Ian

@ianjdeGlobal equity markets, science, risk, culture, the environment, development, second breakfast.

Similar User

@CmnThilo

@piopod38

@loganfintwit

@doctrphil

@questbytate

@nbrice22

@Jbremerv

@TimJames110

@ek839

@philoinv

@LiquidityEvents

@KodipakaAravind

@whoopi_goldbug

@AnityaThoughts

@barrymazada

The Elders call for bold action by world leaders to end Israel’s unlawful occupation of Palestinian territory. Click 'Show more' read the statement in full: The Elders today call on political leaders worldwide, and especially those with influence on Israel, to enforce the…

Them: Since the good old days of the mid 20th century, a few people have gotten richer and everyone else has gotten poorer. The actual data: twitter.com/i/status/16651…

This is my favorite animation!!! I have it bookmarked on my phone for parties. Such a whitepill on past 40 years.

Why this sudden meltdown in bank stocks? A couple of interesting theories and charts are doing the rounds, so let's have a look under the hood. A thread. 1/

$DIS Another reorg + 7k layoffs. Parks still printing money like crazy & now make up 100% of Disney’s operating income! 😳 Media just a break-even biz, even with streaming shrinking. 🙈$5.5bn in savings planned but only $1bn this year. Divvy back… soon. Uncharted waters? 🛥️

When the market believes we're nearing a Fed pivot, lower in this case, the 2yr will start trading below the Fed target rate, which it did after the last hike at the Dec. 14th, 2022 meeting.

1/ A Google colleague recently observed to me that computer science tends to reinvent the wheel every 20 years: “a new generation just reimplements old ideas, but with more compute” What’s fascinating is this 20 year cycle seems to coincide with the timing of tech stock bubbles

If Empire new orders index is any indication of where ISM new orders will come on Feb. 1st, and there certainly appears to be a correlation, it's going to be ugly. -31.1 is the 3rd worst monthly number since the survey was created in 2001.

Long duration US tech “was” the trade of the last decade. Look forwards not backwards. That trade is over. What will be the one to take over?

1/ Get a cup of coffee. In this thread, I'll walk you through "Gambler's Ruin". This is a classic exercise in probability theory. But going beyond the math, this exercise can teach us a lot about life, business, and investing.

