Cyrone𓃵🇳🇬

@omobaGurejeASK any wise man what he most desires and he will more than likely say more wisdom.

Similar User

@AdedePaulAdedeh

@kyngtega

@Debells_MUFC

@Microbaris20

@SalymBabajo

@ekemma

@Folu222

@luther_exe

@Slyadeniyi

@DanayFourgiotis

@AsenathiMhluma

@iam_mubys

@PrinceChuks0

@MichaelIkeOlisa

@mrcurryman57

Be more concerned wit ur character than ur reputation,bcos ur character is wat u really r,while ur reputatn is merely wat others think u r"

I STAND BY TRUTH!

Zagazola - Nigerian Air Force Strikes Terrorist Camps in Zamfara, nutrialised scores of insurgents @DefenceInfoNG @HQNigerianArmy @NigAirForce zagazola.org/index.php/brea…

President Bola Tinubu directs Justice Ministry to work with NASS on concerns over tax bills President Bola Tinubu will always act in the interest of the Nigerian people

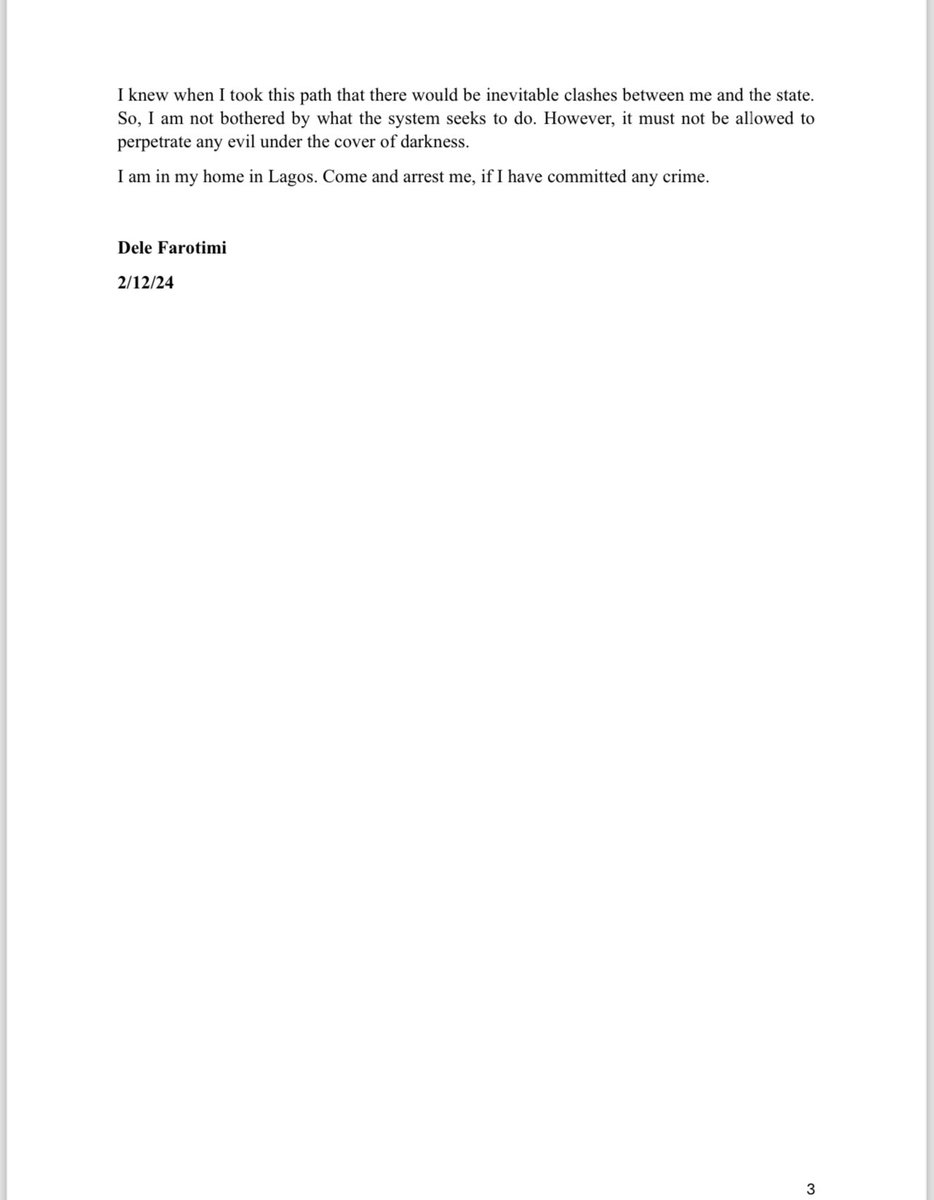

This is the most reckless and irresponsible statement I've read from a government agency in a long while. The assertions here are also patently irresponsible. I have obtained court proceedings and an affidavit sworn to by an @officialEFCC investigator who named the names of…

SPOT THE DIFFERENCE “Increase in VAT rate will lead to inflation” – Taiwo Oyedele (2019) What was proposed then: 1. General VAT increase on almost all items 2. VAT applies on many basic consumptions 3. Businesses can NOT claim tax credit for VAT paid on most of their costs…

VAT rate increase will lead to higher inflation, interest rate hike, more unemployment and generally make people poorer.

"The PIA was passed. We wanted 10% which was what Yar’adua proposed. They (federal lawmakers) reduced it to 3%. Heaven did not fall. This tax reform bills will pass and heavens will not fall. “The Senate has passed the bills for second reading. Public hearing will take place and…

THE PEOPLE’S TAX BILLS The tax reform bills before the National Assembly are aimed at economic transformation to empower Nigerians and facilitate inclusive economic growth. The bills are: the - 1) Nigeria Tax Bill - harmonises all the major taxes such as corporate income tax,…

