khyati

@khyatisarvangProud Indian. Financial markets = first love. External consultant- Strategy and risk management to corporates. Ex- KPMG . IIM C - Dip in Applied Finance .CA.

Similar User

@Prateekbadjatya

@amitabhvatsya

@shome_rajarshi

@investor_vineet

@TBusinessaholic

@menoutfitstudio

@kartikvishu

@GunavanthVaid

@SriniVega

@BeatTheStreet10

@nitin62484423

@tushar9590

@DiscretePriti

@Nupurkunia

@EnSaluja

DECMA 2024 @Prashantshah267 what a brilliant session. Wishing you all the success with Momentify .

25% of all new code at Google is generated by AI. IT companies will need to evolve and adapt quickly. Create revenue streams from services other than only coding. #IT #AI

The market has obliged everyone who have been in cash since yesterday. Diwali Deep cleaning mode #Nifty

This is the start of India + China. Next we will see easing of trade , third step FDI from China. There is no greater bond than that of mutual economic growth when both parties need it desperately. #Geopolitics #china

Looks like the India-China 2020 standoff in #EasternLadakh is almost over! Foreign Secretary Misri announces that 🇮🇳 🇨🇳 have reached an agreement on patrolling arrangements along the #LAC “leading to disengagement and a resolution to issues that have arisen in 2020.”

We will need a second impulse to move higher from here - it could be in the form of FDI, privatisation, government spending. Till then we will stay sideways or see dips. #Nifty50 #indianmarkets

Science fiction without the fiction part. Engineering is truly as close as we get to magic . Insane , crazy , unbelievable and path breaking.#starship #ElonMusk

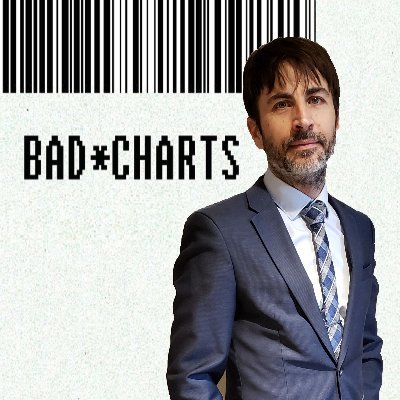

Some very interesting charts and insights.Some key points: 1) Inflation firmly in check = RBI might cut rates 2) Large industries credit demand still sluggish = private capex not picking up 3) India valuations stretched on all parameters, slow down in earnings. 4)Increased FPI

We've created a Capitalmind Flipbook of interesting charts that you might find useful. From economic metrics like inflation/credit growth, to which mutual funds have more AUM in direct versus regular options...check it out. Would love your feedback! drive.google.com/file/d/16ov9EM…

How much gujju? Very much too much Gujju. Navratri best time of the year 🧿

Good always finds a way ….ALWAYS. Evil is defeated and destroyed. Back tested for over 10000 years . Happy Dussehra. #Dussehra2024

Asian paints - acquisition of white teak , setting up premium experience centres. I don’t know if fast moving home improvement is a thing yet (rugs , home accessories, lights wall papers) but could turn out to be a huge market with very high margins. #trends

The man , the institution , the legend. Probably the finest example of wealth and welfare co-existing and beautifully complimenting each other. Thank you and Om Shanti 🙏🏻

Yet again - 2 digit allocation to gold in portfolio. #gold

Gold has become one of the hottest assets this year. For some quick context, gold is up 18% this year, outpacing the Nifty, which has risen by 15%. Just yesterday, gold hit an all-time high in India, reaching ₹7,870 per gram! So, what’s behind this sudden surge? Let's take a…

Hoping for a meaningful mean reversion in Indian markets. GDP , consumer demand , corporate earnings all negative to a relatively high base YoY. JFM 25 should be good. #nifty #investing

China facing deflationary pressures, low demand. This will need fiscal measures , monetary is not going to be enough. But the fact that the Chinese government has decided that reviving the economy is their top agenda + extremely cheap valuations, it might be a value buy/ SIP.

Strong stocks = The ones which remain strong during pull backs

United States Trends

- 1. Bengals 80,3 B posts

- 2. Chargers 69,8 B posts

- 3. McPherson 12,3 B posts

- 4. Herbert 35,4 B posts

- 5. Joe Burrow 21,8 B posts

- 6. #BaddiesMidwest 21,4 B posts

- 7. #BoltUp 5.627 posts

- 8. Zac Taylor 4.415 posts

- 9. #ช็อตฟีลMV 118 B posts

- 10. MILKLOVE SHOT FEEL 203 B posts

- 11. #CINvsLAC 10,5 B posts

- 12. Money Mac N/A

- 13. WWIII 178 B posts

- 14. JK Dobbins 4.661 posts

- 15. #SNFonNBC N/A

- 16. Harbaugh 16,3 B posts

- 17. 60 Minutes 32,5 B posts

- 18. Ladd 5.853 posts

- 19. Scotty 10,3 B posts

- 20. Higgins 10,5 B posts

Who to follow

-

Prateek Badjatya

Prateek Badjatya

@Prateekbadjatya -

Mindful Investor

Mindful Investor

@amitabhvatsya -

Rajarshi Shome

Rajarshi Shome

@shome_rajarshi -

Vineet Bhatia

Vineet Bhatia

@investor_vineet -

Businessaholic

Businessaholic

@TBusinessaholic -

Mens Fashion

Mens Fashion

@menoutfitstudio -

Vishu Kartik

Vishu Kartik

@kartikvishu -

Gunavanth Vaid

Gunavanth Vaid

@GunavanthVaid -

Srinivasan

Srinivasan

@SriniVega -

Beat The Street

Beat The Street

@BeatTheStreet10 -

nitin

nitin

@nitin62484423 -

tushar

tushar

@tushar9590 -

Priti Tiwari

Priti Tiwari

@DiscretePriti -

Nupur Jainkunia

Nupur Jainkunia

@Nupurkunia -

Navneet Saluja D'Souza

Navneet Saluja D'Souza

@EnSaluja

Something went wrong.

Something went wrong.