Similar User

@jennysurane

@Trader_F_R

@PaulinaCachero

@thefuture

@29NewsWVIR

@BarendLeyts

@Quartr_App

@getdelta

@thecryptovalley

@consensus2025

@gulf_intel

@DailyEmerald

@CvilleCityHall

@LDNTechWeek

@Benjaminwmartin

BlackRock CEO Larry Fink wants to push the world’s largest asset manager into the more lucrative world of private markets wsj.com/finance/invest… @jackpitcher20 @WSJ

"Investors in the SPDR technology sector fund might be surprised to learn that until last week, their exposure to Nvidia was roughly four times that of Apple, despite their comparable market values." @jackpitcher20

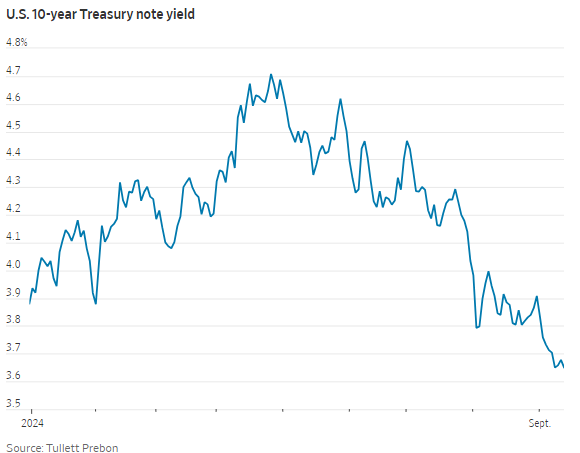

Traders are now pricing in a benchmark rate of about 2.75% by the end of next year--that would equate to 10 standard-size, quarter-point rate cuts—something the Fed is likely to do only in response to a recession @WSJmarkets @jackpitcher20

NEW: July was 1 of the largest deleveraging episodes in 10 years. We explain how deleveraging is key to the market's tumult. w/ @jackpitcher20 @Vlajournaliste @DavidUberti wsj.com/finance/invest…

Customers are reporting issues logging into their brokerage accounts this morning, including at Schwab & Vanguard @jackpitcher20 wsj.com/livecoverage/s…

Breaking: Russia freed wrongly convicted WSJ reporter Evan Gershkovich as part of the largest and most complex East-West prisoner swap since the Cold War on.wsj.com/4cheS5q

The stock market may be roaring, but 2024 has been #WallStreet’s year of the bond fund. (@jackpitcher20 writes) livemint.com/market/investo…

"Bonds are paying the highest yields in a generation and interest rates are poised to come down ... U.S.-listed fixed-income exchange-traded funds have taken in nearly $150 billion through late July, a record through this point in a year." @jackpitcher20

We’re in the “Golden Age of Bonds” @wsj @jackpitcher20 @RickRieder wsj.com/finance/invest…

"If the first rule of forecasting markets is to be right, the second rule might be: Don’t be the only one who’s wrong." @jackpitcher20 on how JPMorgan’s Marko Kolanovic went from red-hot to ice cold. wsj.com/finance/stocks…

"Boomer Candy" products that generate high yields and trailing total returns have gotten 30bln in inflows in the last year. How many investors understand how badly they are trailing the index? @jackpitcher20 highlights the growth of these products: wsj.com/finance/invest…

The 2024 stock-market party extends far beyond the U.S. Vanguard's Total World Stock ETF, which covers more than 98% of the investable market cap globally, rose to a record and is up 15% this year @WSJmarkets @jackpitcher20

BlackRock and other investors are purging ESG from their vocabulary, but the retreat isn't slowing the money going into clean energy. Story with @jackpitcher20: wsj.com/finance/invest…

Executive exodus at Global X, an early contender to launch one of the first U.S. spot bitcoin ETFs and the first to withdraw its application after the SEC greenlit 10 funds. -with @jackpitcher20 wsj.com/finance/invest…

Money is going to flow into bonds eventually… @jackpitcher20 wsj.com/finance/when-w…

“When State Street cut the fee on its SPDR Portfolio High Yield Bond ETF to 0.05% from 0.1% on Aug. 1, it immediately saw a record-setting inflow of $611 million over the course of the month.” @WSJ @jackpitcher20 $HYG wsj.com/finance/invest…

PM John McClain spoke to @jackpitcher20 with @WSJ to discuss the overall impact that elevated borrowing costs may have on the profitability of the issuing companies. on.wsj.com/3LhbIDJ

19 companies issued 47 bond tranches worth $38 billion Tuesday–biggest IG corporate bond issuance day since April 2020. Another 10 bonds worth $14bn on Wed. Average yield of 5.7%. via @jackpitcher20 @WSJmarkets: wsj.com/finance/invest…

“Western business models that were operating freely in China just a couple years ago are being challenged every month … The environment is much, much tougher today than it was.” @jackpitcher20 @RebeccaYFeng wsj.com/finance/stocks…

BlackRock became the first global asset manager to operate a wholly owned mutual fund business in China in 2021. Two years later, the world’s largest asset manager is struggling to compete in the market. @jackpitcher20 @RebeccaYFeng wsj.com/finance/stocks…

United States Trends

- 1. McDonald 50,6 B posts

- 2. #AskFFT N/A

- 3. Mike Johnson 53 B posts

- 4. #RollWithUs N/A

- 5. Good Sunday 70,5 B posts

- 6. #sundayvibes 8.347 posts

- 7. Go Bills 4.983 posts

- 8. Big Mac 4.930 posts

- 9. Coke 33,6 B posts

- 10. #AskZB N/A

- 11. Sunday Funday 5.008 posts

- 12. Tillman 1.856 posts

- 13. Happy Founders N/A

- 14. #ATEEZ_1stDAESANG 12,6 B posts

- 15. Jon Jones 301 B posts

- 16. NFL Sunday 5.560 posts

- 17. CONGRATULATIONS ATEEZ 22,4 B posts

- 18. Founders Day 1.133 posts

- 19. McDs N/A

- 20. Blessed Sunday 21 B posts

Who to follow

-

Jenny Surane

Jenny Surane

@jennysurane -

Fawad Razaqzada

Fawad Razaqzada

@Trader_F_R -

Paulina Cachero

Paulina Cachero

@PaulinaCachero -

Bloomberg Work Shift

Bloomberg Work Shift

@thefuture -

29News - Charlottesville

29News - Charlottesville

@29NewsWVIR -

Barend Leyts

Barend Leyts

@BarendLeyts -

Quartr

Quartr

@Quartr_App -

Delta Investment Tracker

Delta Investment Tracker

@getdelta -

Crypto Valley

Crypto Valley

@thecryptovalley -

#Consensus2025

#Consensus2025

@consensus2025 -

Gulf Intelligence

Gulf Intelligence

@gulf_intel -

Daily Emerald

Daily Emerald

@DailyEmerald -

Charlottesville City

Charlottesville City

@CvilleCityHall -

London Tech Week

London Tech Week

@LDNTechWeek -

Ben Martin

Ben Martin

@Benjaminwmartin

Something went wrong.

Something went wrong.