Ravindra Adireddy

@radireddyEngineer by education | Individual investor by passion | Follow for stock analysis & concall highlights | not SEBI registered | no recommendation to buy sell

Similar User

@anudeepr

@srinathpatil

@Cast_away111

@ishaansingh31

@thrilokhs

@Ashish_Jaywant

@Karthik_Raj

@mohan_pusarla

@4Mujju

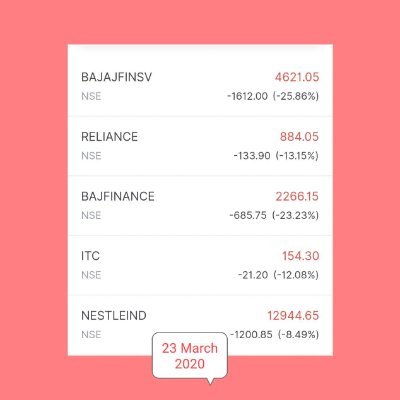

MMI index is close to "Extreme Fear". Best way to invest in this time is bottom up approach. Analyse the business, understand the business model, read concals, compare with peers in the same industry, follow and track all the companies in the segment, be mindful of valuations.…

Co-Working space (Q2FY25) Awfis: Sales up 40% YoY, PAT 15 cr vs -4 EFC: Sales up 72% YoY, PAT up 391% YoY Kontor: Sales up 77% YoY, PAT up 51% YoY (H1 vs H1) Co-Working space is witnessing tailwinds and all the player are growing at faster space between 40% to 100%. EFC leads…

PGEL vs Amber vs EPAC

Consumer durable contract manufactures space The Indian consumer durables market, particularly the AC and washing machine segments, has experienced robust growth in recent years. Industry is witnessing consistent demand for AC even in off season. Companies reported sales growth…

Consumer durable contract manufactures space The Indian consumer durables market, particularly the AC and washing machine segments, has experienced robust growth in recent years. Industry is witnessing consistent demand for AC even in off season. Companies reported sales growth…

SG Mart valuations - Guided for 7K to 8K revenue - Guided for 2%+ EBITDA margins Conservatively considering 7K revenue and 2% margins, FY25 PAT will be 140 crores. A growth of 130% from Fy24. FY25 PE = 4334/140 = 31 PEG = 71/130 = 0.55 EBITDA margins and PAT margins are same…

SG Mart Q2FY25 concall highlights Reported excellent revenue growth and decent profit growth despite of sudden drop in steel prices. Profit margins are impacted due to steel price drop and 18 crores inventory loss booked. Expansion is on track, 3 service center are operational…

SG Mart Q2FY25 concall highlights Reported excellent revenue growth and decent profit growth despite of sudden drop in steel prices. Profit margins are impacted due to steel price drop and 18 crores inventory loss booked. Expansion is on track, 3 service center are operational…

SG Mart Q2FY25 results Excellent results, solid revenue growth but did not get OL due to volatility in steel prices. On track to achieve 7000 to 8000 crores sales in FY25 (3000 in H1). EBITDA margin for H1 is 1.3%, management guided 2.5% for FY25 (might be at risk). - Revenue…

SkyGold Media Release Highlights - Onboarded two new clients, CaratLane and P N Gadgil Jewellers - PAT margin reached 4.8% in Q2. It was 1.8% in Q2FY24 - Registering 3rd straight quarter of more than 2x PAT growth - Raised 270 crores via QIP. Motilal Oswal Small Cap Fund,…

PN Gadgil Jewellers Q2FY25 results and concall analysis Reported excellent growth, like other gold retailers Q2 profit was impacted (18.5 crores) due to duty cut. The only gold jewellery player to report Operating Leverage in Q2 (due to debt reduction). Good store addition and…

Skygold valuations Market cap: 4,583 Current PE: 90 Reported 58 crores PAT in H1FY25. H2 is stronger for gold retailers. Being a gold B2B business, SkyGold H2 should be better than H1. Conservatively assuming similar PAT is reported in H2, FY25 PAT will be ~120 crores. FY25…

SkyGold Q2FY25 results

SkyGold Q2FY25 results - Sales up 98.8% YoY to 789 crores 🔥 - PAT up 405% YoY to 36.7 crores 🔥🔥🔥🔥 - EPS up 406.8% 🔥🔥🔥🔥 #skygold #Q2FY25

Sky Gold Q1FY25 Concall summary Q1 results x.com/radireddy/stat… - Jewelry industry is growing at 15% to 16% - Organised Jewelry industry grew at 18% to 19% CAGR from FY18 to FY24 - Reduction in import duty from 15% to 6% is very positive for the sector. It further…

Bristol-Myers Squibb says sales of Cobenfy (KarXT) will pick up in H2 2025. #neuland #KarXT #cobenfy

Jeena Sikho valuations FY25 PAT guidance: 105 cr (50% increase) Current MP: 4,648 FY25 PE: 4,648/105 = 44 PEG: current PE/growth rate = 55/50 = 1.1 #jeenasikho #JSLL #Q2FY25 #jeenasikholifecare #valuations

Jeena Sikho Q2FY25 results Excellent results. On track to achieve guided revenue and PAT. #Q2FY25 - Revenue up 36.2% YoY to 214 crores (guided for 450 in FY25) - EBITDA up 42% YoY - PAT up 47.3% YoY to 47 crores (Guided for 105 in FY25) - EPS (Diluted) up 47.3% YoY - 34 crores…

United States Trends

- 1. $CATEX N/A

- 2. $CUTO 7.510 posts

- 3. #collegegameday 2.631 posts

- 4. $XDC 1.435 posts

- 5. #Caturday 7.932 posts

- 6. DeFi 106 B posts

- 7. Henry Silver N/A

- 8. Jayce 84,5 B posts

- 9. #saturdaymorning 3.163 posts

- 10. #Arcane 24,9 B posts

- 11. Good Saturday 37 B posts

- 12. Renji 4.009 posts

- 13. #MSIxSTALKER2 6.158 posts

- 14. Senior Day 2.977 posts

- 15. Pence 86,1 B posts

- 16. Fritz 9.149 posts

- 17. Cavuto N/A

- 18. Clyburn 1.153 posts

- 19. Zverev 7.266 posts

- 20. McCormick-Casey 28,8 B posts

Something went wrong.

Something went wrong.