kristianweel

@kristianweelPersonlig økonomi, børs, aksjer og investeringer #finanstwitter

Similar User

@TeknoKonge

@UngeLanche

@StormoenF

@sbkj1979

@Pengenerden1

@fondsspareren

@Andrums3

@Borsogeiendom

@TodosDuo

@obm_bekt

@Trond32060727

Hvordan fastsettes skjermingsrenten for aksjegevinster mv? 1. Snitt 3 mnd statskasseveksler for året 2. + 0,5% påslag 3. -22% Nå er renten ca 4,4%. Er det snittet for året blir skjermingsrenten: (4,4+0,5) * 0,78= 3,8%

📊Tyder på at det man sett siste uken er en korreksjonen i et 🐂bullmarked (blå>grå) God påminnelse om at det er earnings som driver markedet på sikt✅ =Q2 EPS i USA steg +11% år/år✅

The $VIX is at 65 right now, up from 23 at Friday's close. If that were to hold it would be the biggest 1-day % increase in history and one of the highest closes ever. Only periods with higher levels of implied volatility: October/November 2008 and March 2020.

The only thing necessary for evil to triumph is for good people to do nothing.

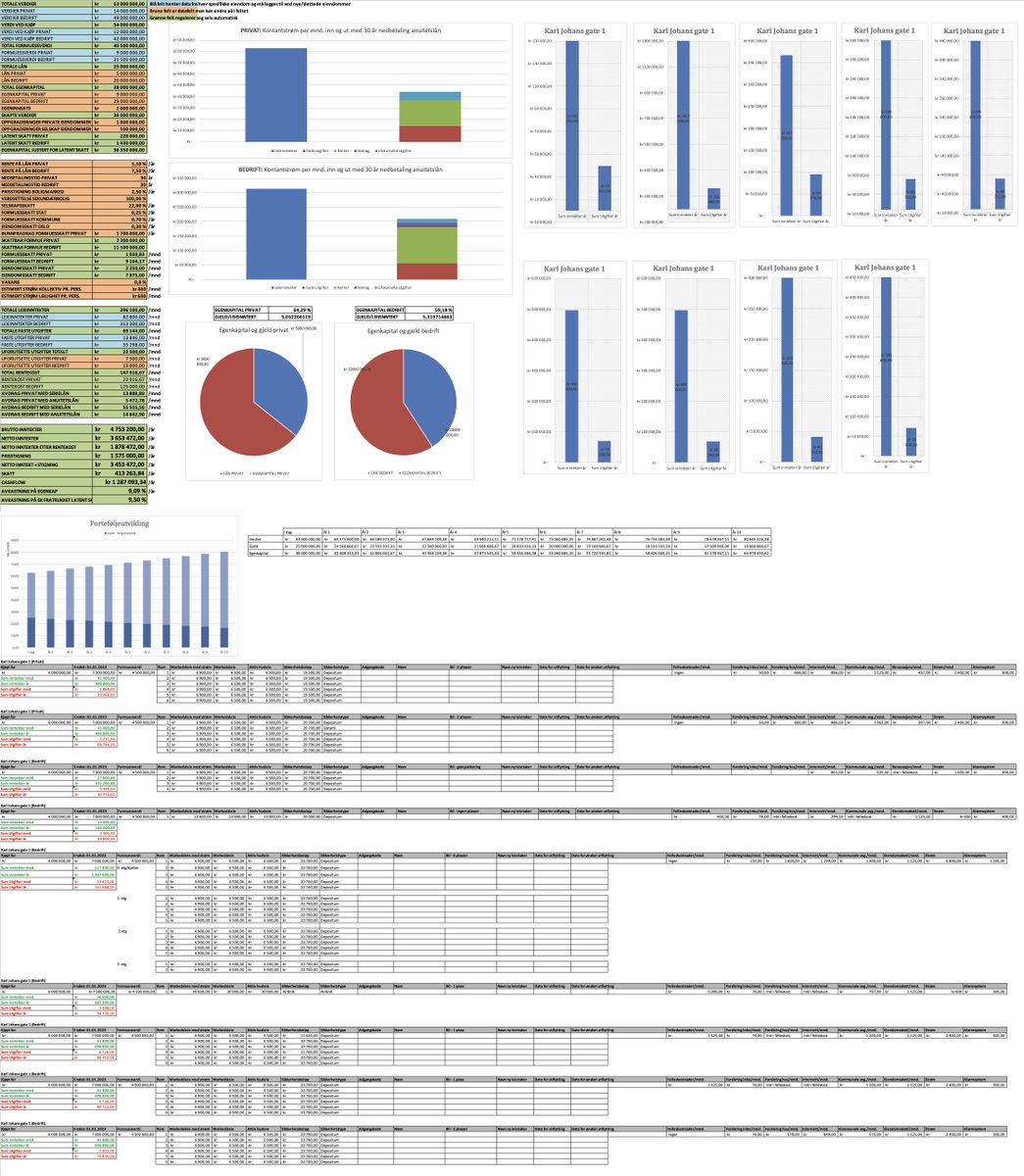

Å ha full kontroll på tallene, være realistisk i kalkylene og formidle det gjennom et regnestykke i excel er det viktigste du må gjøre for å få lån i banken. Her er versjon 2.0. 1 år siden forrige utsending, 1 år til neste. Lik og del for å få det tilsendt på dm Forklaring🧵

The average year for the S&P 500 (since 1950) bottoms today.

