Paul Deng

@mogaocapWorrying top down, investing bottom up. Economist, investor, history buff. Chengdu/TX/Boston/Copenhagen. Dir. of Research, Mogao Capital, HK, https://t.co/EEx86YbpHG.

Similar User

@goranbash

@Marstradamus7

@jimrwebb

@Saucin8912823

@BD_Investing

@FranciscoDAnco

@shayuliel

@poz718

China’s two speed economy is evident in still rising manufacturing investment and retail sales along with strong exports but continuing falls in housing related indicators.

Bitcoin vs. Gold, we have been right here before... *Last decade, largest drawdowns. Gold: -22% Bitcoin: -83%, -71%, -54%, -77%

Been making the point that the one year Sharpe Ratio on the SPX is off the charts... Two comparable periods... Early 2021 when the SPX was up 75% on a YoY basis from the depths of the Covid crash. And also very early 2018 pre the XIV event when the SPX was up 25% on a sub 7…

Jay Powell offered terse answers when asked whether he would finish his term or thought he could be dismissed But those one-word replies hinted at a dormant drama over how far the Fed chief has been prepared to go to defend the central bank’s integrity wsj.com/economy/centra…

TIPS breakevens jump this morning - pricing in higher inflation risk.

What could this election mean for gold? Gold's performance under previous presidents. #Election2024 #gold

The US election results paint a picture of a changing American electorate. The coalition of ethnic minority voters that has for years underpinned Democratic support appears to have fractured on.ft.com/40UEGCn

🇺🇸🗳️ - In just 30 years education divide for US political affinity has reversed • In 1990s Americans with high-school degree voted Democrat while university grads voted Republican • Political polarisation by education level was just as high then as it is today, but in reverse

Here's how stocks have done after the past 24 elections. What really stands out is how well stocks have done after the 10 most recent elections. Higher a year later 9 times and up 15.2% on avg (median of 17.2%).

US households have never been this optimistic about the market and their 401k/IRA accounts. Take note that pessimism was the highest in 1990, 2002, 2008/09, 2011 and 2022 — all of those proved to be wonderful buying opportunities. At extreme points, the crowd is rarely right!

1/3 Bob is 💯 This chart shows the rise in long-rates never after a first-rate cut is unprecedented. The market is rejecting the Fed's rate-cutting policy. Why? * The economy is good * Inflation is not "solved" (and tariffs are inflationary) * Don't need monetary stimulus

The more the Fed commits to cuts, the worse it is for bonds.

Paradigm shift. For the first time, the assets of ETFs investing in Nuclear Energy have surpassed those of Clean Energy ETFs. Chart from the BofA report

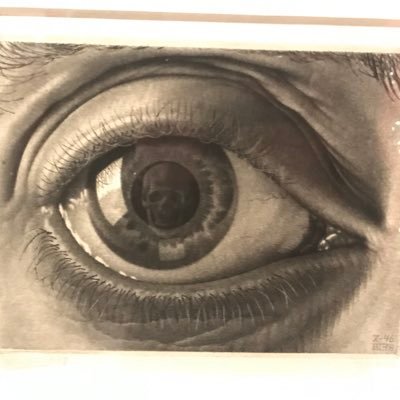

Perspective matters

Is #GOLD already too expensive? Lets compare the current price with various macro and market figures from the previous highs in 1980 and 2011: @TaviCosta @LawrenceLepard @ttmygh @GoldSwitzerland @GoldTelegraph_ @TheLastDegree @LukeGromen @zerohedge @FT

What has changed in the last 10 years

BREAKING: Central banks now hold 12.1% of global gold reserves, the highest level since the 1990s

🚨MARKET PRICING SIGNALS A 100% PROBABILITY OF US RECESSION🚨 The market is currently pricing in over 2.00% Fed rate cuts within 12 months, the most since the Financial Crisis. This implies a 100% probability of a recession in the next 12 months, according to Goldman Sachs.

Buy Vix for Sept - Nov.

The S&P 500 is on track for one of the best election years on record but history suggests weakness between now and the election. @granthawkridge

Good stuff

Bertrand Russell, ten commandments for the freethinker

Here's the problem -valuations are stretched vs history -AND so are earnings expectations This is going to hurt: chartstorm.info/p/weekly-s-and…

United States Trends

- 1. Ravens 75 B posts

- 2. Steelers 101 B posts

- 3. Bears 109 B posts

- 4. Packers 68,5 B posts

- 5. Lamar 29,5 B posts

- 6. Jets 53,1 B posts

- 7. #HereWeGo 18,2 B posts

- 8. #GoPackGo 8.978 posts

- 9. Lions 87,5 B posts

- 10. Caleb 30,9 B posts

- 11. Justin Tucker 19,2 B posts

- 12. Taysom Hill 9.115 posts

- 13. Bills 93,4 B posts

- 14. WWIII 33,9 B posts

- 15. Russ 14,2 B posts

- 16. Browns 29,4 B posts

- 17. Worthy 45,1 B posts

- 18. Eberflus 8.584 posts

- 19. Colts 30,6 B posts

- 20. #OnePride 16 B posts

Something went wrong.

Something went wrong.