Similar User

@DarrylJohnston1

@JRSTrading

@movinghousedjs

@blbglaw

@JJM_Ealing

@TechCompanyy

@sleo03

@JamesDRossiter

@mag_intel

@gbartletr

Thats not a real description more an add he could have wrote? After 9 years at Soros his first macro HF in 2000 which was financed by Soros faltered due to lack of performance and was closed in 2005. He returned to Soros and became CIO from 2011-15 where he was replaced due to…

This is the greatest investor ever. Stanley Druckenmiller has never had a down year. His fund returned 30% annually for 30 years. Here is his updated philosophy:

Who is the MOST OVERRATED band of ALL TIME???

Here are 8 companies down more than 35% so far in 2024: 1) $EL Estée Lauder Market cap: $35 billion Drawdown YTD: 38% Drawdown from Peak: 73%

Peter Lynch achieved 29.5% annual return for 13 years. I was obsessed with his stragey and I spent 100+ hours reading all his books to solve it. Here, I will explain to you his framework in 10 simple steps: 🧵

Larry Ellison is the most ruthless CEO in the tech world: • Hired investigators to spy on Microsoft • Hostile takeover of multiple companies • Donated $500 Million to delay death How an abandoned boy took Oracle to $445 Billion 🧵

Mike Burry's strategy in a single page

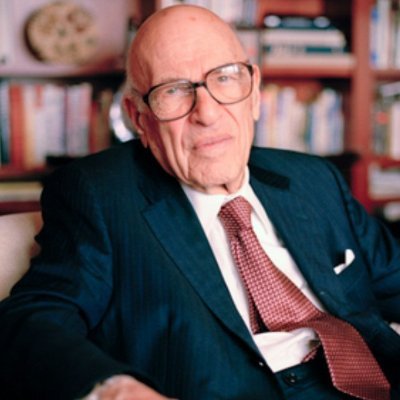

This is Walter Schloss. Schloss achieved a 21.3% CAGR in the stock market from 1956 to 1984. His bargain-hunting strategy is a must-read for investors. Let's dive in 🧵👇

And we are on sale with our 2024/25 Limited Edition Third Shirt! 🩶 #RichHistoryBrightFuture #RedsRiseAgain

If there’s one expensive lesson I’ve learned from investing, it’s this: NEVER FALL IN LOVE WITH THE STORY OF A STOCK I’ve lost money doing this and I’ve seen many private investors lose all their money doing this. It can be heartbreaking. I know as I post this, there will be…

Soros bet on railroads, fitness, gig economy and lightened load on Disney, Amazon, dumped Tesla trib.al/0D73Gtv

I've used Microsoft Excel for 15 years working in Finance and these 10 tips will make you an expert (and increase your productivity 100X) 📊Don't ever use Excel again without knowing these 10 functions:

The UK property market is one of the most rigged markets across the west. The rigging that’s occurring in the property market is nuts. We’re in a crazy position where temporary rent caps would actually make the housing market more of a free market. That’s how nuts it’s become.

1/49 Many have asked questions about my time at FTX US and why I left when I did. As I indicated earlier this week, I’m happy to begin sharing my experiences and perspective publicly.

Druckenmiller: "I never use valuation to time the market. I use liquidity considerations and technical analysis for timing. Valuation only tells me how far the market can go once a catalyst enters the picture to change the market direction."

Executive of U.K.-based hedge fund BlueBay Asset Management predicts the BOJ may abandon its yield-curve control strategy by the end of the year, saying that if that happens, "selling JGBs is an attractive trade." #BOJ #markets #Japan s.nikkei.com/3xT5ALI

United States Trends

- 1. #SyriaUnderAttack N/A

- 2. $CUTO 5.533 posts

- 3. #IDontWantToOverreactBUT N/A

- 4. #GoldenGlobes 101 B posts

- 5. #mondaymotivation 25,3 B posts

- 6. $RWA 9.450 posts

- 7. Mets 157 B posts

- 8. Yankees 87,3 B posts

- 9. Time Magazine 2.640 posts

- 10. Good Monday 53,3 B posts

- 11. COBOL N/A

- 12. Soto 242 B posts

- 13. #ProtectMinorities 1.930 posts

- 14. Jay Z 310 B posts

- 15. Person of the Year 8.681 posts

- 16. Victory Monday 2.403 posts

- 17. Loser of the Year N/A

- 18. Lara Trump 13,5 B posts

- 19. Happy Birthday Ryan 3.119 posts

- 20. Denis 13,1 B posts

Who to follow

Something went wrong.

Something went wrong.