Yann Ranchere

@tek_finOn an exploration / Venture Partner @anthemis : board @kwhanalytics @Qover @goinofficial @WeavrPayments Stoik

Similar User

@JPNicols

@Finextra

@FTPartners

@matteorizzi

@sytaylor

@Finovate

@BankAutomation

@Chris_Skinner

@rshevlin

@SusanneChishti

@dgwbirch

@anthemis

@annairrera

@FSClub

@GhelaBoskovich

🧵1/5 The tides of Fintech are shifting 🌊 with Modulr, Rails, and Solarisbank under the regulatory 🔍. It's clear the BaaS model is being tested, but it's the intricate agent model that truly calls for a deeper analysis. Let’s dive in. ➡️

The IPO season is coming! 🥳 “ServiceTitan, the software platform that powers the trades businesses, filed a registration statement on Form S-1 with the U.S. SEC”

👀

Pixtral Large: - Frontier-class multimodal model - SoTA on MathVista, DocVQA, VQAv2 - Maintains text performance of Mistral Large 2 - 123B decoder, 1B vision encoder - 128K seq len Download it on HF: huggingface.co/mistralai/Pixt… Try it on Le Chat: chat.mistral.ai 2/3

Added H100 clusters from MareNostrum 5, Ruhr University Bochum, and RWTH Aachen University to the @stateofaireport Compute Index thanks to pointers from @ruggsea :)

Whats the implication for their current brokerage infra partners ?

#Revolut has gained a second UK broker license that will allow it to offer UK and EU-listed stocks and ETFs. New service set to launch next year. bloomberg.com/news/articles/…

Here goes my evening

Second ship of the day 📈 We're building ChatGPT into a contextual assistant. If you're wondering why @openai is building macOS and PC apps—this the beginning of why.

Most agri machinery is robotic in some shape or form today and can be retrofitted to increase automation. Fieldbee is an super interesting company in that space : fieldbee.com

Good summary of $NU's Q3 results. Interesting growth of the SME segment.

I woke up wanting to do a review of $NUs Q3 results. After $MELI it is the best tech company in my zip code. Then you have the rest. Far away. And because I had a key role in both I think I know WTF I’m talkin about. Also I am my own boss these days so I respond to nobody but…

French politics 😂

Un comité de la hache anti-bureaucratique, j’en ai rêvé et @elonmusk va le faire !

Klarna has filled for IPO in the US. This is interesting for a handful of reasons 1. It picked the US not Europe (its home) 2. It could be the dam breaking for Fintech IPOs in 2025 3. It's an incredible comeback story from a massive down-round to multi-billion IPO 👀 ICYMI:…

Solar power will be the vast majority of power generation in the future

NEWS: Rooftop solar delivers milestone of 80.5% share of electricity generation in Western Australia 🇦🇺 Yesterday at 1:30 PM, distributed solar PV accounted for 2.12 gigawatts of output, with natural gas and coal both reduced to shares of 8.6% and 8.3% respectively.

Shout out to WesdeSilvestro (not on X I believe) github.com/wdesilvestro for building github.com/wdesilvestro/v… based on @ganeumann model for venture fund. Would love to dive deeper with someone to expand further on it.

And to celebrate BTC ATH, I'm proud to announce that @KaikoData has acquired @vinterco!

🌍 Kaiko Acquires Vinter, Europe’s Leading Crypto Index Provider! 📢 We’re thrilled to announce that Kaiko has acquired @vinterco, Europe’s top name in regulated crypto indices! This strategic move amplifies Kaiko’s role as the global leader in crypto market data and indices,…

