Similar User

@MarquesMansilla

@LPTrustCo_CO

@turkey039

@IndianAnCap

@SylentT16

@dylan18096995

@QWERTYSAITO3110

@Aahhhchooo

@SekiroSanHandle

The basic problem is that most people extrapolate the problems of a household, municipality or corporation to the public sector economy because that's the only way they can conceptualize the issue. A federal government which has a printing press and can collect taxes and has no…

1. Why global diesel demand worries me. Sorry it si a bit of a long thread Diesel has always been the balancing barrel in a reifnery's product slate. The cut is made around diesel/gasoil to make sure the refinery maximises margin.

Everything! 🤣

What is David Tepper buying in China? "Everything," he says. "ETFs, I would do futures - everything. Everything."

Will #smallcap finally catch a real bid? Interesting note from @yardeni: "#Leveraged companies that rely on #floating-#rate #debt now have cheaper debt-servicing costs. The Russell 2000 index of small companies finished the day higher. The S&P 493—including #Value #stocks and…

There have been 20 occasions when the #Fed cut rates at all-time highs. While there were bumps along the way, stocks were higher 12-months later 100% of the time.

Despite growth in Mexican exports, potential challenges lie ahead for trade agreements. We turn to our Mexican Leading Exports Index for what lies ahead.

$PLTR "We don't know how to deal with this much demand!" - Palantir CEO Alex Karp

This is what it looks like when doves 🕊️ cry … @MacroMicroMe

This is such a key point and why 50bp would require a massive correction and a sharply negative NFP on Sept 6th and CPI negative on meeting day. The Fed is both cautious and has an ego and 50bp would be such a massive failure by the Fed that it won't happen

Inkling effects of the ¥en carry trade unwinding …

There are emerging signs that global financial liquidity is turning. While any of MXN/BRL/CNY/JPY/EUR Spreads/R2K selloffs as US stocks rose can be explained away by idiosyncratic dynamics, these are the sorts of edges where receding liquidity shows first. MXN sharply down:

Existing home inventory: near record low. New home inventory: near record high. What's the real story? Let's explore the true US housing inventory situation and what it means for the construction sector and the broader economy going forward 👇 1/x

For those questioning whether labor markets are tight, take a look at how many working age adults are working. The share of prime age workers that are working is at multi-decade highs, only previously surpassed by the late-90s boom.

I challenge anyone to show a hard proof of a 50-year agreement between the US and Saudi Arabia regarding the use of the US dollar in oil pricing on June 6, 1974! If there is no agreement, there is NOTHING to expire! End of story! @MarioNawfal #Oil #SaudiArabia #US

The tender volume increase is widespread across the market (green is increase YoY). This is a real positive sign for a fundamental shift in market direction.

AI and EVs can potentially increase the nation’s productivity growth, which would go a long way toward boosting economic growth. However, with the potential benefits come significant investments. realinvestmentadvice.com/ai-data-center…

Of 18tln in US household borrowing, only 250bln (1.4%) in loan value is seriously delinquent and that's only up about 50bln in the last 12m. While there is a tail of folks clearly struggling and that's been rising modestly, in any historical perspective it's still quite low.

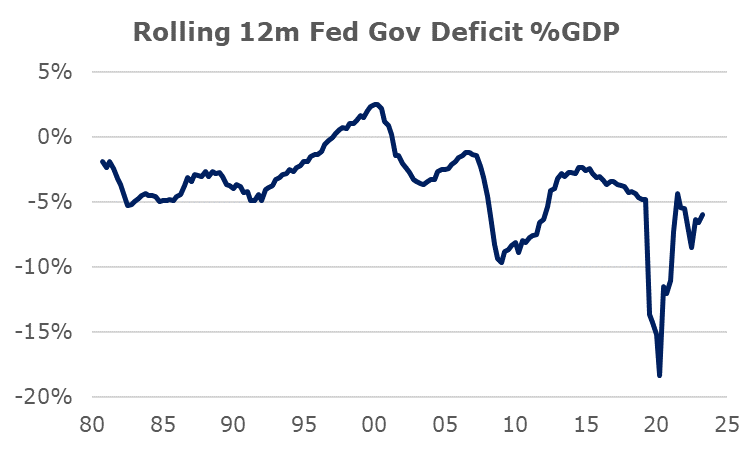

If the federal government deficit is at 6% of GDP and nominal growth is running at a 5-6% nominal pace, is there really a sovereign debt crisis looming in any time frame traders today should care about?

Incredible: 50 cranes at work on Samsung's $17 billion Texas chip plant. One building alone is 11 football fields long and needs 5,000 construction workers. The plant will do cutting-edge chips and advanced packaging for HBM. Started early 2022. Expected to open in 2024 or 2025.…

The strength of this cycle is driven primarily by income growth. That is unfamiliar for many like @neelkashkari b/c it is unlike past credit-fueled cycles and means even when policy appears tight, its flow through impact on the real economy is modest relative to the past.

didn't have time to write about the QRA, but if i did, it would look almost identical to this previous piece where I detail the mechanics (no paywall) concoda.com/p/the-stealth-…

Just spent a couple of days at a #distressed #credit and #debt conference. Big takeaway - the #CRE issue is being resolved as distressed credit players are taking a lot of deals off bank balance sheets ahead of maturity.

United States Trends

- 1. Kendrick 501 B posts

- 2. #AskShadow 16,7 B posts

- 3. $CUTO 7.135 posts

- 4. Luther 37,9 B posts

- 5. Daniel Jones 44,2 B posts

- 6. Drake 72,6 B posts

- 7. Wayne 50,4 B posts

- 8. Kdot 7.947 posts

- 9. Squabble Up 22,7 B posts

- 10. TV Off 31 B posts

- 11. MSNBC 174 B posts

- 12. Giants 76,3 B posts

- 13. Dodger Blue 11,1 B posts

- 14. Kenny 23,7 B posts

- 15. Reincarnated 29,6 B posts

- 16. Gloria 45,1 B posts

- 17. #BO6Sweepstakes N/A

- 18. NASA 68,4 B posts

- 19. #TSTTPDSnowGlobe 4.938 posts

- 20. #AyoNicki 3.684 posts

Something went wrong.

Something went wrong.