Similar User

@andreilontano1

@bod_djo

@VreetDubariya

@gino88p

@RawlingsChemuka

@BenTudor7

@threadebt

$BTC Medium Timeframe Analysis #Bitcoin has been following the primary path for months on end from our continued narrative, and we did great eliminating a lot of the unnecessary alternative pathways. Now, we can refresh our set of ideas now that we are inching closer to a…

No SFP on #BTC however I remain htf bearish & the two short set-ups I see are a move back below the .236/ into the prior range or weakness into low 29ks. It will take a while to play out & as per #SPX update a peak is not due until early September #Bitcoin

#FireCharts shows that after #Bitcoin PA started getting toppy and losing momentum bid liquidity started fading back toward $25k. This actually sets the order book up for some volatility around Thursday's U.S. Economic Reports AND the Monthly candle close. I would love to see a…

What happened in crypto in the last 24h? In case you just woke up and saw all the euphoria, here is a recap. (1/5) 🧵

BTC Liquidation Heatmaps 12hr - SL at 27.5, 27.8, 28.3. LL 27250, 27, 26.4 7day - SL at 28.3-28.6. LL at 25.7-25.5 and 25.2-25. Could see 28.3-28.6 then retrace to 25.7-25 OR flush to the 25 range. Imagine though they will want to keep the price up here until news later this wk

Clown Show... Main Message: We will provide a full Audit somewhen in the next 100 years, maybe. 🤡😆 In a rare interview with Paolo Ardoino, the CTO of Tether, Camila Russo from The Defiant podcast was able to discuss the embattled $82 billion stablecoin. The always-cagey…

$BTC Medium Timeframe Analysis The move we had to upside really doesn't change much of the narrative from the last update, it only increases the possibilities for other alternatives if invalidated. We are still technically in a wave 4, or, a possible WXY for a larger wave 2.

BTC Liquidation Heatmaps We saw BTC take the SL out at 27k... woohoo. 12hr - LL at 26.5 7day - LL at 25.7-25.5 and 25.2-25 & some LL at 28.3-28.6

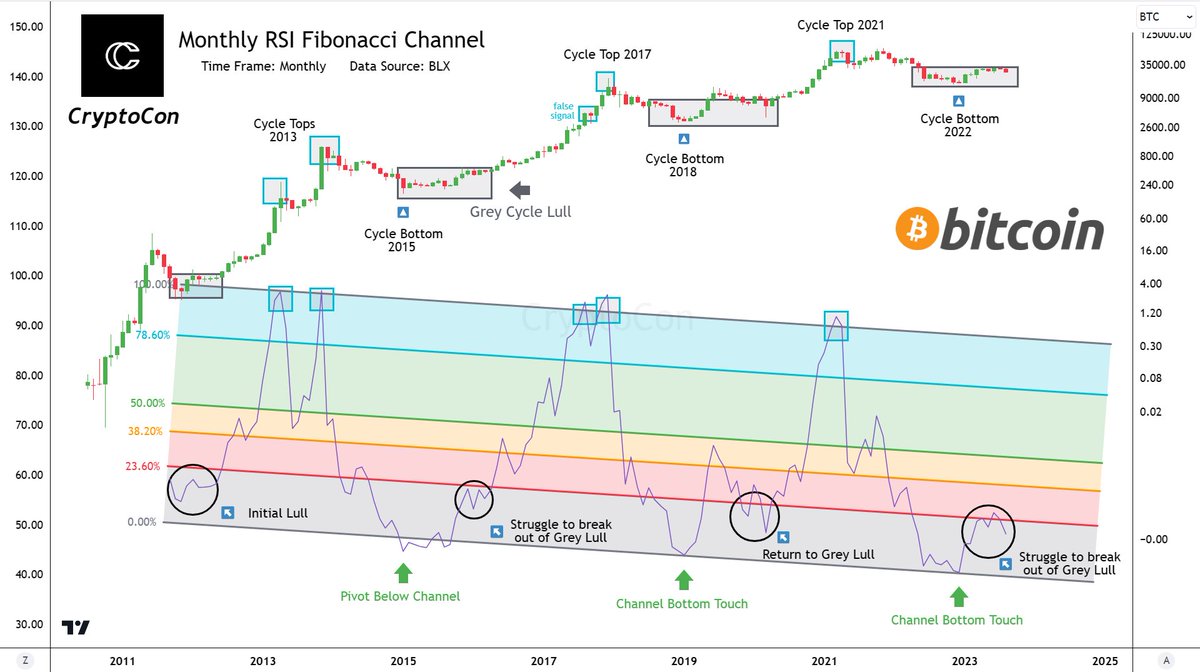

The Fibonacci Sequence is present on more than just #Bitcoin price action The Monthly RSI has remained inside a Fibonacci channel for its entire existence It has gotten very close to telling us when Bitcoin bottoms and tops, and also tells us…

$PEPE Medium Time Frame Count: I am not a fan of this shit coin but ABC looks clear. Invalidation is 4H close below 0.00000065. Use margin that you afford on sl. Dont go heavy. #PEPE #PEPECASH #CryptoX