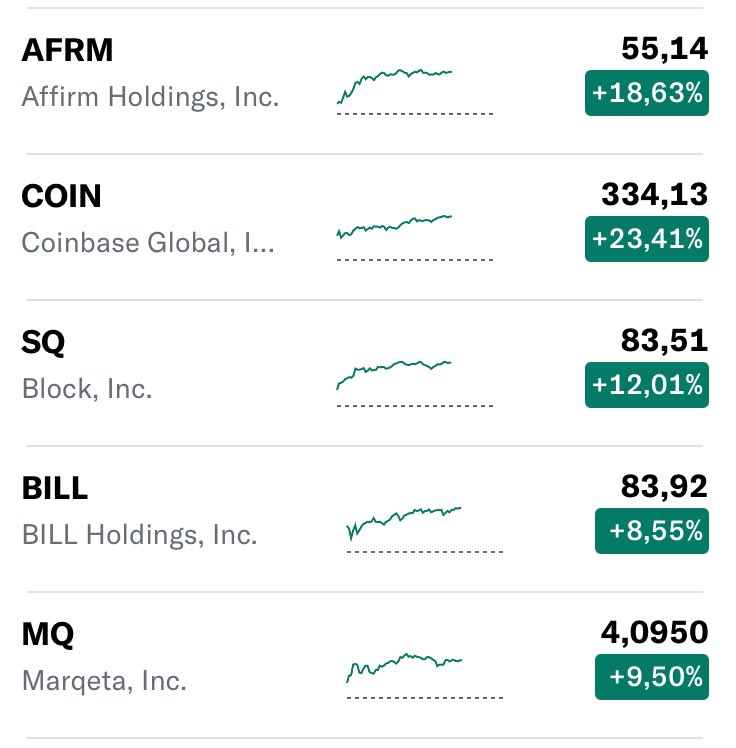

There will be ups and downs along the way, but today we celebrate that Fintech is alive and thriving💪🏻 $AFRM $COIN $SQ $BILL $MQ

And more to come

Woah! Nubank is now over 100m customers in Brazil. That's 57% of the population. GOAT Neobank status confirmed. Every major bank is now trying to figure out how to execute like this. The problem is there's such a massive amount of context required to understand what makes…

Network of RTP networks, this is the way.

Kristo Kaarmann, Wise $WISE.L CEO: "To move trillions, we intend to be directly connected to all the payment systems in the world without the middleman, of which we now have 6 live with a further 2 on the way."

It's been very difficult to build fintech companies over the past two years. Regulators pulled banks back, rates went up, and venture capital was scarce. All three of these factors are changing (for different reasons) but the result is, we're about to enter a fintech boom.

This. Point solutions gains are pretty much done. Next gains come from orchestration hence software footprint needs to be much larger before generating a sufficient business case to sell.

To win today in SaaS, you have to just build an insane amount of software. Much more, and much more quickly than before: - AI has led to an explosion of new competitors - Many buyers want to buy from platforms, not point solutions, raising the bar to what you have to build, and…

A super interesting slide from @BatteryVentures's latest report: 👉Start-ups are the most "overpriced" ever. Far more than 2021, in fact. Why more "overpriced" than 2021? Because while start-up valuations have stayed high, or even grown since 2021 for AI, YC and other hot…

It seems like a lot of the classic B2B GTM playbook isn't working that well But head over to any booming segment of Vertical SaaS The whole playbook works just fine there Outbound Community Events Dinners Drip Marketing Content Marketing They just often don't check email that…

United States Trends

- 1. Dalton Knecht 13 B posts

- 2. #DWTS 25,2 B posts

- 3. #LakeShow 3.255 posts

- 4. Spurs 15,6 B posts

- 5. Cavs 48,5 B posts

- 6. Celtics 55,4 B posts

- 7. #RHOBH 9.534 posts

- 8. Linda McMahon 35,4 B posts

- 9. Tatum 32,4 B posts

- 10. #WWENXT 26,8 B posts

- 11. Garland 66,9 B posts

- 12. Kam Jones 1.745 posts

- 13. Chris Paul 2.514 posts

- 14. Honduras 42,8 B posts

- 15. #Lakers 1.034 posts

- 16. Marquette 4.904 posts

- 17. Keldon Johnson 2.943 posts

- 18. Chase U 5.560 posts

- 19. Dorit 4.566 posts

- 20. Cenk 27,9 B posts

Who to follow

-

JP Nicols

JP Nicols

@JPNicols -

Finextra

Finextra

@Finextra -

Steve McLaughlin FT

Steve McLaughlin FT

@FTPartners -

Matteo Rizzi

Matteo Rizzi

@matteorizzi -

Simon Taylor

Simon Taylor

@sytaylor -

Finovate

Finovate

@Finovate -

Bank Automation News

Bank Automation News

@BankAutomation -

Chris Skinner

Chris Skinner

@Chris_Skinner -

Ron Shevlin

Ron Shevlin

@rshevlin -

Susanne Chishti

Susanne Chishti

@SusanneChishti -

David “Whisky Tango Foxtrot“ Birch

David “Whisky Tango Foxtrot“ Birch

@dgwbirch -

Anthemis

Anthemis

@anthemis -

Anna Irrera

Anna Irrera

@annairrera -

Chris Skinner

Chris Skinner

@FSClub -

Ghela Boskovich

Ghela Boskovich

@GhelaBoskovich

Something went wrong.

Something went wrong.