Axel Ragnarsson

@multifamwealthMultifamily investor/operator | 500+ units. Active investors can buy our "7-Day Multifamily" program and passive investors can join our investor list below:

Similar User

@cre_cole

@SimpleCRE

@redwood_ryan_a

@BabakZiai

@LiferRealestate

@Jb2Investments

@JaretTurkell

@DylanMarma

@MultifamMason

@johnplumstead

@_apryor

@PerrySolem

@Nick_Keesee

@groundupgrind

@davidellebrecht

My episode on the @BiggerPockets Multifamily Mentors show went live today, check it out! Such a great experience to go from learning the basics of REI on BP over 6 years ago to coming on the show and talking about how we’ve grown to 300+ units. #retwit Link in thread —>

Why New England is the best

My experience of rejection in regions of the US: •California: Nobody says no. They just go quiet on you. The "West Coast No." •Northeast: They tell you no to your face, then tell you to go F yourself. •South: They tell you yes, smile broadly, then never hear from them again.…

The CEO: multifamily investors The armor: Their PM company

Body armor company demonstrates their stab protection on their CEO

Building a robust pipeline of deals is challenging in the beginning because no one is bringing you deals. You have to scrape and claw to get the first few deals done, but once you’ve got a few closed, people know you and start sending you deals… and it compounds from there.

Fun to do this every once in a while, as it shocks non-northeast investors. Ages of properties we’re under contract to buy right now: - 1880 - 1900 - 1895 - 1980 Funny to think many investors consider 80s construction as “older”, when it feels new to us (and residents)

Great interview with @credealjunkie coming the second week of September. Andrew has extensive experience in multiple facets of the multifamily sector (and is a great twitter follow)!

First podcast appearance yesterday, really enjoyed it! (and only sweated through one shirt) Thank you @multifamwealth for the invite - great conversation and looking forward to the episode dropping in a couple weeks.

I’m always alarmed at how often investors’ are surprised to discover how we find deals.. “can you actually find multifamily deals direct-to-seller?” We’ve done 33 deals DTS in the last 3 years (275+ units). We just signed a 72-unit from a mailer. It’s more than possible

The more a sponsor/GP discusses macroeconomics when marketing a deal, the less an LP should be interested. Need to communicate the deal, biz plan, market, and ability to execute. If you see “buy land, they aren’t making anymore of it” in a deck, the deal should be an auto-pass

In real estate, there is an inverse relationship between how much time you spend in excel and how much money you make

Please take note. I’ve received at least 15 DMs saying “you don’t understand how important modeling is” It doesn’t matter long term

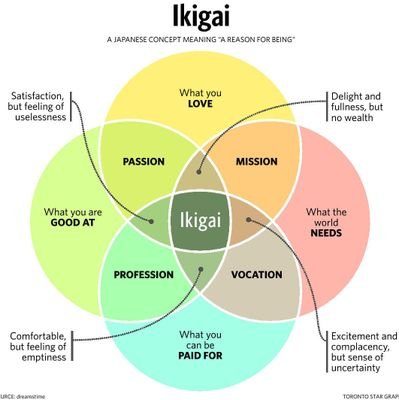

“A personal identity” Yeah that should pay the bills

This is the fundamental issue with most people’s rent vs. buy analysis. Yes, you’d have spent the same money, and wouldn’t have accumulated equity. However, you’re leaving out $$ earned by investing the down payment vs. tying up $$ in a house, not to mention transaction costs.

Alternatively, if you were renting for 3 years, at $2,000/mo, you'd still have spent $72,000, and you have zero principal pay down, and zero equity growth.

A periodic reminder that 80%+ of successful multifamily operations is driving and managing revenue (minimizing vacancy, maximizing income). Considering the majority of your expenses (taxes/ins/contract services) are fixed, increases in revenue drop straight to NOI.

United States Trends

- 1. Travis Hunter 8.422 posts

- 2. Northwestern 5.706 posts

- 3. Heisman 4.021 posts

- 4. Carnell Tate 1.232 posts

- 5. Sheppard 2.952 posts

- 6. $CUTO 8.120 posts

- 7. Colorado 66,6 B posts

- 8. Jeremiah Smith N/A

- 9. Arkansas 27 B posts

- 10. Denzel Burke N/A

- 11. Ewers 1.188 posts

- 12. Shedeur 3.048 posts

- 13. $CATEX N/A

- 14. Jahdae Barron N/A

- 15. Wrigley 3.594 posts

- 16. #Buckeyes N/A

- 17. #collegegameday 5.655 posts

- 18. #SkoBuffs 3.096 posts

- 19. #HookEm 2.339 posts

- 20. Renji 6.910 posts

Who to follow

-

CRE Cole

CRE Cole

@cre_cole -

Jason Richards

Jason Richards

@SimpleCRE -

Ryan Auger // Industrial & Storage

Ryan Auger // Industrial & Storage

@redwood_ryan_a -

Babak Ziai

Babak Ziai

@BabakZiai -

Michael Lewin | CRE

Michael Lewin | CRE

@LiferRealestate -

Jonathan Barr

Jonathan Barr

@Jb2Investments -

Jaret N. Turkell (Deal Crush)

Jaret N. Turkell (Deal Crush)

@JaretTurkell -

Dylan Marma

Dylan Marma

@DylanMarma -

Mason Fiascone

Mason Fiascone

@MultifamMason -

John Plumstead

John Plumstead

@johnplumstead -

Alexander Pryor

Alexander Pryor

@_apryor -

Perry Solem

Perry Solem

@PerrySolem -

Nick Keesee

Nick Keesee

@Nick_Keesee -

Ground Up Grind

Ground Up Grind

@groundupgrind -

David Ellebrecht

David Ellebrecht

@davidellebrecht

Something went wrong.

Something went wrong.