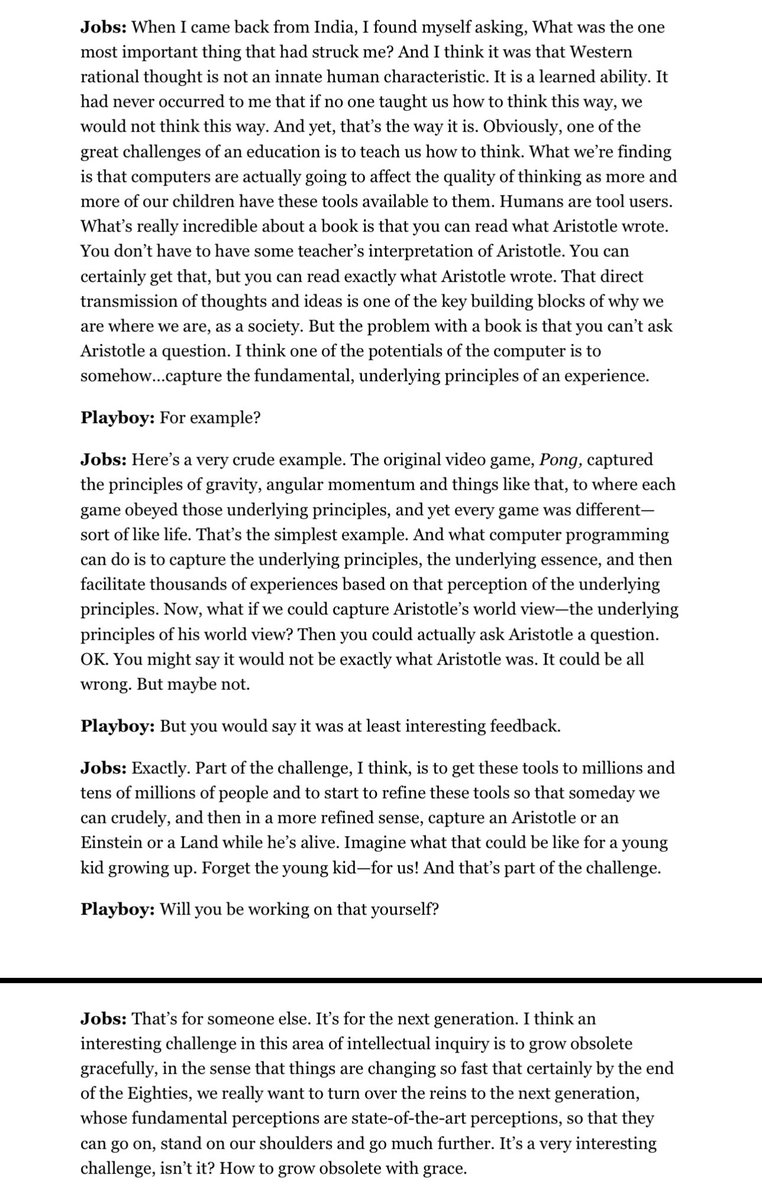

Every time I use ChatGPT, I’m reminded of Steve Jobs describing it in this Playboy interview, Feb 1985 🔮

#NoSingsofRecession. Seriously, at some point in the not-so-distant future, the market is going to point back to metrics like this and ask the Fed what the he!! were they thinking.

Yes, but Wen Recession? Let's refresh some of my forward-looking indicators to answer this pressing question. A thread. 1/

The next was triggered by the y/y change from the Composite Leading Index that fell further into contraction territory. 2/3

Very important to watch - turn on captions - and listen closely. youtube.com/watch?v=IMeuzv…

1/ If there’s one business I’d put a big bet on for leading the new wave of innovation in this world, it would be Ginkgo Bioworks $DNA 🧬 Thread 🧵

MICHAEL BURRY JUST SAID THESE 200 + COMPANIES SHOULD GO TO 0 BUT HE DID NOT PROVIDE THE LIST DON'T WORRY I GOT THE ENTIRE LIST FOR YOU GUYS.

Here’s a good LDI explainer for you. principlesandinterest.wordpress.com/2022/09/28/lia…

from 'Learning for Analysts and Future Portfolio Managers' neckar.substack.com/p/the-learning…

United States Trends

- 1. $CATEX N/A

- 2. $CUTO 7.469 posts

- 3. #collegegameday 1.897 posts

- 4. $XDC 1.339 posts

- 5. DeFi 102 B posts

- 6. #Caturday 7.632 posts

- 7. Henry Silver N/A

- 8. Good Saturday 36 B posts

- 9. #saturdaymorning 3.066 posts

- 10. Jayce 79,8 B posts

- 11. #MSIxSTALKER2 5.846 posts

- 12. #Arcane 297 B posts

- 13. Senior Day 2.874 posts

- 14. Pence 84,7 B posts

- 15. Renji 3.491 posts

- 16. Fritz 8.275 posts

- 17. Fishers N/A

- 18. Zverev 6.651 posts

- 19. McCormick-Casey 27,8 B posts

- 20. Tyquan Thornton N/A

Who to follow

-

Thilo Cmn

Thilo Cmn

@CmnThilo -

TenTegoTen

TenTegoTen

@piopod38 -

Logan Moulton,CFA

Logan Moulton,CFA

@loganfintwit -

§Phillip Zeuner

§Phillip Zeuner

@doctrphil -

OotanoO

OotanoO

@questbytate -

Nicolas Brice

Nicolas Brice

@nbrice22 -

Jeronimo Bremer

Jeronimo Bremer

@Jbremerv -

TJames

TJames

@TimJames110 -

ek83

ek83

@ek839 -

The Philosophy of Investing

The Philosophy of Investing

@philoinv -

Chart Junkie

Chart Junkie

@LiquidityEvents -

Aravind Kodipaka

Aravind Kodipaka

@KodipakaAravind -

CJ

CJ

@whoopi_goldbug -

Anitya Thoughts

Anitya Thoughts

@AnityaThoughts -

PowerTec

PowerTec

@barrymazada

Something went wrong.

Something went wrong.