Bruce Fraser

@rdwyckoffPassion for all things Technical Analysis. 40 years of trading using Wyckoff Method. Taught graduate Wyckoff Courses. Co-host Wyckoff Market Discussion webinar.

Similar User

@WyckoffAnalysis

@martin_pring

@markminervini

@LindaRaschke

@chasharris1025

@DrGaryDayton

@StockChartsTV

@DKellerCMT

@mboxwavewyckoff

@epsm_alert

@WalterDeemer

@MarkRitchie_II

@StocktonKatie

@gilmoreport

@TheChartReport

stockcharts.com/articles/wycko… The latest #Wyckoff Power Charting blog is posted. Title: Secular Shenanigans The long term secular trend of the $NDX continues its epic rise. Using Wyckoff trend analysis it is OverBought in that uptrend. Also, a look at the CBOE Equity P/C Ratio.

Bruce @rdwyckoff featured a Long Term Put Call Ratio Chart and Greedometer. We have posted today's interview with Bruce Fraser: bit.ly/4dRF3Ak #Trading #Analysis @ForexStopHunter

A great session with Coach. Always a blast. Thanks for having me on.

Join us on FACE in 10 minutes for live market analysis, today's guest: Bruce @rdwyckoff Link: bit.ly/2WhbchO Analysis by @ForexStopHunter @PipCzar @GregaHorvatFX @Vulgi @forexflowlive @kvanderschrick #TRADING #FOREX

Join us for Today's event. Sign up Now. Registration is almost full.

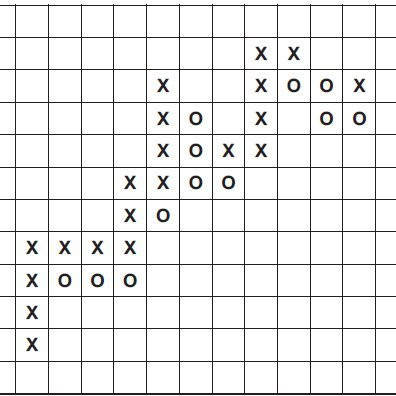

S&P 500 descending toward intraday PnF objectives. Here is an updated vertical chart. Read the recent Wyckoff Power Charting blog and view #PnF here: stockcharts.com/articles/wycko…

tsaasf.org The TSAA-SF annual conference. Saturday Sept 14th 2024 at Golden Gate University It is an all day hybrid event Attend in person or via zoom Speakers: * John Bollinger, CFA, CMT - Creator of Bollinger Bands, Author, Investor * Linda Raschke - Author of…

Thank you for reading the blog.

stockcharts.com/articles/wycko… The latest #Wyckoff Power Charting blog is posted. Title: S&P 500 Tempest in a Teapot Charts are often fractal. The intraday $SPX has a compelling Distribution structure. Using Wyckoff Method - Vertical & #PnF charts are analyzed. Check it Out!

Under 'Type' Use the 'High/Low' Option on StockCharts.com

@rdwyckoff I don’t remember you ever mentioning this so I will ask: Do you use high-low or close to calculate pnf charts?

The latest #Wyckoff Power Charting blog has been posted. Title: Who Let the DOG Out? Invert the scale of the #DJIA with $DOG. What does it reveal about the possible future direction of the index? stockcharts.com/articles/wycko…

stockcharts.com/articles/wycko… The latest #Wyckoff Power Charting blog has been posted. Title: S&P 500 Equal Weight ETF Gains Strength S&P 500 Equal Weight ETF $RSP builds #PnF count objectives & is Jumping. Relative Strength is also Surging. Read it Here:

Last Day of the Quarter! Hmmm....

stockcharts.com/articles/wycko… The latest #Wyckoff Power Charting blog has been posted. Title: End of Quarter NASDAQ 100 Pile-On NASDAQ 100 Index Advance-Decline Line has changed its character in the second quarter. Meanwhile #PnF count objectives are being fulfilled as the 2nd…

stockcharts.com/articles/wycko… The latest #Wyckoff Power Charting blog has been posted. Title: End of Quarter NASDAQ 100 Pile-On NASDAQ 100 Index Advance-Decline Line has changed its character in the second quarter. Meanwhile #PnF count objectives are being fulfilled as the 2nd…

Bruce just dropped an article on how theres a STRONG argument to be made for $SPX Distribution currently, but you won't read it because it doesn't fit your bias

stockcharts.com/articles/wycko… The latest #Wyckoff Power Charting blog has been posted. Title: Wyckoff at Work in the Intraday Timeframe How the intraday timeframe helps Wyckoffians to sharpen their market analysis skills. Read it Now:

Terrific Additions! Love the work. Thanks for posting.

$SPX (10x1)30min - Different structure, similar targets. Threw in the #channel #reversal as well. ( I had to "borrow" your chart as I don't have intraday access). Thks for the article and all the work you do! 🙂 #pointandfigure

stockcharts.com/articles/wycko… The latest #Wyckoff Power Charting blog has been posted. Title: Wyckoff at Work in the Intraday Timeframe How the intraday timeframe helps Wyckoffians to sharpen their market analysis skills. Read it Now:

Join our #Wyckoff Market Discussion every Wednesday for in-depth market analysis, our stock selection process, and more golden nuggets like this one. Subscribe now while it is on a reduced rate (for a limited time): wyckoffanalytics.com/wyckoff-market…

As of today the $SPX is back below the Supply Trendline of the upward striding channel. Read more about it here: stockcharts.com/articles/wycko… (click on the $SPX vertical chart to bring it current)

United States Trends

- 1. Bo Nix 9.380 posts

- 2. Falcons 15,8 B posts

- 3. Chiefs 67,5 B posts

- 4. Ravens 83,1 B posts

- 5. Steelers 117 B posts

- 6. Paige 17,3 B posts

- 7. Bears 116 B posts

- 8. Packers 75,5 B posts

- 9. Broncos 23,4 B posts

- 10. Bills 105 B posts

- 11. WWIII 60,7 B posts

- 12. Jets 58,4 B posts

- 13. Lamar 32,9 B posts

- 14. Josh Allen 8.001 posts

- 15. Mahomes 20,5 B posts

- 16. Jennings 8.944 posts

- 17. Randle 12,3 B posts

- 18. Geno 22 B posts

- 19. 49ers 23,5 B posts

- 20. Worthy 48,9 B posts

Who to follow

-

Wyckoff Analytics

Wyckoff Analytics

@WyckoffAnalysis -

Martin Pring

Martin Pring

@martin_pring -

Mark Minervini

Mark Minervini

@markminervini -

Linda Raschke

Linda Raschke

@LindaRaschke -

Charles Harris

Charles Harris

@chasharris1025 -

Trade Mindfully

Trade Mindfully

@DrGaryDayton -

StockCharts TV

StockCharts TV

@StockChartsTV -

David Keller, CMT

David Keller, CMT

@DKellerCMT -

MBoxWave Wyckoff

MBoxWave Wyckoff

@mboxwavewyckoff -

EPSMomentumAlert

EPSMomentumAlert

@epsm_alert -

Walter Deemer

Walter Deemer

@WalterDeemer -

Mark Ritchie II

Mark Ritchie II

@MarkRitchie_II -

Katie Stockton, CMT

Katie Stockton, CMT

@StocktonKatie -

Gil Morales - TheOWLTrader.com & VoSI

Gil Morales - TheOWLTrader.com & VoSI

@gilmoreport -

The Chart Report

The Chart Report

@TheChartReport

Something went wrong.

Something went wrong.