Men’s haircut price: 🇳🇴 Norway: $64.60 🇯🇵 Japan: $56.00 🇩🇰 Denmark: $48.21 🇸🇪 Sweden: $46.13 🇦🇺 Australia: $46.00 🇺🇸 USA: $44.00 🇨🇭 Switzerland: $42.96 🇫🇷 France: $37.05 🇰🇷 South Korea: $36.94 🏴 England: $35.74 🇩🇪 Germany: $35.39 🇦🇹 Austria: $35.06 🇫🇮 Finland: $31.03 🇮🇪…

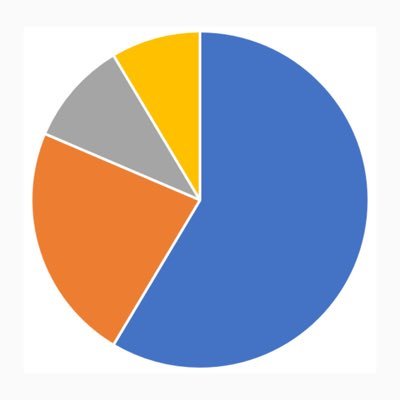

I ildfullt oransje Hva som kommer ut av munnen til ledelsen når de presenterer kvartalstallene I fredfull hvitt De uvitende

The top 20 stocks in the S&P 500 account for over 90% of the YTD returns in the index. A very mega-cap concentrated rally. H/T Genuine Impact (excellent graphics!)

W=P*MPL, som stemmer fint som en gjennomsnittbetraktning over tid; stasjonær lønnsandel. Men ikke i 2022, hvor lønnsandelen falt tilbake. Får vi ikke et kraftig lønnsløft i år, får vi et permanent fall i lønnsandelen. Men bamsemums og øl er sikkert viktigere.

John contributes $2k/year between the age of 18 and 27, then stops Erica contributes $2K/year between the age of 28 and 65 Both compound at 10%/year At age 65, who ends with more money? Erica has $728,086.87 John has $1,192,257.81

Oh here we go again. JP Morgan’s game plan for tomorrow’s US CPI.

The S&P 500 is up 6% in the first 18 trading days, the best start to a year since 2018. Big difference from 2022 at this same point when the S&P 500 was down 9% (2nd worst start). $SPX

The S&P 500 has returned 9.7% annualized since 1928 with an average intra-year drawdown of -16.4%. There's no upside without downside, no reward without risk. $SPX

3 out of 4 people make up 75% of the population.

US Treasury Yields: End of 2021 --> Today 1-Mo: 0.06% --> 2.55% 3-Mo: 0.06% --> 3.28% 6-Mo: 0.19% --> 3.75% 1-Yr: 0.39% --> 3.92% 2-Yr: 0.73% --> 3.75% 3-Yr: 0.97% --> 3.75% 5-Yr: 1.26% --> 3.58% 7-Yr: 1.44% --> 3.53% 10-Yr: 1.52% --> 3.42% 30-Yr: 1.90% --> 3.51%

The Fed is desperate to win their core inflation fight. To succeed asap, they need to: - Get people unemployed - Hit the housing market hard Don’t fight the Fed.

Enig. Videre så er premisset uansett feil i praksis. I stressperioder, være seg pandemi, skillsmisse eller at man mister jobben, så har bankene mulighet til å lempe på kravene (avdragsfrihet etc.) uten at det går på tvers av forskriften.

Moro. Du hører det du vil høre.

Amazing: If you read "green needle," that's what you'll hear; if you read "brainstorm," you'll hear that instead. Also works if you just hold each phrase in mind. 😮

United States Trends

- 1. Pete 307 B posts

- 2. DeSantis 35,5 B posts

- 3. Jokic 12,6 B posts

- 4. Kerr 7.321 posts

- 5. Mavs 12,6 B posts

- 6. Podz 3.427 posts

- 7. Clemson 25,2 B posts

- 8. Wiggins 2.782 posts

- 9. Nuggets 17,1 B posts

- 10. Jamal Murray 1.530 posts

- 11. Kentucky 19,2 B posts

- 12. azealia 4.319 posts

- 13. Kuminga 2.370 posts

- 14. Marcus Smart 2.702 posts

- 15. XDefiant 18,5 B posts

- 16. NBA Cup 15,5 B posts

- 17. #MFFL 4.164 posts

- 18. Knicks 16 B posts

- 19. #DubNation 1.534 posts

- 20. matty healy 2.703 posts

Something went wrong.

Something went wrong.