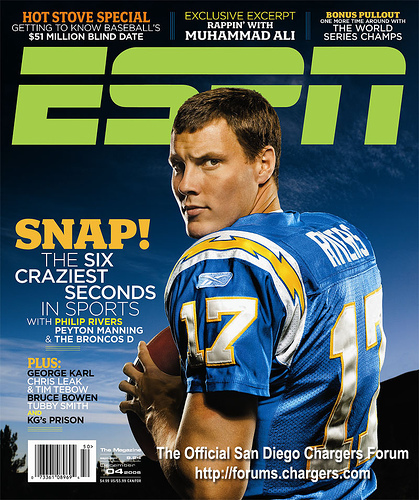

Mayor of Offshore Drilling

@offshoremayorCaptain of a deepwater drilling asset

Similar User

@TommyDeepwater

@BryanRe06450026

@nordicinvaders

@felixm63_

@koledevri

@OmerAlali7

@rma1776

@SumOfUs1

@RebelCapPro

@flykillab95718

@Leroy_Deutsche

@MarineMike05

@TradersCom

@brandon_munro

@DSteinmoeller

Two sister drillships being built in Hyundai’s shipyard. One drillship was already floating and about to complete equipment commissioning while the second ship was still in dry dock awaiting derrick installation. Hyundai’s mass production line was unlike anything I’ve ever seen .…

I have no clue what oil is going to do under Trump. I’m sure Iran is gonna get cut off but OPEC can cover that. I know the fundamentals seem really positive but if the Ukraine Russia war ends do the sanctions go away? He is extremely pro shale but will shale companies bite? Or…

It’s very rare to see NOAA so indecisive on the potential path of a Hurricane like they are with Rafael but this could end up being a short term issue for production in the Gulf of Mexico. If Rafael ends up turning north towards Louisiana at all then it will be going right over…

OFS has been ugly lately so I’ll do my best to be positive for once 😂. While I don’t think day rates will really squeeze anytime soon, the market is slowly but surely healing. Three things come to mind: 1) The day rate floor seems to be set around 450k. 2) The length of…

Comparing 2013 to now is like comparing apples to oranges. 2013 was a time of panic, greed, and FOMO. I don’t think I’ll ever see that type of hysteria going around the industry ever again. Oil companies couldn’t lock up drillships fast enough and when they did it was for 5…

Why would $630k be any kind of ceiling when the “highest” fixture in the previous cycle was Pacific Khasmin @ $660k (Chevron). Clients aren’t going to accept a DR based on “8G newbuild economics” (at least initially).

This is a great question. Obviously I’m not a lawyer so this is out of my realm but Transocean’s headquarters is actually in Switzerland so I don’t think the U.S. has any say in the matter. Companies in the past have used a little island off the UK as well. It makes it really…

Any thoughts on whether the deal would actually clear? The US is even trying to stop the combo of $TPR and $CPRI in the handbags industry. Shouldn’t it be much harder to get approval for a $RIG - $SDRL deal?

I just wanted to add that if the Seadrill Transocean merger actually goes through then I think you can write off all those cold stacked drillships as scrap metal unless oil can consistently stay above 100. We are going on 6-7 years since the first rigs started to stack. It’s hard…

The Seadrill Transocean rumor has been floating around the industry for a few months now. I don’t like saying anything until the press announces it but usually it’s a done deal by time we hear about it out in the field. I’ll be surprised if this deal doesn’t happen. $rig $sdrl

I learned this lesson the hard way

Please take your days off, these jobs don't care about you.

Did I hear jack ups??????

Welp I just found out about another drillship that will be going stack. Until all of these drillships have long term contracts $rig nor any other company will consider breaking out those cold stacked rigs. Some of these cold stacked rigs might end up getting scrapped. Drillships…

This is the projected path of the next low of interest. Apparently it has favorable conditions to potentially develop into a hurricane. Part of the reason why these hurricanes are rapidly intensifying once they get in the gulf is bc of the loop current. I used a red highlighter…

Right on cue, after I said yesterday watch for ppl start calling for 300 dollar oil 😂😂. I sold half my $oxy today. 10 percent in a week ain’t too shabby.