If you followed the $ETH analysis you will know the macro range idea and this seems to be playing out. $1800-$1850 the sell zone. Range lows are around $1200. Upside will depend upon #Bitcoin #Ethereum #ETH

$ETH I totally forgot to post the #ETH bearish alternative you guys asked for(threaded) This would be my primary bear count if the macro base channel breaks Since this first move from the high looks so 3 waved I'd have to lean towards the expanding diag It's still pretty…

#BTC Very Shorter Time Frame Count: Looks more than shit... Wait for lows to get long. 26200 to 26300 is a nice short opportunity with invalidation previous High. #Bitcoin #Powell #CryptoX

Still of the mindset that this is a range. Any pop up into the $23 region is a sell. The low for the crypto market is many weeks away. #Solana #SOL #BTC

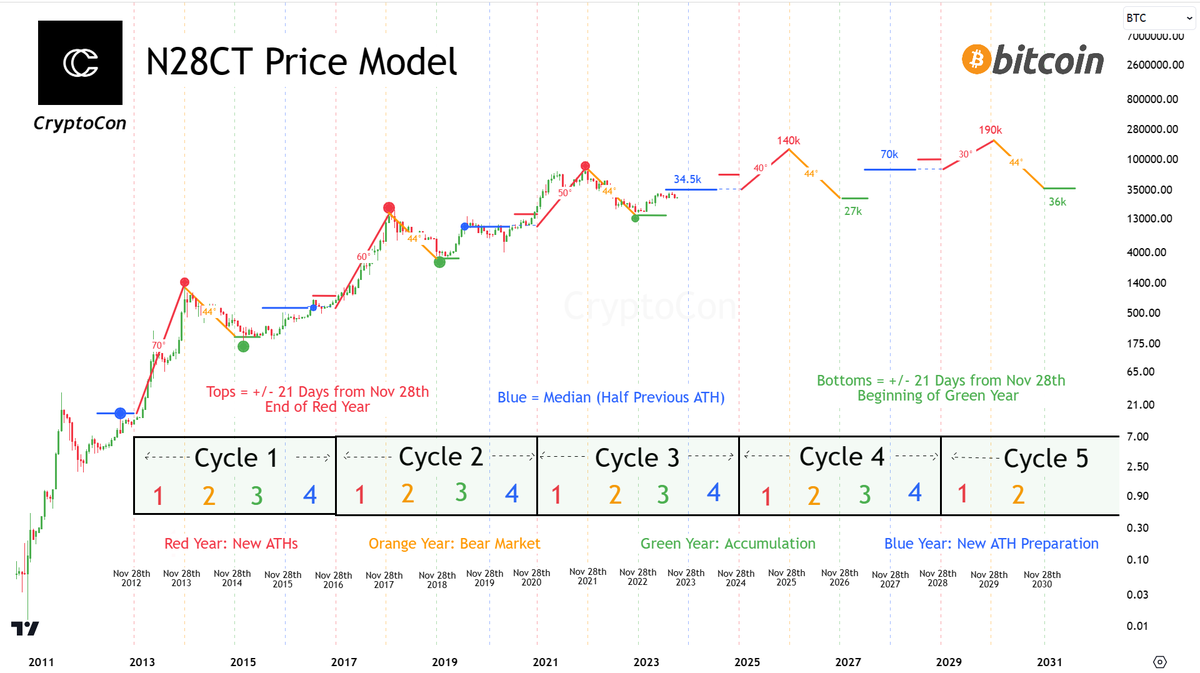

It's time to break down exactly how this new #Bitcoin price model works... As I said this is derived from my November 28th Cycles Theory. This Theory calls tops and bottoms with a +/- 21 day accuracy and tells us what happens in each given year Tops and bottoms come at these…

Relatively straight forward for this market. Ideally $BTC forms a bear flag into 27-28k before further downside. 90% of alt coins have confirmed their breakdown. #Bitcoin #BTC

$BTC Primary Macro Analysis Let's now zoom out of the medium timeframe for a moment and focus on how it can connect to the larger picture. I have ordered them from the highest to the lowest priority. Enjoy! - If we are continuing with the WXY/ABC idea to the upside, it would…

$ADA I posted this ADA update for subscribers back on 8/7(threaded) Since then Cardano has dumped 17% where we were expecting Macro outlook is still the same Eventual trip down to…

United States Trends

- 1. Dalton Knecht 51,4 B posts

- 2. #wednesdayfeelings 1.127 posts

- 3. Lakers 66,5 B posts

- 4. Hump Day 8.176 posts

- 5. $QUANT 16,5 B posts

- 6. Jaguar 4.347 posts

- 7. Jay Leno 4.821 posts

- 8. Hampton Inn 2.154 posts

- 9. #LakeShow 6.102 posts

- 10. Linda McMahon 47,4 B posts

- 11. Dorit 5.910 posts

- 12. Spurs 17,7 B posts

- 13. #RHOBH 11,7 B posts

- 14. Carmel 3.535 posts

- 15. #WWENXT 31,1 B posts

- 16. Chase U 6.296 posts

- 17. Astrid 29,7 B posts

- 18. #chillguy 18,7 B posts

- 19. Lichtman 11,4 B posts

- 20. Honduras 49,8 B posts

Something went wrong.

Something went wrong.