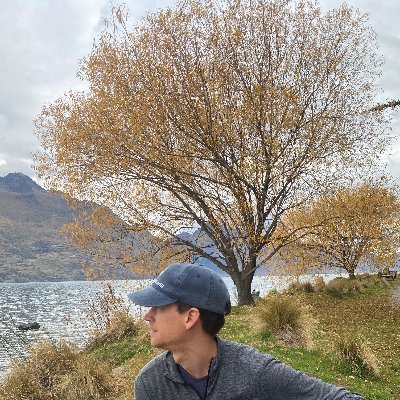

Jon Bathgate

@jbathgateInvestor at NZS Capital. https://t.co/YcYJOu5XEJ Not investment advice.

Similar User

@bradsling

@dylan522p

@_inpractise

@LongHillRoadCap

@joelmcohen

@_fabknowledge_

@dsundheim

@ElliotTurn

@goodinvestingc

@scuttleblurb

@SouthernValue95

@bizalmanac

@soonervaluecap

@YHamiltonBlog

@DrFrederickChen

Appreciate @ReustleMatt hosting us to talk about CDNS on Business Breakdowns, one of my all time favorite companies.

“This is one of the most important companies you have never heard of.” @bjohns3 and @jbathgate explain why. joincolossus.com/episodes/93241…

NZS is HIRING for an IT and investment analytics associate position in Denver. This is an exciting opportunity to add value to a growing $3B+ AUM boutique asset manager. nzscapital.com/jobs

It's earnings season, the sun is out and it's 60 degrees. Time for the investors @NZSCapital to take a hike!

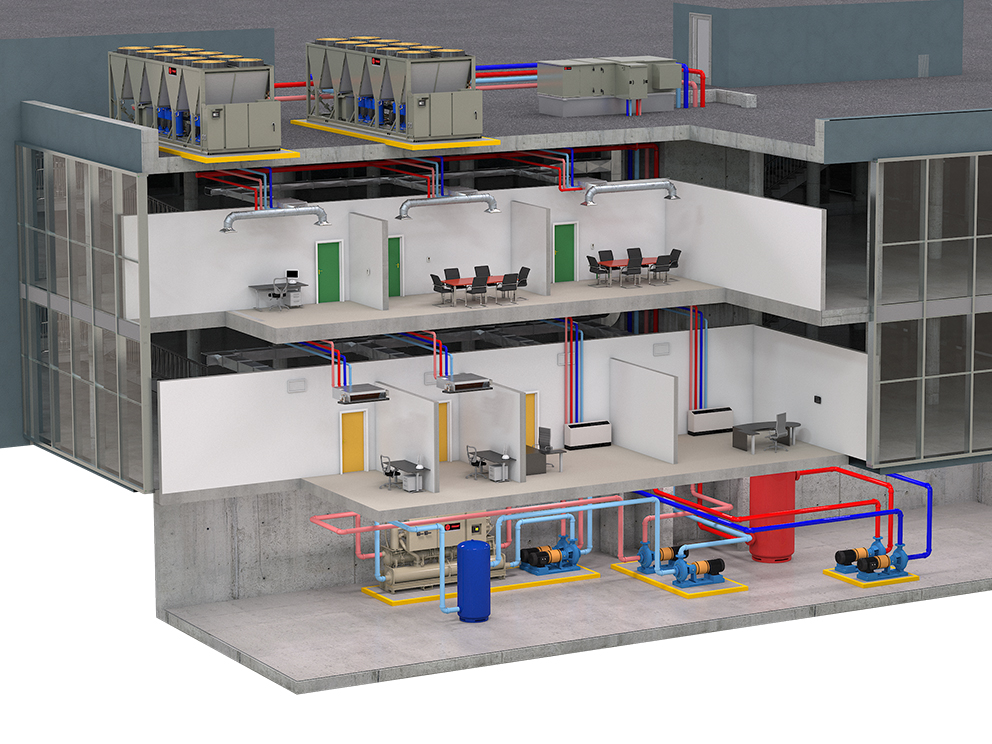

Check out NZS's new-ish secret weapon @blarsonbrf reviewing Trane Technologies on @bizbreakdowns

Trane Technologies? This company embodies the irresistible allure of industrial pureplays Thank you to Brett Larson and @NZSCapital for bringing this one to @bizbreakdowns ▫️ $50bn market cap (TT) yet rarely discussed ▫️ 100+ year history of between independence and…

What the market is expressing today was an extremely unpopular opinion just 6 months ago. It's important to stay long term focused, whether the market is way up or way down. You're not as dumb as you think at the bottom or as smart as you think at the top. youtube.com/watch?v=hp4LjF…

Intel vs Nvidia quarterly data center revenue back to 2015

Enjoyed talking to @ianmking for this excellent Bloomberg article about ASML's rise and their unique position amidst the geopolitical tensions in semiconductor land.

