Synapse

@synapsefiThe Launchpad for Financial Innovation. The only BaaS platform enabling companies across the globe to launch feature-complete deposit & credit products in weeks

Similar User

@zachperret

@astrange

@FTPartners

@ModernTreasury

@FirstMarkCap

@sankaet

@Jillwillnyc

@dkimerling

@singareddynm

@mattcharris

@InstabaseInc

@gocashfree

@MoneyLion

@unit_co_

@usealloy

Launching an embedded finance product requires careful consideration of licensing, technology, operations, user interface, & more. Check out @synapsefi's latest guide to learn about the different elements required to launch a successful product: bit.ly/3P9ceWP

@Synapsefi has been recognized as one of the World's Best Fintech Companies in 2023 by @CNBC & @Statista Synapse is part of a comprehensive list of global companies that are building innovative, tech-enabled, and finance-related products & services. bit.ly/448wfRF

The fintech ecosystem has been evolving since the 2010s. From single bank integration to multi-banking, there hasn’t been a framework that mitigates risk for all parties (including banks) while increasing efficiency. Modular Banking is changing that. bit.ly/3KmkvnL

Fintech companies are expanding globally, offering various financial services to customers worldwide. This presents challenges with KYC regulation compliance. Learn how to navigate diverse identity systems along with global KYC successfully: bit.ly/3O030dE

As the Fintech industry evolves, the need for comprehensive and compliant embedded finance platform services has grown. With this growth has come challenges. See how @synapsefi is tackling these challenges with Modular Banking: youtu.be/hPR-FcguyI0

Have you taken the @synapsefi Fintech Stress Test yet? This 5-minute quiz will assess your risk for material business disruption. The fintech industry environment is changing and regulatory scrutiny has never been higher. See where you stand: bit.ly/46GsQfo

Check out @fintech_review's insightful interview with our CEO, @Sankaet He shares his personal journey leading to the founding of @Synapsefi, as well as insights into emerging trends in embedded finance. Read the full interview here: bit.ly/3CnQUG2 #Fintech #BaaS

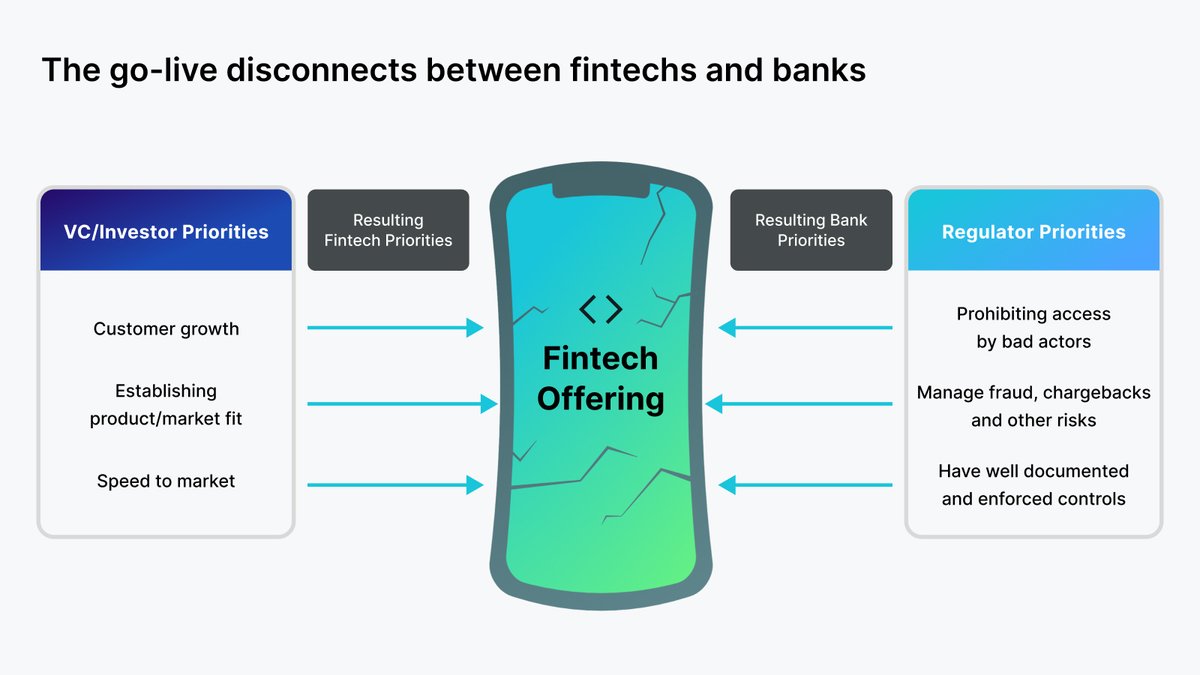

Banks are motivated by regulators to evaluate risk & compliance. Fintechs are motivated by VCs & investors to accelerate their path to build & launch compelling products. Their priorities conflict at a critical juncture - when the product is going-live. bit.ly/3oLIGo5

