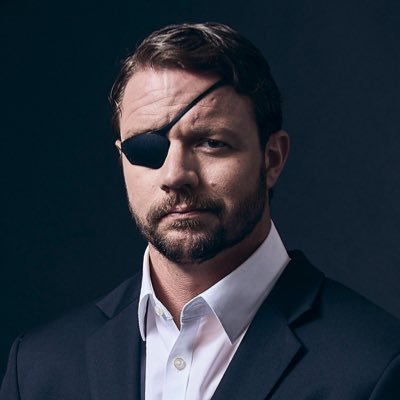

Ken McElroy

@kenmcelroy🏢 Real Estate Investor | 📚 Best-Selling Author ABCs of Real Estate Investing | 💼 30+ Years in Multifamily & Property Management🎙 Host of Real Estate Pod

Similar User

@theRealKiyosaki

@TonyRobbins

@wealthfactory_

@kimkiyosaki

@andytannerstock

@GarrettSutton

@DavidGreene24

@RaoulGMI

@Official_TCFA

@blairsinger

@TheMichaelBlank

@BeardyBrandon

@JJerhonda

@GeorgeGammon

@BiggerPockets

Do you have a question about real estate or investing? Ask it in the comments! You question could be answered by Danille and I on an upcoming YouTube live stream.

The offer on the right has more assets that move with inflation😏 I'd accept that trade!

Your ego is usually just an illusion—something you've self-fabricated over the years. As you age, you must let go of your ego and maintain self-confidence. Then, you'll grow both professionally and personally.

FED Chair Jerome Powell is set to speak in a half hour. There is plenty for him to discuss: the rising inflation in October, the FED's continued pursuit of trimming interest rates, and, of course, Donald Trump's election.

Since 1971, the US dollar’s monetary expansion has been a staggering 8,250%! This exponential growth drives inflation—and debt payments rely on printing even more. This simply isn't sustainable...

In fiscal year 2024, the US Government collected $4.92 Trillion. Just one problem… They spent $6.75 Trillion. A $1.83 TRILLION deficit. In one year. It’s not a tax problem. It’s a spending problem.

Inflation rose to 2.6% in October, despite the FED cutting interest rates a month prior. This is to be expected for the short-term. As interest rates go down, the inflation number may continue inch up before leveling out. As always. Invest in assets that move with inflation.

Did you know the U.S. monetary supply has grown 8,250% since 1971? This debt and spending cycle, spanning multiple administrations, leaves us with tough choices. With no clear path to cut spending, inflation could be our long-term reality.

The biggest income generator for the government? Individual taxes.

Happy Veteran's Day! 🇺🇸 Thank you to all the brave men and women who have served this great country.

Canada's new immigration policy will cap population growth to catch up on housing & healthcare demands. They need 3.5M homes to restore affordability, yet with high immigration rates, the housing gap continues to grow...

What sort of non-educational content would you like to see more of on my social media pages?

This right here is how successful businesses grow! Yesterday, the KenPro team and I had an all-day strategy meeting to discuss our individual and company goals for the next 1-3 years. This is a great way to effectively communicate with your team, get valuable feedback from all…

United States Trends

- 1. $MAYO 10,7 B posts

- 2. Tyson 400 B posts

- 3. Pence 45,7 B posts

- 4. Dora 22,5 B posts

- 5. Kash 75,6 B posts

- 6. Laken Riley 43,9 B posts

- 7. Mike Rogers 10,5 B posts

- 8. Ticketmaster 16,8 B posts

- 9. Debbie 19,3 B posts

- 10. #LetsBONK 7.256 posts

- 11. Gabrielle Union N/A

- 12. Pirates 19,4 B posts

- 13. Iron Mike 16,7 B posts

- 14. Cenk 11,6 B posts

- 15. #FursuitFriday 15,8 B posts

- 16. The UK 436 B posts

- 17. Whoopi 60,3 B posts

- 18. Fauci 178 B posts

- 19. Mr. Mayonnaise 1.451 posts

- 20. Scholars 10,7 B posts

Who to follow

-

Robert Kiyosaki

Robert Kiyosaki

@theRealKiyosaki -

Tony Robbins

Tony Robbins

@TonyRobbins -

Wealth Factory

Wealth Factory

@wealthfactory_ -

Kim Kiyosaki

Kim Kiyosaki

@kimkiyosaki -

Andy Tanner

Andy Tanner

@andytannerstock -

Garrett Sutton

Garrett Sutton

@GarrettSutton -

David Greene

David Greene

@DavidGreene24 -

Raoul Pal

Raoul Pal

@RaoulGMI -

The Cashflow Academy

The Cashflow Academy

@Official_TCFA -

Blair Singer

Blair Singer

@blairsinger -

Michael Blank

Michael Blank

@TheMichaelBlank -

Brandon Turner

Brandon Turner

@BeardyBrandon -

Just Je’Rhonda

Just Je’Rhonda

@JJerhonda -

George Gammon

George Gammon

@GeorgeGammon -

BiggerPockets

BiggerPockets

@BiggerPockets

Something went wrong.

Something went wrong.