Oil prices could rally above $200 if Iran’s energy infrastructure is wiped out, analyst says - CNBC

Last week retail was told Saudi was supposedly abandoning their hopes for 100 dollar per barrel oil and “opec was prepping for 50 dollar oil”. Now we get a glimpse of what the big boys are actually positioning for. When oil is at the bottom of its range they tell you it’s going…

Traders Bet On $100-a-Barrel Oil as Middle East Risks Escalate Almost 27 million barrels of Brent $100 calls traded Some are hedging against price spike, others covering position #oott bloomberg.com/news/articles/…

Wow, I guess we found out who “they” is. . . I told ya’ll my BS meter was going through the roof with these ridiculous articles!

So the Biden admin is now pretending to be "OPEC sources" and rotating Reuters, FT and WSJ to leak fake news that hammer oil.

All these fake articles coming out right when capitulation is either happening or in this case may have already happened . . .

100 percent trying to shake you out of your long position. The more articles I see like this the more bullish I get.

“OPEC Secretariat categorically refutes the claims made within the story as wholly inaccurate and misleading” Very interesting that they quickly and vigorously denied this story in contrast to last week’s FT story. Article in question:

As someone who has been employed by unions, the person that benefits the most from the union is the president. This guy is a joke.

President of the International Longshoremen’s Association, Harold J. Daggett, 100% means business: "People never gave a s*** about us until now. When they finally realized that the chain is being broke now ... You know how many people depend on our jobs. Half the world! It's…

Right on cue, last Thursday they wanted to shake everyone out one last time before sending oil back up. 5 days later they drop the most bullish catalyst for oil. . . WWIII, it’s really shameless how they time these articles. You know some of retail panic sold and or thought it’d…

When a stock or commodity is shit for months you usually get that one last piece of bad news that makes ppl capitulate right before it starts to rip. I’m sure this will cause people to sell. Maybe we have finally bottomed or at least bottomed for the time being . . .

United States Trends

- 1. Mike 1,81 Mn posts

- 2. #Arcane 169 B posts

- 3. Serrano 243 B posts

- 4. Jayce 28,5 B posts

- 5. Vander 8.229 posts

- 6. Canelo 17,2 B posts

- 7. MADDIE 13,5 B posts

- 8. #NetflixFight 74,8 B posts

- 9. Father Time 10,8 B posts

- 10. Logan 80,2 B posts

- 11. #netflixcrash 16,7 B posts

- 12. Jinx 83,8 B posts

- 13. He's 58 28,4 B posts

- 14. Boxing 309 B posts

- 15. ROBBED 101 B posts

- 16. Rosie Perez 15,2 B posts

- 17. Shaq 16,6 B posts

- 18. #buffering 11,2 B posts

- 19. Tori Kelly 5.412 posts

- 20. Roy Jones 7.319 posts

Who to follow

-

Tommy Deepwater

Tommy Deepwater

@TommyDeepwater -

Bryan

Bryan

@BryanRe06450026 -

Nordic AI

Nordic AI

@nordicinvaders -

Felix Moreno

Felix Moreno

@felixm63_ -

KÖLE

KÖLE

@koledevri -

Omer Alali

Omer Alali

@OmerAlali7 -

Ray Alexander 🇺🇸🇮🇱

Ray Alexander 🇺🇸🇮🇱

@rma1776 -

Kent Reynolds

Kent Reynolds

@SumOfUs1 -

Rebel Capitalist Pro

Rebel Capitalist Pro

@RebelCapPro -

Brandon Carrington

Brandon Carrington

@flykillab95718 -

Leroy

Leroy

@Leroy_Deutsche -

Michael SB

Michael SB

@MarineMike05 -

Traders Community

Traders Community

@TradersCom -

Brandon Munro

Brandon Munro

@brandon_munro -

Dave

Dave

@DSteinmoeller

Something went wrong.

Something went wrong.