@synapsefi CEO, @Sankaet, joined a panel at @FintechNexus discussing the 4 essential layers of embedded finance: Licensing, Technology, Operations, & UI. Synapse is advancing the frontier of innovation across all 4 layers. bit.ly/3P0b5RH

“We’re obsessed w/ solving problems. Initially, the problem was ‘how can we give (underbanked) people in the US a bank account?’ Now, the problem is ‘how do we give people access to a USD account, regardless of where they live?’” - @sankaet (@synapsefi) bit.ly/43q1yYL

🕫 Exciting news! @synapsefi expands its Policy & Regulatory Advisory Board w/ top experts @alexbarrage1, Troy Paredes, Michael Mosier, & Sarah Elliott. They bring extensive expertise in financial regulation & governance to drive compliance excellence. bit.ly/3pXLVbZ

Calling all fintechs committed to business continuity! Take @Synapsefi’s Fintech Stress Test now to gauge your risk of disruption in a world of rising uncertainty and regulatory scrutiny. Don't wait, start de-risking your program today! bit.ly/3owCccf

In today's episode, @josh_benadiva sits down with @sankaet, Founder and CEO of Synapse to discuss the foundations of embedded finance and banking-as-a-service. Tune in at Soundcloud: bit.ly/3pTNW9j Spotify: bit.ly/3MgEcNU Apple Podcasts: bit.ly/41N8Iob

Explore the strategies fintechs are deploying to get ahead and stay ahead of identity theft, fraud, and money laundering schemes while still delivering great experiences for their users. Download @synapsefi's thought guide now: bit.ly/457EgYU

Attending @Fintechnexus this week? Schedule some time to chat with @synapsefi about the fastest, most compliant, and most cost-effective way to take feature rich financial products to market globally. bit.ly/44JlCGw #fintechnexus

.@bankingdive features @synapsefi in an interview with @sankaet They cover our partnership with AMG National Trust, the latest addition to our modular banking partnerships, as well as the Synapse FastTrack Program and some exciting updates on Global Cash! bit.ly/3M3DAfL

We are thrilled to announce our new partnership w/ AMG National Trust. This collaboration represents an extension of our modular banking strategy, enhancing @synapsefi's capacity to rapidly deliver innovative fin. services to fintechs & their customers. bit.ly/3oX3rfY

.@FinTech_Series featured @sankaet, co-founder and CEO of @synapsefi, in an article that proposes a new model for addressing the challenges of business disruption and financial risk facing fintechs and their sponsor banks, Modular Banking. bit.ly/3oOvZbE

Have you made plans for @Fintechnexus yet? Don’t miss New York’s largest fintech event! @synapsefi cofounder and CEO, @sankaet will take the stage to tackle the topic of Embedded Finance: Changing the Innovation Roadmap. Get your tickets now: bit.ly/445YzFA #fintechnexus

Are you an enterprise fintech looking to drive incremental revenue from your existing customer base? Use Synapse’s interactive Fintech Revenue Modeling Tool. Use the tool to explore how multiple fintech revenue opportunities could impact your top line. bit.ly/3mJxKWR

United States Trends

- 1. Good Tuesday 30,3 B posts

- 2. Nikki Giovanni 51,3 B posts

- 3. #tuesdayvibe 4.585 posts

- 4. 28 Years Later 19,9 B posts

- 5. Neely 285 B posts

- 6. Malibu 6.657 posts

- 7. #HumanRightsDay 65,4 B posts

- 8. Trino Mora N/A

- 9. #10Dic 2.836 posts

- 10. #FranklinFire 3.754 posts

- 11. Mason Graham 1.295 posts

- 12. #TacoTuesday N/A

- 13. Jackie Aina N/A

- 14. Nobel 52,2 B posts

- 15. Pepperdine 2.121 posts

- 16. Derechos Humanos 42,8 B posts

- 17. Flour 27,5 B posts

- 18. Cillian Murphy 11 B posts

- 19. She's 12 12,9 B posts

- 20. Cleaning 30,5 B posts

Who to follow

-

Zachary Perret

Zachary Perret

@zachperret -

angela strange

angela strange

@astrange -

Steve McLaughlin FT

Steve McLaughlin FT

@FTPartners -

Modern Treasury

Modern Treasury

@ModernTreasury -

FirstMark

FirstMark

@FirstMarkCap -

Sankaet

Sankaet

@sankaet -

Jillian Williams

Jillian Williams

@Jillwillnyc -

Dan Kimerling

Dan Kimerling

@dkimerling -

Nikita S

Nikita S

@singareddynm -

Matt Harris

Matt Harris

@mattcharris -

Instabase

Instabase

@InstabaseInc -

Cashfree Payments

Cashfree Payments

@gocashfree -

MoneyLion

MoneyLion

@MoneyLion -

Unit

Unit

@unit_co_ -

Alloy

Alloy

@usealloy

Something went wrong.

Something went wrong.