Pietro

@pietrogzHybrid Trader. I tweet real time high probability signals

Similar User

@buildalpha

@TraderDunn

@hudson_thames

@HelixTrader

@QuantpT

@QuantifiablEdgs

@Modtrade

@Hunter_GL2

@Schecter_Six

@GustavMejlvang

@TradersLaunch

@ParallaxFR

@Xtremtfokus

@InterestRateArb

@systematictrade

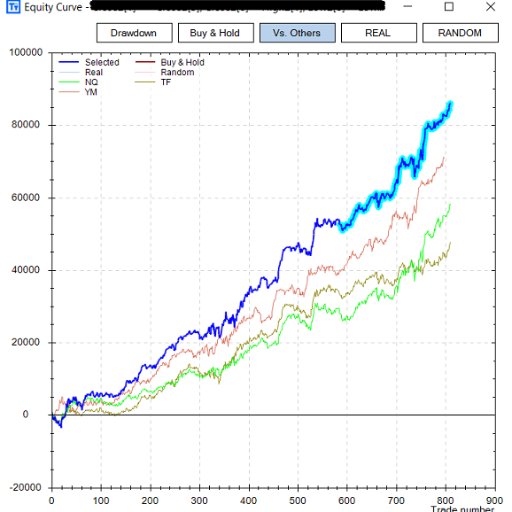

This are the algo signals that I’ve sent to my ko-fi peeps. Many of them for free in chat and some here on twitter. So far so good. Please note that they are like 2 o 3 per week. That’s how I trade, like a sniper.

My weekly algo has been live trading #SPY for about about 4 years now and it’s equity curve is at ATH #SPX

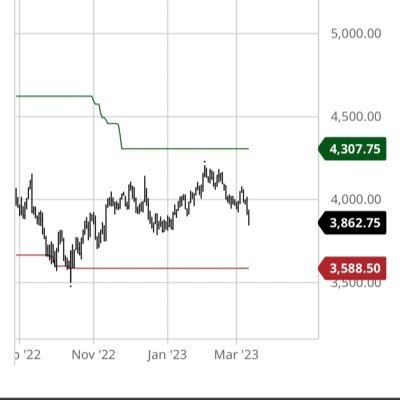

Finally my Tradestation account was unrestricted and I bought more shares of $SPY. History shows that we could go sideways for about 6 months from here but that’s ok for me. The FED will pivot

I’ve been trying to buy more shares with @TradeStation since a week ago but it tells me that my account is restricted. After asking me lots of nonsense they tell me it’s because my W8 form expired even though its expiration date is in 2024. This has cost me a lot of money.💸

Dave Portnoy's "Investing" Journey "Anybody can do this game" -- Dave 3/27/2020 🔊sound🤣

Almost every participant in the BofA Global Fund Manager Survey expects #inflation to fall. Why is this important? Because should inflation again beat expectations, this will be accompanied by another violent sell-off in risk assets.

These two algos bought the dip at the open. They have been doing well during this downturn but it’s not a prime royal setup for me. Protect your gains. #SPX #ES_F

The S&P 500 is down 17.7% in the first 95 trading days of 2022, the 2nd worst start to a year in history. $SPX

I’m still trading like a sniper and making money this year for me and my kofi signals. I’m only down in my long term holding that is Boeing to which I plan to add during next week.

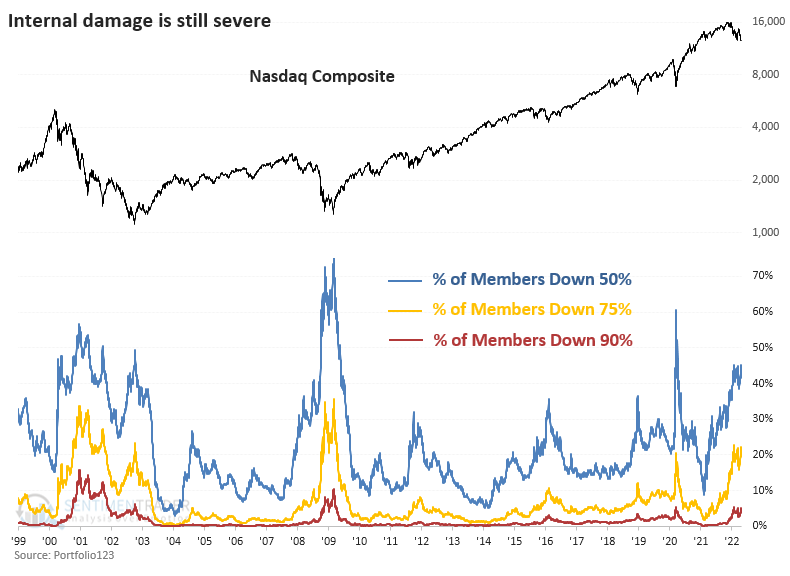

Internal Nasdaq damage: 😒More than 45% of stocks down 50% 😢More than 22% of stocks down 75% 🤬More than 5% of stocks down 90%. The only comparisons are Oct 2000 - Oct '02 and Nov 2008 - Apr '09.

Treasury yield curve spreads now: Ten Year minus Two Year: 3 basis points Thirty Year minus Five Year: 0 basis points Right on cue, the “It Doesn’t Matter This Time” white papers are coming out. Don’t believe them.

"Appropriate use of models requires a good dose of common sense and an awareness of the limitations of whatever model you happen to be using. In this way, they are like any tool." - The physics of Wall Street.

When the S&P500 #SPX is up more than 4% in 2 days is generally bullish. Bad idea during 2008 but still worth noting imo: Results are last 11 years vs last 61 years.

United States Trends

- 1. Joe Douglas 9.111 posts

- 2. #OnlyKash 23,2 B posts

- 3. Jaguar 40,9 B posts

- 4. Maxey 12,2 B posts

- 5. Embiid 20,5 B posts

- 6. Rodgers 12 B posts

- 7. Jets 41 B posts

- 8. Woody 14,5 B posts

- 9. Nancy Mace 53,9 B posts

- 10. #HMGxCODsweeps N/A

- 11. $CUTO 8.387 posts

- 12. Ukraine 1,01 Mn posts

- 13. How to Train Your Dragon 35,4 B posts

- 14. Toothless 13,7 B posts

- 15. Zach Wilson 1.554 posts

- 16. Cenk 10,4 B posts

- 17. Merchan 27,2 B posts

- 18. Sarah McBride 49,4 B posts

- 19. Rove 5.021 posts

- 20. WWIII 169 B posts

Who to follow

-

Build Alpha

Build Alpha

@buildalpha -

Eric | Algo Trader

Eric | Algo Trader

@TraderDunn -

Hudson & Thames

Hudson & Thames

@hudson_thames -

Helix Trader

Helix Trader

@HelixTrader -

QuantpTrader

QuantpTrader

@QuantpT -

Quantifiable Edges

Quantifiable Edges

@QuantifiablEdgs -

MoneyBall

MoneyBall

@Modtrade -

Hunter Gallagher

Hunter Gallagher

@Hunter_GL2 -

Max Thomas

Max Thomas

@Schecter_Six -

Gustav Mejlvang, CFA

Gustav Mejlvang, CFA

@GustavMejlvang -

Traders Launch

Traders Launch

@TradersLaunch -

Parallax Financial Research

Parallax Financial Research

@ParallaxFR -

MrX

MrX

@Xtremtfokus -

Brrr Infinity Capital

Brrr Infinity Capital

@InterestRateArb -

System Trader

System Trader

@systematictrade

Something went wrong.

Something went wrong.