Thank you Professor Pantami,you’re very correct about the mistrust among citizens & it’s the major cause for suspicion however,I don’t agree legislative action should be suspended on the bills. A public hearing is part of the legislative process & it must be utilized in this case

TAX REFORM BILLS! I have been preoccupied for the past week, having attended the World Halal Summit 2024 as a speaker at the invitation of the Presidency of the Republic of Turkiye. Consequently, I couldn't find time to read and review all the 4 bills, including the Nigeria Tax…

This tax reform isn’t about taking from the poor; it’s about shifting the burden to those who’ve dodged it for years. Let’s break it down: Reality Check for Low-Income Earners: If you’re earning less than ₦1.7m a month, your income tax is either reduced or completely removed.

If your income is up to 100k a month, just know that Tinubu plans to take atleast 15% of it as income tax. Oya tell me how this proposed tax bill will benefit you as a poor man earning 100k since they said the bill will favour the poor.

Nigeria has successfully returned to the Eurobond market and did it in grand style. While around $1.5 billion was offered, Nigeria recorded a total subscription of $8.8 billion. Only $2.2 billion was later allotted. The allotments are - $700 million for the 6.5-year bond…

No part of tax reform bills recommends scrapping TETFUND, NASENI, and NITDA..no provision will impoverish the north

Happening Now in London: Nigeria has made a triumphant return to the Eurobond market with a $2.2 billion offering. The international response has been overwhelmingly positive, signaling a strong vote of confidence in President Bola Ahmed Tinubu’s economic reforms, led by Minister…

"In Kenya, you don't pay Personal Income Taxes until your revenues reach N282,000 monthly equivalent. In South Africa, you don't pay Personal Income Taxes until your revenues reach N660,000 monthly. In Nigeria, you pay Personal Income Taxes once your Income reaches N30,000…

My initial breakdown, I still have a few questions. Before Tax Reform 1. Nigeria is among the highest taxing jurisdictions in the world. 2. If you earn N30,000 a month, you pay Personal Income Tax 3. Nigerian Companies are forced to pay tax on losses. 4. If Remote Workers…

