Santhosh

@santhosh8117Auditor Tax Practitioner RTs are not Endorsements

Similar User

@RasoolCkm

@ajaybe154

@DineshMuluru

The CBDT has launched a Compliance-Cum-Awareness Campaign for Assessment Year (AY) 2024-25 to assist taxpayers in accurately completing Schedule Foreign Assets and reporting income from foreign sources in their ITRs. ➡️ As part of this campaign, informational messages will be…

There are so many QRMP taxpayers who file IFF monthly and reconcile GSTR 2B on monthly basis to calculate accurate tax payable amount Now GSTR 2B will not be available for M1 and M2 so they have to reconcile with GSTR 2A but GSTR 2A for M1 shows invoices pertaining to M1 only…

76% Of Tax Collected From Those Earning Over Rs 50 Lakh Tax burden on individuals earning less than Rs 20 lakh a year, broadly described as middle class, has come down during the 10 years of Prime Minister Narendra Modi-led govt, while there has been a substantial increase in…

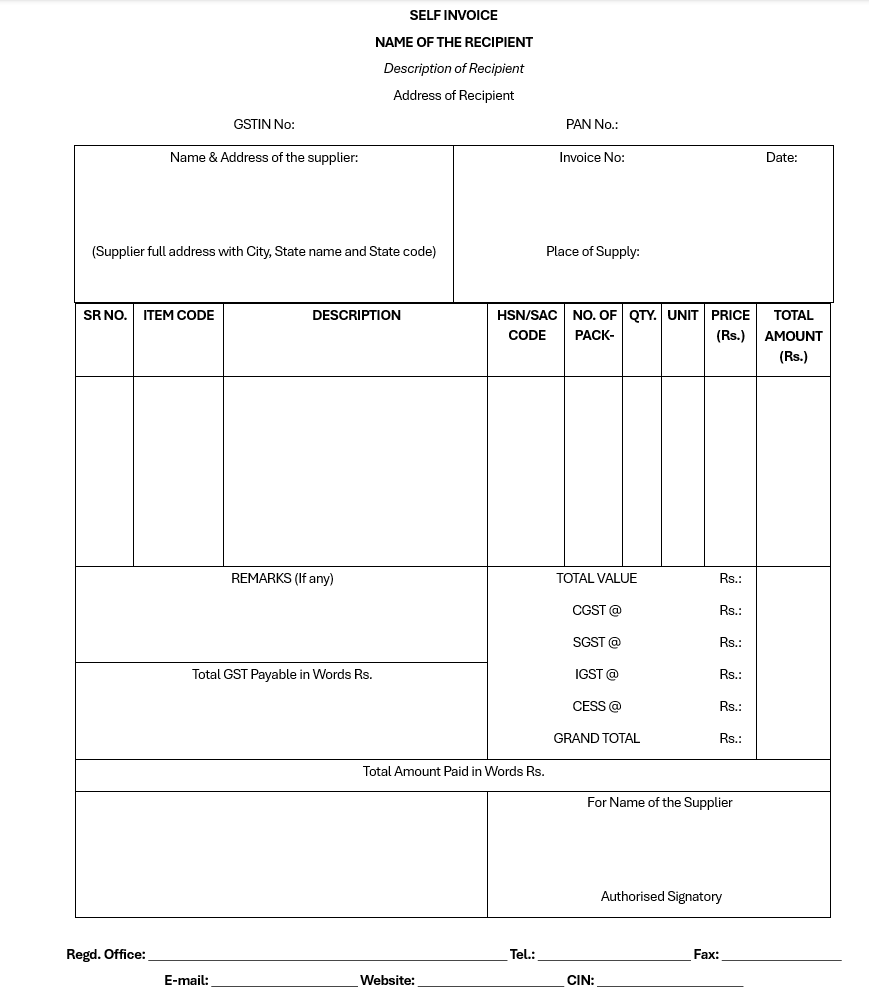

Format of GST - Self Invoice required to be issued under RCM!

This madness should stop @IncomeTaxIndia TDS under 194H/194C/194IA/ 194IB / 194M/ 194S in many cases , It may fall in "Business" head , and Net profit is offered to tax In many case , It is forming part of "Other source" Head It depends taxpayer to taxpayer There is no…

Argued before Hon'ble Supreme Court that 'Sale at Subsidised Price' is Different from 'Sale at Discounted Price', and accordingly ITC cannot be disallowed in case of goods sold at discounted price than that of purchase price. SLP Admitted. Rohan Motors Vs. ACCT #SC #VAT #ITC

The government should implement demonetisation once every five years to act as a speed bump for the black economy. RT if agree

It is morning in America again

Centre to curb unauthorised use of PAN details by tech companies As the Union government prepares to notify the Digital Private Data Protection Act, 2023 (DPDP), law enforcement authorities are cracking down on almost every unauthorised use of personally identifiable information…

Huge setback to ED !! SC rules that sanction under Section 197(1) of CrPC is mandatory for the trial courts to take cognisance of the prosecution complaint (chargesheet) filed by ED under PMLA. This judgment by Justice Oka and Justice Masih has far reaching consequences, all…

India’s GST collections touched ₹1.87 lakh crores in October —up 8.9% YoY — fueled by robust domestic demand and import growth, says @FinMinIndia @sheersh0510 @TimsyJaipuria | #GST #GSTCollections @cbic_india cnbctv18.com/economy/gst-co…

Rule 47A of the CGST Rules – Effective from 1st November 2024 🔹Explanation of Relevant Sections of the CGST Act, 2017 🔹List of services under the Reverse Charge Mechanism (RCM) in GST as of October 2024 🔹Sample Format for Self-Invoice under RCM Presentation by…

The Aadhaar card is not a valid document for determining age: Supreme Court of India. We have multiple KYC in India. Can Finmin @FinMinIndia should keep only one document as a Master document for all purposes? May be Aadhaar?

I've been saying for a long time that poor people are increasing and middle class is shrinking. Only premium segment, wealthy people are doing well. Same opinion is shared by Nestle India whose sales volumes are dipping.

🚨 We urge @IncomeTaxIndia to urgently address ongoing issues with the income tax portal. As deadlines for filing ITR and TDS Returns are fast approaching, these persistent glitches are creating tension and consuming valuable time and resources for professionals.

🚨 Urgent issue: Taxpayers are struggling to file UPDATED ITRs involving ADVANCE TAX payments due to the error: "Schedule IT 2 can't be filed as it is not prior." This ongoing problem has caused genuine hardships and unnecessary interest levies for many, stemming from delays

#NewsFlash | GST GoM On Life & Health Insurance Likely To Propose A Complete Exemption From 18% GST, sources to @TimsyJaipuria

United States Trends

- 1. Jake Paul 995 B posts

- 2. #Arcane 230 B posts

- 3. Jayce 6.524 posts

- 4. Good Saturday 26,4 B posts

- 5. #SaturdayVibes 3.140 posts

- 6. Serrano 248 B posts

- 7. #saturdaymorning 2.114 posts

- 8. #PlutoSeriesEP5 133 B posts

- 9. Vander 16,9 B posts

- 10. AioonMay Limerence 108 B posts

- 11. Pence 82,1 B posts

- 12. #SaturdayMotivation 2.074 posts

- 13. maddie 21,3 B posts

- 14. WOOP WOOP 1.409 posts

- 15. John Oliver 14,5 B posts

- 16. Caturday 7.500 posts

- 17. Jinx 111 B posts

- 18. Fetterman 37 B posts

- 19. Father Time 10,8 B posts

- 20. He's 58 31,1 B posts

Something went wrong.

Something went wrong.