Rodrigo Ko

@ko_rodrigoInvestment Team & Partnerships @ Republic 🚀

Similar User

@Vaultavo

@RameshK14771653

@jbraknes

@rayodelsol_930

@YHWH_7777

@RebekkaPro

@VicVerse_9

@firstfounderscc

@blaise_malley

@DrParikhMBA

@sonyasunkim

@vineetjoseph

@shawnwlim

@Citizen_Gunner

@smachadolopes

To everyone who's ever heard me rant about personal finance, this one's for you! 🎉 Read my latest article on Medium here and let me know what investment platforms and credit cards are your personal favorites!💰 link.medium.com/JzD2UfYMVIb

Why are YC companies worth YC demo day prices? Because you are more likely to find a multi-turn fund returner that makes your whole investing career in one check than any other place in the world

How to find deal flow before breaking into VC: 1. Social media - search founder or building something new 2. Demo days - AWS accelerator, Forum Ventures, Hearst Labs, ERA, Techstars, YC, 43 North 3. Universities - Network with DRF, RDV, PearVC, NEA fellows 4. Product hunt

From not tweeting to tweeting about an article on tweeting 🤯 Top VC & startup accounts to follow: medium.com/the-investors-…

If you invested in every YC company, for every 100 companies you did you would have 5 unicorns 👀

You frame it well! It's hard to be a top VC over 20 years. That's probably investing in a top company every year or at least every other year (10-20 in total). Odds of $B company is like ~1% at seed/early, so do the math for 20 years. Super hard. I don't know you quantify the…

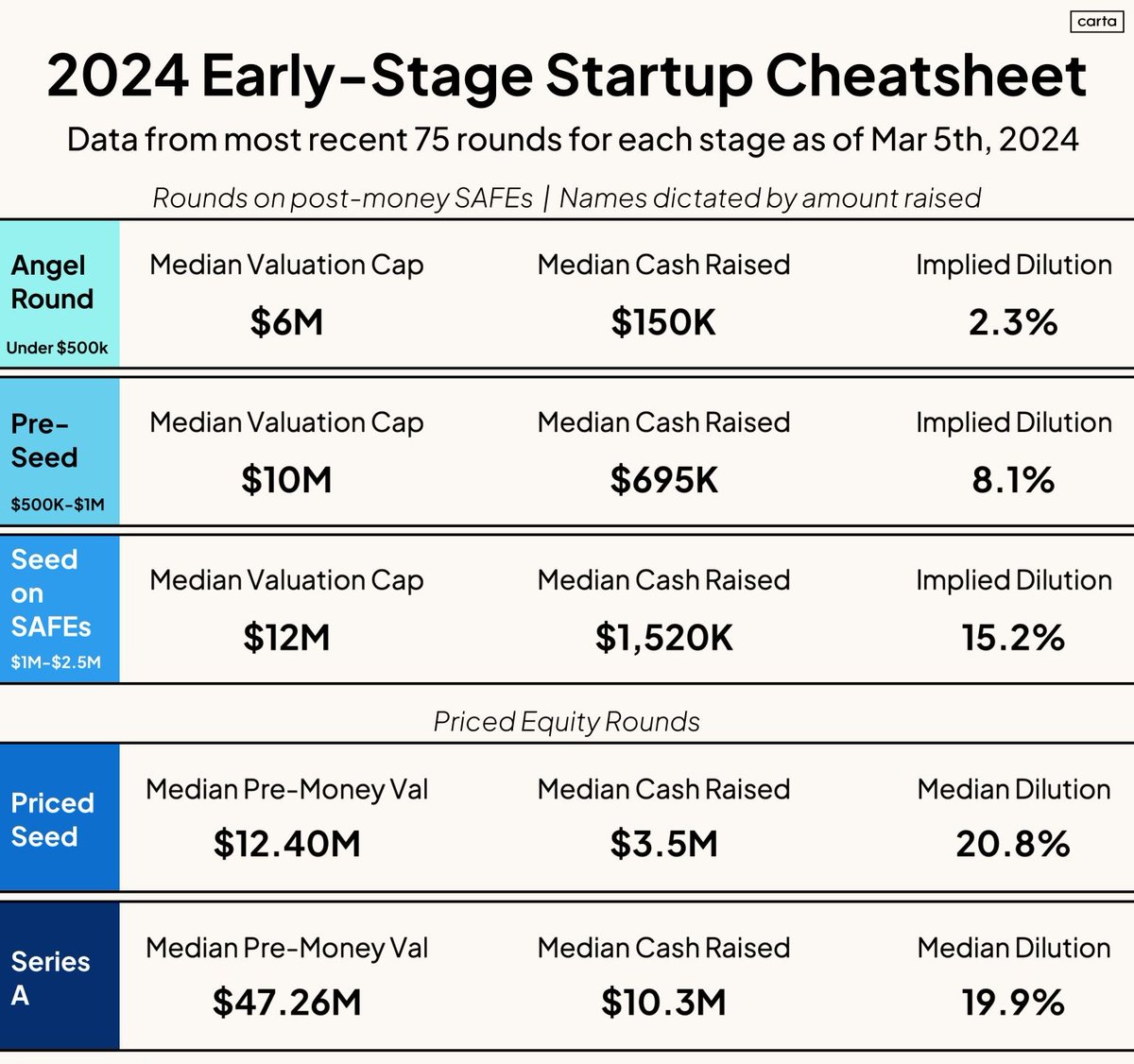

📊US founders looking to fundraise: below are the latest round and valuation numbers from @cartainc Consider them as you go out to market!