NEW: ASML’s rapid rise to become Europe’s most valuable tech firm has put it at the heart of the US-China chip war. Read The Big Take ⬇️ trib.al/IXqd75l

Today I learned that Texas Instruments is worth more than Intel, Qualcomm, or AMD. 🤯 Everyone sleeps on analog. h/t @jbathgate

I felt embarrassingly dumb defending the long term outlook for tech/chips on CNBC back in September. I wasn't as dumb as I felt that day, but also I know that I am nowhere near as smart as I might feel now. The best ROI is always on humility. cnbc.com/video/2022/09/…

Not the first time Berkshire has traded semis well with an uncharacteristically short holding period. They may have missed their calling in just being semi cycle junkies 😂

Happy retirement to Rich Templeton, the OG CEO who showed that good semiconductor businesses can be free cash flow machines investor.ti.com/news-releases/…

I can't comment on forward earnings but when I read this what jumped out his how epic the 118% cut to earnings estimates was in the GFC, that was special. @tculpan is one of the best journalists in semi land btw

“On average, 24-month forward earnings estimates for the SOX have been trimmed by 17% since a peak in the first quarter of 2022.” @bjohns3 and @jbathgate is this enough of a cut? bloomberg.com/opinion/articl…

Someone told me the other day I'm in the Acknowledgements in Chip War! Just ahead of Dougie B and the 🐐 Morris Chang. (yes I'm aware it's in alphabetical order and I'm one of probably 100 way more knowledgeable people than me 😂)

I think @crmiller1 might be onto something with this whole Chip War concept... Great read (so far) with some fun history. And impeccable timing on the release last week.

I've said that I thought Berkshire should invest in analog - biz models w/ high returns, high terminal value, lower disruption/tech risk, a bit of a bet on 🇺🇸. TSMC makes a lot of sense for them tho - irreplaceable asset. Hopefully it is their gateway drug to other semis😂

@jbathgate @bjohns3 Wasn't it you guys who, while describing the Buffett businesslike characteristics of semiconductor businesses, wondered if Warren Buffett would ever invest?

I think @crmiller1 might be onto something with this whole Chip War concept... Great read (so far) with some fun history. And impeccable timing on the release last week.

Reminder: today at 4:00 PT is our Zoom session with the @NZSCapital gang! We'll be talking about their whitepaper, "Redefining Margin of Safety". You can register or join here: us02web.zoom.us/meeting/regist…

Savage

"I don't hear our users asking that we put a lot of energy" into RCS, says Tim Cook in response to a question at Code. "I would love to convert you to an iPhone." "I can't send my mom certain videos," says the questioner. "Buy your mom an iPhone," says Tim.

$WOLF is a great story. In 2016 the prev. mgmt team tried to sell the Wolfspeed biz to Infineon for $850M (to focus on LEDs). CFIUS blocked it for national security reasons. Gregg Lowe came in, invested in Wolfspeed, shed the LED units, and Wolfspeed alone is worth $14B today.

We're going to have our full team from NZS on with the @AcquiredFM community for a live Zoom to talk about complex systems, investing and portfolio construction this afternoon at 4pm PT! Sign up link 👇

Reminder - tomorrow is our talkback with the @NZSCapital guys! We'll be on Zoom at 4 PM PT discussing the ideas in their Complexity Investing whitepaper. Register here: us02web.zoom.us/meeting/regist…

I shared a few thoughts in this @FortuneMagazine article about Pelosi’s visit to Taiwan and the pull for the big Asian semi players to take sides. fortune.com/2022/08/07/nan…

I don't like it when one of our investments takes the easy way out by selling to private equity. In part because we miss out on the compounding, but mostly because the hard-fought soul of the company will evaporate. But, then I think: how great this is for their competitors!

United States Trends

- 1. Jameis 49,5 B posts

- 2. Broncos 66,9 B posts

- 3. Jeudy 28,2 B posts

- 4. Bo Nix 19,1 B posts

- 5. Levi Wallace 5.779 posts

- 6. #WWERaw 125 B posts

- 7. Watson 19,7 B posts

- 8. #SkeletonCrew 9.372 posts

- 9. Big E 64 B posts

- 10. Kofi 29,9 B posts

- 11. #CLEvsDEN 12,4 B posts

- 12. New Day 129 B posts

- 13. Chubb 7.278 posts

- 14. #DawgPound 5.023 posts

- 15. Delaware 56,8 B posts

- 16. Sean Payton 2.629 posts

- 17. #SupermanAndLois 20,1 B posts

- 18. Elvis 13,4 B posts

- 19. Njoku 5.181 posts

- 20. Seth 41,8 B posts

Who to follow

-

brad slingerlend

brad slingerlend

@bradsling -

Dylan Patel

Dylan Patel

@dylan522p -

In Practise

In Practise

@_inpractise -

Implied Expectations

Implied Expectations

@LongHillRoadCap -

Joel Cohen

Joel Cohen

@joelmcohen -

Fabricated Knowledge

Fabricated Knowledge

@_fabknowledge_ -

Daniel Sundheim

Daniel Sundheim

@dsundheim -

Elliot Turner

Elliot Turner

@ElliotTurn -

Tilman Versch | Good Investing

Tilman Versch | Good Investing

@goodinvestingc -

scuttleblurb

scuttleblurb

@scuttleblurb -

SouthernValue

SouthernValue

@SouthernValue95 -

Andy 🍕🏔️

Andy 🍕🏔️

@bizalmanac -

soonervaluecap

soonervaluecap

@soonervaluecap -

YHamilton

YHamilton

@YHamiltonBlog -

Fred Chen

Fred Chen

@DrFrederickChen

Something went wrong.

Something went wrong.