/s/690a991. You can also access the video via the CNBC Investing Club - cnbc.com/video/2024/05/…. We have seen that bearish divergence before, yikes.

Last December, Bears outnumbered Bulls by 32% in the AAII Sentiment Poll. Today, Bulls outnumber Bears by 32%. What changed? The S&P 500 is 27% higher & the Nasdaq 100 is 58% higher. Video: youtube.com/watch?v=WtFzao…

If you're not an active trader of Corn, this is the only chart you need to focus on for the rest of the month. ⬆️Upside risk before next big move? 2.8%🟢 ⬇️Downside risk before next big move? 1.8% 🔴 There really isn't anything major going on so let's not pretend there is…

I assumed the Goldman Financial Condition Index was merely an index level. I just learned the index is actually the equivalent of fed funds basis points (bps). So, November's record easing of financial conditions was the equivalent of 90 bps of Fed cuts. Or rounding it works…

This is a well documented scam. Beware…

Usage of the Fed's emergency bank funding facility jumped by $116 million last week. It now stands at its record high of $108 billion, even as the regional bank crisis is "over." Banks are currently paying the Fed ~6% in interest on these emergency loans. Meanwhile, the…

Dealers have the most negative gamma exposure that's ever been recorded by Goldman Sachs. That's fine right?

Data from the past 3 years (didn't want to include too much pre-covid era) sees positive average and median 1-week, 1-month, and 3-month returns for S&P 500 $ES $SPY $SPX when AAII bearish sentiment spikes by >16.5% (we're at 16.46% as of 9/28/23).

S&P 500 $ES $SPY $SPX putting up; bearish sentiment has surged over the past three months (biggest spike seen since low in stocks first week of May). Tradeable low? Looking like it. Close above daily 5-EMA today worth watching.

End of Quarter Positioning Sends Market Volatility Higher @OliverSloup on @OfficialRFDTV @ScottTheCowGuy bluelinefutures.com/2023/09/28/end… #corn #soybean #grains #futurestrading #agriculture #livestock

Credit card default rate has been rising rapidly: Top 100 banks - 2.45% The rest - 7.51%, highest level on record This could get worse as interest rates continue to remain high

Wetness in Brazil’s 14-day precipitation map implies potential support to #coffee plants, which need moisture for fixation and blooming, but Brazil weather outlook still overall adverse, with Oct-Nov maps dry & the heat wave anticipated to continue for the next 2 weeks.

United States Trends

- 1. ICBM 142 B posts

- 2. #KashOnly 19 B posts

- 3. The ICC 96,1 B posts

- 4. Good Thursday 27,6 B posts

- 5. #ThursdayVibes 3.895 posts

- 6. International Criminal Court 51,6 B posts

- 7. #ThursdayMotivation 5.355 posts

- 8. Bezos 29,4 B posts

- 9. Gallant 134 B posts

- 10. Happy Friday Eve N/A

- 11. Dnipro 57,4 B posts

- 12. Adani 797 B posts

- 13. Katie Couric N/A

- 14. #21Nov 3.233 posts

- 15. Reece James 9.300 posts

- 16. #thursdaytechnology N/A

- 17. Diddy 102 B posts

- 18. Nikki 54,7 B posts

- 19. Vegito 2.298 posts

- 20. MIRV 1.240 posts

Who to follow

Something went wrong.

Something went wrong.