Today, we're thrilled to share the news of 🧿 Dili's $3.5 million seed funding round! If you work in PE or growth equity and want to try the state-of-the-art in finance-focused AI today, sign up for a trial of Dili for your fund: dili.ai

Have seen this in action and it's magical: For investors of any kind, from PE to VC to real estate, imagine being able to drop a folder of data rooms into Dili and getting back a full summary of good/better/best metrics that would take a dozen human analysts months to create

Congrats to the team @dili_ai on the $3.6M seed! Dili (YC S23) uses AI on public and private datasets to help investors with their due diligence and make better investment decisions with generative insights and analysis. techcrunch.com/2024/02/19/dil…

💰LATAM founders looking for capital: @VolcanoSummit 2023 has opened apps for their Startup Avenue Competition, where you could win a $100K investment. Learn more and apply by 8/11. volcanosummit.com/startupavenue

100% agree but the founders need to keep investors aware of what’s happening. Too many founders stop updating folks that can actually help…especially if things aren’t going as well as founders had hoped.

I view the investor job is to provide honest feedback. If the founder is behind - I tell them. If they are crushing it - I tell them. Many investor always challenge founders, but I don't think thats right. You build trust - by caring, being honest and being consistent.

📚AI founders, funders, and friends: here’s an AI tool chart you might like.

Thanks for the insights and for the shoutout @sidneyhaitoff ! Couldn't agree more and can't wait for our next conversation on this!

Love that the concept of Direct-to-Community, ie D2C² is catching on The opportunity surely transcends healthcare. It was fun jamming on this with you! @ko_rodrigo medium.com/the-investors-… Thanks for the thoughtful writeup

Recently listed as a top writer in Venture Capital on @Medium! To read more, visit and follow my page: medium.com/@rodrigoko medium.com/tag/venture-ca…

For us, AI is not a fad. We’ve been investing in startups with artificial intelligence-based products & services for over seven years. Here are some of the conversations our partners are having around AI 🧵 [1/5]

United States Trends

- 1. Bengals 75,3 B posts

- 2. Chargers 63,5 B posts

- 3. McPherson 11,3 B posts

- 4. Herbert 32,9 B posts

- 5. Joe Burrow 19 B posts

- 6. #BoltUp 5.175 posts

- 7. Zac Taylor 4.041 posts

- 8. #CINvsLAC 10 B posts

- 9. #BaddiesMidwest 18,4 B posts

- 10. #SNFonNBC N/A

- 11. JK Dobbins 4.207 posts

- 12. Money Mac N/A

- 13. Harbaugh 15,2 B posts

- 14. Ladd 5.365 posts

- 15. #WhoDey 1.749 posts

- 16. Chiefs 155 B posts

- 17. Tee Higgins 3.670 posts

- 18. WWIII 157 B posts

- 19. Russia 753 B posts

- 20. Josh Allen 67,6 B posts

Who to follow

-

Vaultavo

Vaultavo

@Vaultavo -

Ramesh Kumar

Ramesh Kumar

@RameshK14771653 -

Jonatan Raknes

Jonatan Raknes

@jbraknes -

Ms. Wilson, CFEI

Ms. Wilson, CFEI

@rayodelsol_930 -

YHWH

YHWH

@YHWH_7777 -

Rebekka🧊Pro 🐻🤡

Rebekka🧊Pro 🐻🤡

@RebekkaPro -

⚡️Vic ₿𝗥𝗘𝗔𝗞𝗜𝗡𝗚 — e/acc

⚡️Vic ₿𝗥𝗘𝗔𝗞𝗜𝗡𝗚 — e/acc

@VicVerse_9 -

FirstFounders Inc.

FirstFounders Inc.

@firstfounderscc -

Blaise Malley

Blaise Malley

@blaise_malley -

Arpan Parikh, MD MBA 🧠

Arpan Parikh, MD MBA 🧠

@DrParikhMBA -

Sonya Kim

Sonya Kim

@sonyasunkim -

Vineet Joseph

Vineet Joseph

@vineetjoseph -

Shawn @ Artichoke Capital

Shawn @ Artichoke Capital

@shawnwlim -

Festus (Raising Pre-Seed $500k)

Festus (Raising Pre-Seed $500k)

@Citizen_Gunner -

Sofia

Sofia

@smachadolopes

Something went wrong.

Something went wrong.