As a reformer, the greatest asset that my brother @taiwoyedele has is not intelligence or experience, it is his demeanor. He smiles through every ridiculous proposition without getting angry. If…if…if… “If you can keep your head when all about you Are losing theirs and…

Oya o na just a little above 300 pages. Don’t be lazy to read. After this, if you haven’t read it and you come here to talk rubbish, walai na thunder go fire your yansh 😂😂

In case you need to read up on the Tax Reform Bill, see the links below: 1. fiscalreforms.ng/wp-content/upl… 2. fiscalreforms.ng/wp-content/upl…

This is one of our biggest Lessons from COVID, the FOOD SECURITY question. We are now putting the lesson in good use. Lagos wants to have the power to feed itself, before another pandemic happens again and beyond that too. WHAT DID YOUR OWN STATE LEARN FROM COVID ???

LAGOS FOOD SUFFICIENCY Governor of Lagos State, Mr @jidesanwoolu yesterday paid a Working Visit to the Ongoing Lagos Central Food Security Systems and Logistics Hub at Ketu-Ereyun, Epe, Lagos. This hub will be the largest of its kind in Sub-Sahara Africa, which is aimed at…

Changed Identity From FIRS to NRS Signifies Broader Mission At the Stakeholder Session with Tax Consultants and Chief Financial Officers (CFOs), Mr Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee,

Mr Aliyu Nda Salami The Former Regional Head United Bank of Africa, Former Chairman Kogi State Internal Revenue Service and presently the Chief Economic Adviser to the Kogi State Governor also added his voice on the tax reform bill.

ONGOING: The Kogi State Commisioner of Finance, Budget and Economic Planning is addressing the public during a one day interactive session on the new proposed National tax bill. @mrlurvy @lollylarry1

United States Trends

- 1. Bama 33,2 B posts

- 2. Miami 106 B posts

- 3. Clemson 16,7 B posts

- 4. #WWENXT 17 B posts

- 5. Sabres 2.859 posts

- 6. South Carolina 25,7 B posts

- 7. XDefiant 10,8 B posts

- 8. #GoAvsGo 1.634 posts

- 9. minghao 24,4 B posts

- 10. Josh Dix 1.416 posts

- 11. #MAFS 1.111 posts

- 12. #SurvivingBarstool N/A

- 13. Warde Manuel 2.535 posts

- 14. Gundam 123 B posts

- 15. Hegseth 151 B posts

- 16. Cam Payne N/A

- 17. Africa 276 B posts

- 18. Ubisoft 8.934 posts

- 19. #MarriedAtFirstSight N/A

- 20. Brandon Miller N/A

Who to follow

-

Adede Adede

Adede Adede

@AdedePaulAdedeh -

drey

drey

@kyngtega -

I felt sorry for you and

I felt sorry for you and

@Debells_MUFC -

ISMAIL 🇳🇬

ISMAIL 🇳🇬

@Microbaris20 -

Muhammadu Salimu II

Muhammadu Salimu II

@SalymBabajo -

Ifeanyi Nsofor

Ifeanyi Nsofor

@ekemma -

Peleh

Peleh

@Folu222 -

0.0.0.1

0.0.0.1

@luther_exe -

Iba Ella of 9ja🇳🇬

Iba Ella of 9ja🇳🇬

@Slyadeniyi -

Δανάη Φουργιώτης 🕊

Δανάη Φουργιώτης 🕊

@DanayFourgiotis -

Asenathi

Asenathi

@AsenathiMhluma -

REIGN of LEO

REIGN of LEO

@iam_mubys -

Prince Of Peace The Second🕊️

Prince Of Peace The Second🕊️

@PrinceChuks0 -

Michael O.

Michael O.

@MichaelIkeOlisa -

Mike

Mike

@mrcurryman57

Something went wrong.

Something went wrong.