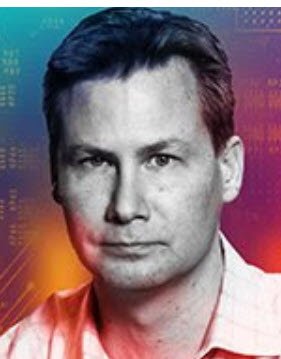

Todd Salamone

@toddsalamoneSenior V.P. Research, Schaeffer's Investment Research.

Similar User

@schaeffers

@AlmanacTrader

@chartsmarter

@WillieDelwiche

@OptionsHawk

@ZorTrades

@andrewnyquist

@seeitmarket

@AriWald

@MarkArbeter

@RussellRhoads

@TradeVolatility

@HumbleStudent

@MarketCharts

@Sassy_SPY

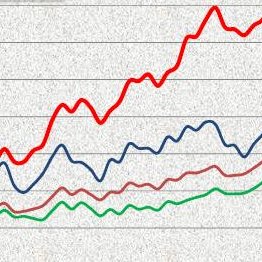

"potential support/resistance levels for $SPX: last month's high of 5,880 (support), the 5,782 close ahead of Wed election-driven gap higher (support), 50D MA and pre-election lows at 5,720 (support).. round 6,000 close on Fri + $SPY below $600 level (resistance) " -@toddsalamone

"last week's rally supported by positive seasonality and bullish head&shoulder mid-Sept breakout pattern... target for $SPX by EOY is 6,215 (550 above mid-Sept neckline breakout level" -@toddsalamone

$ weakness vs yen around time of monthly employment number emerges again. In fact, today's USD/Yen low is around 8/5 low. More carry trade unwind and delta-hedge selling risk next week (a repeat of early Aug)? $SPY 9/20 540-strike put heavy and important into 9/18 FOMC meeting

Per my weekly commentaries, key levels on $VIX and $SPX broken to upside and downside, respectively. Ride momentum while it lasts, but now threat of corrective action heightened as of Thursday, 4/4 close schaeffersresearch.com/content/analys…

For our latest Monday Morning Outlook, @toddsalamone tackles The $SPX's 30-day moving average $SPY call open interest $VIX resistance levels schaeffersresearch.com/content/analys…

$VIX closed above 15.40 yesterday - “resistance” in January and one-half its 52-wk high. Half-highs and double lows sometimes mark key highs or are indicative of higher vol ahead when penetrated.

$VIX above 200dayMA and nearing 18.23, or one-half its 2022 closing high. 18.23 area marked a peak in mid-August and, as such, a level to keep your eye on as potential clue to where vol is headed in coming days/weeks. $SPX

$VIX intraday high so far today is 18.14, just below 18.23, which is one-half its March 2022 closing high... The 18.22 area marked VIX lows in January and February of this year

VIX 1D on verge of a double in one day - opened at 9.34, now at 18.54. $VIX $SPX

If this technical pattern repeats, bulls will be in control this month schaeffersresearch.com/content/analys…

Technical improvement in $SPX today amid gap higher above the trendline connecting lower highs since early-Feb peak. Closed above the round 4,000-millennium level too. Fwiw - SPX high and low above 4,000 on only 15% of trading days in the past six months, today was not one.

The $VIX has traded above 26.80 intraday Friday through Wednesday, but all closes have been below this level. 26.80 is a round 50 percent above its '22 close $SPX

3,850 level back in play on $SPX - the level it was at when Biden took office in January '21

An easy $SPX level to watch: 4,000 Plus, @toddsalamone on $NDX p/c ratios unwinding into expiration week schaeffersresearch.com/content/analys…

Shorts giving up on their bearish posturing over the past several months? $SPX

$SPX 3,837 (20% below all-time closing high) and 3,850 (level when Biden took office) in play again after key 3,900 is decisively broken to the downside .

$SPX highs from 12/1 plus trendline resistance connecting lower highs since January and higher lows Oct-Nov proving difficult to overcome post CPI... $SPY call wall at 400 strike also in play ahead of #Fed on Wed afternoon

$SPX 30-dayMA marked peak in mid-September prior to sharp decline.., A late-Oct crossover of this moving avg proved bullish with a retest of it on 11/3. 30dayMA currently at 3,923 and marked 12/7 low, fwiw

Eye-balling $SPX daily chart. A candle that looks closest to today's (2-month intraday high and close at or near day's low) last occurred on 8/11. $SPX rallied three more days before sell-off into October trough

The $SPX cleared 3,900 last week, a big marker for @toddsalamone Now, he's looking to 4K, which has some added significance schaeffersresearch.com/content/analys…

United States Trends

- 1. $CUTO 4.124 posts

- 2. Colorado 60,8 B posts

- 3. Kansas 32,6 B posts

- 4. Devin Neal 5.447 posts

- 5. #AEWFullGear 15,5 B posts

- 6. Arizona State 8.615 posts

- 7. #BeatTheSnail N/A

- 8. Big 12 18,5 B posts

- 9. Ole Miss 33,6 B posts

- 10. Penn State 10,2 B posts

- 11. Travis Hunter 11 B posts

- 12. Notre Dame 18,8 B posts

- 13. James Franklin 1.459 posts

- 14. Indiana 63,8 B posts

- 15. Kenny Dillingham N/A

- 16. Sanders 25,6 B posts

- 17. #Huskers 2.931 posts

- 18. Heisman 9.225 posts

- 19. Nebraska 15,5 B posts

- 20. Hail Mary 4.194 posts

Who to follow

-

Schaeffer's Investment Research

Schaeffer's Investment Research

@schaeffers -

Jeffrey A. Hirsch

Jeffrey A. Hirsch

@AlmanacTrader -

Douglas Busch CMT

Douglas Busch CMT

@chartsmarter -

Willie Delwiche, CMT, CFA

Willie Delwiche, CMT, CFA

@WillieDelwiche -

Joe Kunkle

Joe Kunkle

@OptionsHawk -

Frank Zorrilla

Frank Zorrilla

@ZorTrades -

Andy Nyquist

Andy Nyquist

@andrewnyquist -

See It Market

See It Market

@seeitmarket -

Ari Wald, CFA, CMT

Ari Wald, CFA, CMT

@AriWald -

Mark Arbeter, CMT

Mark Arbeter, CMT

@MarkArbeter -

Russell Rhoads

Russell Rhoads

@RussellRhoads -

Trading Volatility

Trading Volatility

@TradeVolatility -

Cam Hui, CFA

Cam Hui, CFA

@HumbleStudent -

MarketCharts.com

MarketCharts.com

@MarketCharts -

Rachel S Goldberg, LMFT, PMH-C

Rachel S Goldberg, LMFT, PMH-C

@Sassy_SPY

Something went wrong.

Something went wrong.