Javier Pino

@javier_pino_e🚴 Cyclist 🚴 and 🧙 economist 🧙 Financial Analyst, Afi.

Similar User

@Afi_Escuela

@MonicaGuardado

@JMAafi

@est_snchez

@FranLomba_

@saddu2014

@mromero_afi

@salva_sja

@meiattini

@IgnacioAstorqui

@EzquiagaPedro

@dmanzano_afi

@moihdezm

@jsosa_aparicio

@RicardoPedraz

Hoy hace un mes que no estás con nosotros pero no pasa un segundo sin que nos acordemos de ti. Gracias a @Pachi_Idigoras por su homenaje @jpinoestevez

S&P 500 free cash flow per share hasn’t grown at all in three years. Booyah?

Looks like the Fed will have start working on talking points for Dec meeting on why to ignore the Oct core PCE reading of ~0.3%, or 3.6% ann, along with the pretty clear trend upward over the last 6m.

The fate of the treasury market is now at the whim of foreign demand. At this point, nearly all the bond issuance required to finance huge ongoing Federal deficits is bought by foreigners, in the last 12m taking 1.0tln of the roughly 1.1tln in LT bonds issued. Thread.

A favorite of mine, freshly updated. China claims it bought a record 1.8m b/d of **Malaysian** oil in October. That's more than triple the real output of Malaysia. The reality? Iranian. I wrote for @Opinion about the "global oil bazaar" last year: bloomberg.com/opinion/articl… #OOTT

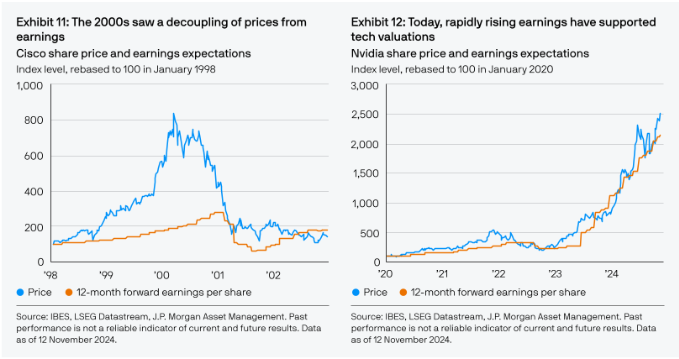

The 2000-bubble saw a decoupling of prices from earnings. Not so this time.

From the @FT article, "Inflation worries seep back into US bond market." #economy #markets #inflation #federalreserve #econtwitter

What is behind Europe's productivity problem? A large productivity gap relative to the US in the tech sector & low business dynamism. Two factors driving this: smaller market size and lower access to finance relative to the US. The fix: Deepen the EU single market. Read more…

Hoy para @elpais_espana por @dmanzano_afi y @javier_pino_e 👇 Balance de una doble crisis: elpais.com/economia/negoc… @el_pais @elpais_economia

Suttmeier BofA: Risk: Bearish divergence on weekly RSI

More than 50% of debt for Russell 2000 companies is floating rate. For the S&P 500, it is 24% -Torsten go2.apollo.com/e/1047283/h-ea…

🇪🇸 #España ha enviado a #Bruselas su primer Plan Fiscal Estructural de Medio Plazo (2025-2028). Este plan busca reducir la deuda y consolidar las finanzas públicas. El plan incluye reformas e inversiones del PRTR y se extiende hasta 2031. Aquí algunos puntos clave 👇

JUST IN 🚨: The market now shows a 0% chance of a 50 bps rate cut in November. Last week, it was 53%!

Map — Key Iranian infrastructure, military bases, oil platforms, & nuclear sites that Israel could target in a retaliatory strike. Also: - U.S. Gen. Kurilla in Tel Aviv - Iranian Navy gets underway - More countries close airspace - Iran issues NOTAMs - “All options on the table”

🇨🇳#IMPORTANT #China will hold a press conference on Tuesday, October 8, 2024, at 10:00 AM(2:00 AM GMT). Senior officials from the National Development and Reform Commission (NDRC) will provide an update on the "comprehensive implementation of a package of incremental policies to…

Today’s employment report confirms suspicions that we are in a high neutral rate environment where responsible monetary policy requires caution in rate cutting. With the benefit of hindsight, the 50 basis point cut in September was a mistake, though not one of great consequence.…

Stanley Druckenmiller this morning: “GDP above trend, corporate profits strong, equities all-time high, credit very tight, gold new high. Where’s the restriction?”

Look at the U.S. Dollar go! $DXY rallying to highest level since August 🇺🇸

Good news for olive oil enthusiast: The Andalusia region of Spain (~1/3 of global output) has released its first official forecast for the upcoming 2024-25 harvest. It estimates output of 1.02 million metric tons, up ~77% y-on-y, thanks to good weather. juntadeandalucia.es/sites/default/…

Oil Options Show Market Sees Further Gains on Middle East Risks Brent, WTI options skews showing a bias toward calls over puts Higher-than-usual volumes of call options traded on Wednesday #oott bloomberg.com/news/articles/…

United States Trends

- 1. Kendrick 645 B posts

- 2. #AskShadow 22,4 B posts

- 3. MSNBC 205 B posts

- 4. Drake 85,5 B posts

- 5. Luther 47,5 B posts

- 6. Wayne 59 B posts

- 7. Brandon Allen 1.902 posts

- 8. Daniel Jones 47,2 B posts

- 9. Kdot 7.121 posts

- 10. TV Off 39,6 B posts

- 11. Squabble Up 28,5 B posts

- 12. LinkedIn 41,4 B posts

- 13. Dobbs 1.890 posts

- 14. NASA 72 B posts

- 15. Dodger Blue 14,9 B posts

- 16. #BO6Sweepstakes N/A

- 17. Reincarnated 37,3 B posts

- 18. Brock Purdy 4.423 posts

- 19. Gloria 47,6 B posts

- 20. Giants 79,1 B posts

Who to follow

-

Afi Escuela

Afi Escuela

@Afi_Escuela -

Mónica Guardado

Mónica Guardado

@MonicaGuardado -

Jose Manuel Amor

Jose Manuel Amor

@JMAafi -

Esteban Sánchez

Esteban Sánchez

@est_snchez -

Francisco Lomba Galluzzo

Francisco Lomba Galluzzo

@FranLomba_ -

Genghis Khan

Genghis Khan

@saddu2014 -

María Romero

María Romero

@mromero_afi -

Salvador Jiménez Albert

Salvador Jiménez Albert

@salva_sja -

Silvia Meiattini

Silvia Meiattini

@meiattini -

Ignacio Astorqui

Ignacio Astorqui

@IgnacioAstorqui -

PedroEzquiaga

PedroEzquiaga

@EzquiagaPedro -

Daniel Manzano Romero

Daniel Manzano Romero

@dmanzano_afi -

Moisés Hdez Morales

Moisés Hdez Morales

@moihdezm -

jsosa_

jsosa_

@jsosa_aparicio -

Ricardo Pedraz #freeUkraine

Ricardo Pedraz #freeUkraine

@RicardoPedraz

Something went wrong.

Something went wrong.